Volume 18, Issue 04

January 28, 2021

In This Issue:

- Cuba Appoints H.E. Lianys Torres Rivera as Ambassador to the USA

- Washington Update

- The Texas Rice Council Meets Virtually

In This Issue:

In This Issue:

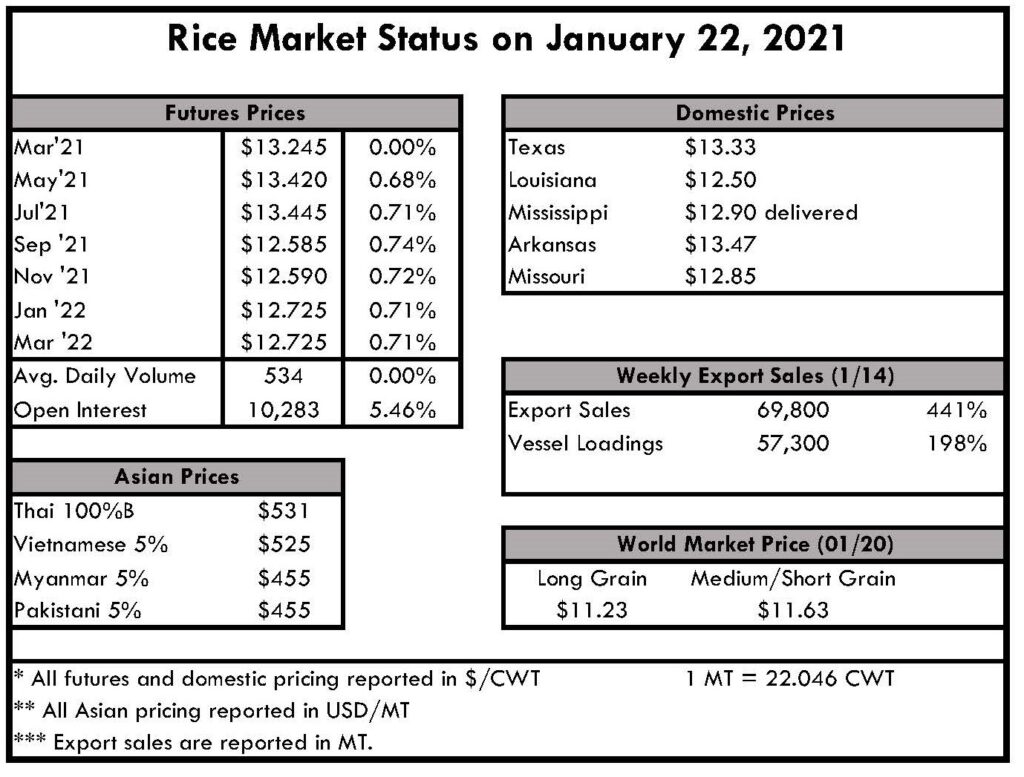

The rice market continues firm as a result of a 13% reduction in carryover stocks in the January WASDE report at 26.3 million cwts. Demand from paddy buyers in Mexico and Central America is expected to grow. There are always reasons for the market to go up and down. Buyers in Mexico, Central America and several South American markets cannot ignore the severe drought conditions in the Mercosur rice region. While the harvest is just getting underway in Paraguay and the Brazilian state of Santa Catarina it is obvious there will be a significant overall reduction in production. Will Brazil need to import U.S. rice again as they did in late 2020? Will the new administration in Washington D.C. enhance the effort for Iraq to buy U.S. rice? The high prices of soybeans and corn are the result of the Mercosur drought as well so will we see a shift downward in rice acres in the Mississippi River Delta? There is no rice in farmers' hands in South Louisiana and maybe 2.5 million cwts in Texas with bids expected to ease upwards. Farmers are working ground as they prepare to plant new crop rice in 30-40 days.

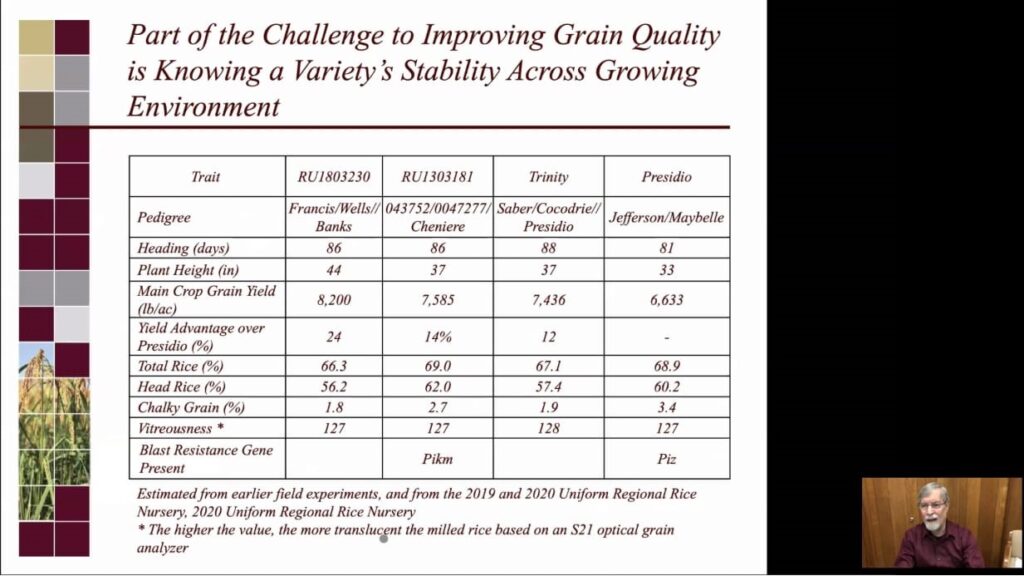

This week the Texas A&M AgriLife Extension Center in collaboration with the Texas Rice Council, hosted the first virtual Western Rice Belt Production Conference. The conference had 146 unique views and attendees logged on from all across Texas, and even gained some international viewers from Mexico, Uruguay and even Pakistan!

Presentations included:

Attendees also heard from Tommy Turner, retired rice farmer, about projects that the Texas Rice Council and US Rice Producers Association are taking on to that have helped rice farmers in Texas and throughout the US market and sell their rice.

Sponsors and other organizers, including Galen Franz, Chairman of the Texas Rice Research Foundation, Tim Walker from Horizon Ag, Dennis Neuman with Ducks Unlimited and the USA Rice Federation were also featured during the conference.

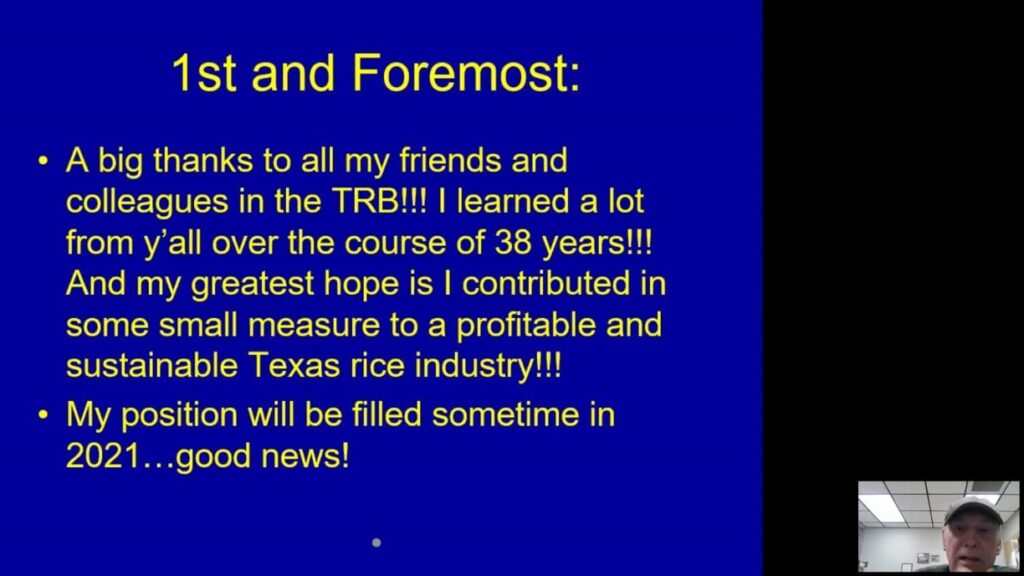

Finally, Bob Little and Dr. Mo Way, were both recognized for their contributions in their many years serving the Texas rice industry. Attendees sent messages of appreciation and congratulations to both gentlemen and we will surely be missing them but wish them the best in their retirement!

While attendees miss the in-person meetings for the camaraderie and networking, comments were overwhelmingly positive:

“I thought the virtual program went quite well. It was easier to follow the presenter and slides. Look forward to be able to review the presentations at a later time. But I do like the traditional face to face meeting better.”

“Enjoyed the program very much. Best wishes to everyone and stay healthy.’

The conference will continue to be available On-Demand for the rest of the month.

On Wednesday, Joe Biden was inaugurated as the 46th President of the United States. As expected, one of his first actions was a regulatory freeze (See reg freeze memo).

The Administration is moving quickly to fill slots, and USRPA joined with other agricultural organizations in support of President Biden’s Secretary of Agriculture nominee, Tom Vilsack, in this letter to Chairwoman Stabenow and Ranking Member Boozman. There were over 120 signatories from a robust cross-section of federal and state food and agriculture associations who joined in signing the letter.

President Biden has also nominated Virginia Ag Commissioner Jewel Bronaugh to be the next deputy secretary of agriculture, the second-highest position at USDA usually in charge of day-to-day operations. Bronaugh, who has run the Virginia Department of Agriculture and Consumer Services since 2018, served as Virginia state director for USDA's Farm Service Agency during the Obama administration, starting in 2015. Bronaugh also has a doctorate in career and technical education from Virginia Tech and spent time as the dean of the College of Agriculture for Virginia State University, where she oversaw extension, research, and educational programming. Other appointments included individuals who will hold senior staff positions in Washington, D.C. staff list in addition to the announcement of three Deputy Under Secretaries in the Areas of Nutrition, Rural Development and Marketing and Regulatory Programs USDA undersecretaries. Action on the Senate side of Capitol Hill is still largely dominated by the organization of the new 50-50 Congress along with impeachment. Rumors indicate that articles of impeachment could arrive as early as this week, with much concern about the effect that would have on the Biden Administration's initiatives. Chair Stabenow is interested in reauthorizing children’s nutrition programs (which has lapsed) as a priority and then moving to climate change. Reports indicate that Stabenow wants agriculture and forestry to be leaders on climate policy employing voluntary, producer-led initiatives that create carbon markets for producers. In addition, there are rumors that the Committee will have a hearing on Secretary Vilsack’s nomination at the end of next week or the following week, however, most believe that is an ambitious schedule that will not be met, especially with the impeachment pending.

About this Event

This joint effort of our Western Rice Belt planning committee, The Texas A&M AgriLife Extension Service, U.S. Rice Producers Association, and Texas A&M AgriLife Research offered growers and others the opportunity to hear presentations from the top Extension and Research scientists from Texas as well as respected individuals from the rice industry.

| Time | Agenda Item |

| 8:00 a.m. | Welcome |

| 8:15 a.m. | Basics of Herbicide Resistance Development in Weeds - Dr. Muthu Bagavathiannan |

| 8:45 a.m. | Break |

| 9:00 a.m. | Rice Varieties and Current Breeding Programs in Rice - Mr. Galen Franz |

| 9:30 a.m. | Insect Management - Dr. Mo Way |

| 10:00 a.m. | TDA Pesticide Laws & Regulations Update - Melissa Barton |

| 11:00 a.m. | Cost of Rice Production - Dr. Joe Outlaw |

| 11:30 a.m. | Rice Market Outlook - Dr. Thomas Wynn |

| 12:00 p.m. | LUNCH BREAK |

| 12:50 p.m. | Recognize upcoming retirement of Dr. Mo Way and Bob Little |

| 1:00 p.m. | Update on Conservation and Working Lands Programs - Dennis Neumann |

| 1:30 p.m. | Rice Water Efficiency - Dr. Michele Reba, Research Hydrologist USDA Agricultural Research Service |

In This Issue:

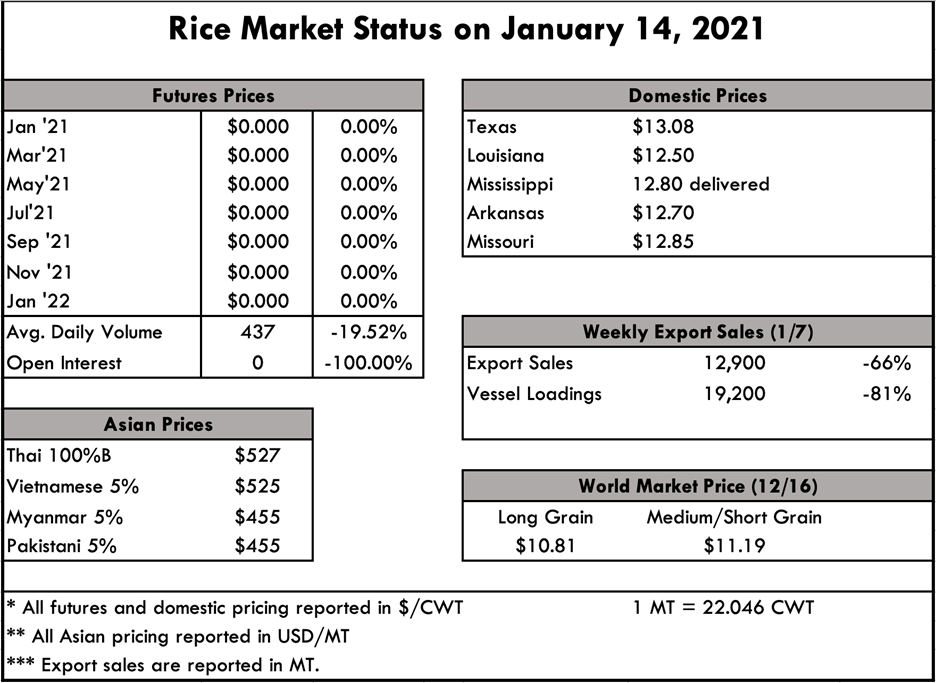

The spot market throughout much of the delta remains quiet. While rice continues to lightly trade, the market is lacking any significant developments that would cause prices to come off their month-long pricing. In conducting this week’s surveys, there appears to be minimal to no change in spot pricing from the early December trades. The cash market is expected to strengthen in the weeks ahead as the fundamentals reported in the most recent WASDE report work their way into the industry, which is already being seen in the futures market.

This week the USDA published their January World Agricultural Supply and Demand Estimates report which was generally accompanied by a more bullish undertone for grains across the board. These revisions quickly worked their way thru the futures markets where beans, corn, wheat and rice all posted respectable gains following the report’s release. The USDA elevated its production figure for long-grain rice, which was more than offset by a considerable uptick in domestic demand expectations. The latest demand forecast calls for a record 125 million cwts of domestic use, up from the historical average of roughly 108 million cwts. According to the USDA, this revision is the result of higher use during August and September as implied by the NASS Rice Stocks report. Ultimately this change pushed ending stocks down to 26.3 million cwts from the 38.2 million cwt projection a month earlier. Now the current ending stocks projection falls in line with the 10-year average. The USDA also bumped the season-average farm price for long grain by $0.20 per cwt. As for US medium and short-grain, the changes made to the balance sheet were unremarkable.

The USDA also published their Crop Production Annual Summary report which shows the final acreage figures for all rice in the USA. Last year’s bull market certainly bought more rice acreage, as the official data indicates long grain harvested acres were up 572,000 acres or 33% from 2019/20. Although Southern medium grain acreage was off by 72,000 acres in 2020, a strong Calrose market motivated growers to increase plantings which was reflected in the 2.6% year over year increase for the state.

Perhaps more noticeable than the increase in planted area were the yields. While yields in Arkansas, the nation’s largest rice growing state held steady year over year, the rest of the Delta benefited from cooperating weather and other factors that ultimately drove up yields basically across the board. As a result, total production was over 36% in 2020.

Looking to Asia, prices appear to have found a footing as all origins are up from 4-weeks ago. Pakistan export prices saw the sharpest increase, up $50 per ton from the prior month, while the appreciation in the other Asian origins was closer to $20-30 per ton for the same time period. At present, one of the more critical factors in terms of global trade pertains to container availability and costs. For the past 6-8 weeks, exporters around the world have struggled to find equipment and capacity to ship bulk goods. Due to this bottlenecking, shipping and logistic prices have spiked to 52-week highs, making trade especially difficult in certain regions.

According to the International Grain Council (IGC), which publishes a price index for soybeans, corn, wheat, barley and rice, prices are up 10.3% from a month earlier, and 37.9% from a year earlier. The commodities posting the largest gains are soybeans up 10.9% and corn up 13.4% this month.

As expected, these fundamentals are now being reflected in Chicago, where futures prices continue their march upward. Most analysts have published various comments surrounding the bullish undertone taking shape in the market. With planting right around the corner, significant price action at the futures level could certainly have a large impact in what gets planted this spring. Typically, when a price hike is accompanied by rising volume and open interest, the market is considered strong, which is exactly what we see happening in the market right now. Between a new administration entering the office, ongoing currency volatility, shipping & logistic constraints, and projected plantings, there are multiple variables coming to bear on the market over the next several weeks that could perpetuate the market strength or reduce it; for these reasons, it’s important to maintain market liquidity in order to reduce price risk.

USRPA and ARROZGUA's team of chef promoters kicked off 2021 right by sharing their expertise with local importers of American rice. Essentially, our chefs are providing training to the sales and promotions teams of companies who import U.S. long-grain rice on how to prepare live demonstrations, cook long grain rice and keep the audience engaged while providing information on the benefits of consuming U.S. long-grain rice. These private company teams will continue to spread the message that U.S. long-grain rice is not only tasty but easy to prepare, economical, and nutritious, allowing the message to spread farther and faster in supermarkets throughout the country.

The first training took place on January 13, 2021, at ARROZGUA's facilities with Agroindustrias Albay, the country's second-largest importer of U.S. long-grain rice. Overall, Guatemala is expected to import 95,000 MT of paddy rice. USRPA and Arrozgua look forward to this collaboration to promote U.S. long-grain rice in Guatemala and will continue to schedule training in the weeks to come.

In This Issue: