Trump Administration Releases Preliminary MAHA ReportOn Thursday, the Trump Administration’s Make America Healthy Again (MAHA) Commission released a report addressing the pressing childhood chronic disease crisis in this country and outlines government-wide efforts to help ‘Make Our Children Health Again.’ Spearheaded by Human and Health Services Secretary Robert F. Kennedy Jr., the report largely attributes blame for the current health crisis likely due to ultra-processed foods, exposure to chemicals, lack of exercise, stress, and overprescription of drugs.

Throughout the report, the MAHA Commission acknowledges the significant role played by American farmers in the agricultural sector, noting their contribution to ensuring food abundance and affordability. It states that mechanization, synthetic fertilizers, and industrial-scale farming has elevated the agricultural output of the United States, transforming it into the largest food exporter globally. In the chemical exposure portion of the report, pesticides are recognized as essential for crop protection and as a critical component of maintaining a healthy, abundant, and affordable food supply, which supports American farmers and the MAHA agenda. However, concerns regarding potential links between pesticides and adverse health effects, especially in children, were raised and highlighted through the citing of various studies.

Additionally, the report reiterates some of Kennedy and the MAHA movement’s criticisms about the role ultra-processed foods, added sugars, food dyes and additives play in American’s diets. Overall, the report suggests a shift toward a whole-food diet and touts the nutritional benefits of foods like whole milk, dairy, beef, leafy greens, legumes and more. Looking ahead, the Commission is expected to build upon the report and form a federal strategy over the next 100 days that is likely to include more definitive policy recommendations. You can find the full MAHA report here. House Passes ‘One Big, Beautiful Bill’ Reconciliation PackageEarly Thursday morning, the House of Representatives managed to pass its budget reconciliation bill by a vote of 215-214-1, after surviving a contentious 21-hour House Rules Committee markup to advance it to the floor. The bill passed with majority support from House Republicans, excluding Reps. Thomas Massie (R-KY) and Warren Davidson (R-OH) who voted no along with all present Democrats, Rep. Andy Harris (R-MD) who voted present, and Reps. Andrew Garbarino (R-NY) and David Schweikert (R-AZ) who abstained from voting altogether.

The bill H.R.1 – the One Big Beautfiul Bill Act largely reflects President Trump’s fiscal policy agenda and includes tax reforms, spending adjustments, and policy changes across various sectors. Specifically, the bill extends the 2017 Tax Cuts and Jobs Act, introduces new tax breaks and exemptions such as lower individual tax rates and increased standard deductions. From the lens of the agricultural sector, the package expands and permanently extends 199A deductions, restores bonus depreciation, increases Section 179 expensing, and raises the estate tax exemption level. Acting as offsets, the bill also enacts cuts to social programs, including Medicaid and the Supplemental Nutrition Assistance Program (SNAP). Within the Agriculture Committee’s jurisdiction and over a 10-year period, the bill cuts $294.6 billion mainly from the nutrition title, while also reinvesting $58.792 billion into vital farm bill programs and titles.

Notably, the bill increases Title I reference prices for rice, enhances crop insurance, and provides doubled funding for trade promotion programs like Foreign Market Development (FMD) and Market Access Program (MAP).

Now, the House reconciliation package heads to the Senate for consideration where Republicans hold a narrow 53-47 majority.

USDA to Dismantle Several Advisory CommitteesOn Monday, the Federal Register released a notice that the U.S. Department of Agriculture (USDA) intends to disband seven advisory committees aligning with President Trump’s Executive Order (EO), “Commencing the Reduction of the Federal Bureaucracy,” which works to minimize waste, fraud, and abuse by reducing federal bureaucracy. The named committees on the chopping block include:Advisory Committee on Agriculture StatisticsAdvisory Committee on Universal Cotton StandardsFruit and Vegetable Industry Advisory CommitteeNational Advisory Committee on Meat and Poultry InspectionNational Advisory Committee on Microbiological Criteria for FoodsNational Wildlife Services Advisory CommitteeNorthwest Forest Plan Area Advisory CommitteeThe notice also acknowledged several advisory committees that the Secretary had initially flagged for termination under memorandum, “Restructuring of Federal Advisory Committees within the Department of Agriculture,” that now have been paused until further notice. Those paused committees include:Agricultural Technical Advisory Committee for Trade in Animal and Animal ProductsAgricultural Technical Advisory Committee for Trade in Fruits and VegetablesAgricultural Technical Advisory Committee for Trade in Grains, Feed, Oilseeds, and Planting SeedsAgricultural Technical Advisory Committee for Trade in Processed FoodsAgricultural Technical Advisory Committee for Trade in Sweeteners and Sweetener ProductsAgricultural Technical Advisory Committee for Trade in Tobacco, Cotton, Peanuts, and HempBlack Hills National Forest Advisory BoardGeneral Conference Committee of the National Poultry Improvement PlanFor more information, you can find the notice posted to the Federal Register here. |

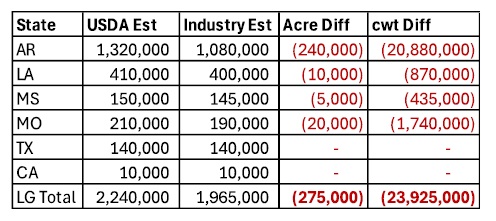

As the table illustrates, by not adjusting for lost acreage in this month’s

As the table illustrates, by not adjusting for lost acreage in this month’s