RMTC 2025 Proudly Serving Texas Jasmine Rice

|

“Maintaining the navigability of the channel is critical to ensuring ongoing vessel access and expanding export opportunities for SLRF rice,” stated Mark Pousson, USRPA board member and South Louisiana Rail Facility General Manager, following his visit to Washington, D.C. with the Port of Lake Charles delegation. “Advocating for consistent channel maintenance and dredging is essential to supporting the long-term success of our regional economy and agricultural exports. We’re grateful for the time and attention of House Speaker Mike Johnson, who took a moment to meet with us during our visit.”

Secretary Rollins Testifies before both House and Senate Appropriations:

This past week, U.S. Department of Agriculture (USDA) Secretary Brooke Rollins took to Capitol Hill and testified before both the Senate and House Appropriations Subcommittees on Agriculture, Rural Development, Food and Drug Administration, and Related Agencies. Generally, Democrats and Republicans alike agreed that the President’s fiscal year 2026 budget request must sufficiently fund the USDA to best support farmers, ranchers, and families in rural America. Members of the Subcommittee emphasized the importance of the USDA releasing the $20 billion in natural disaster relief funding that was appropriated through last December’s continuing resolution.

Republicans commended Secretary Rollins for prioritizing producers and facilitating efforts to eliminate wasteful spending within the Department. Additionally, Republicans discussed Supplemental Nutrition Assistance Program (SNAP) reform, expanding foreign market accessibility, and protecting domestic farmland from foreign ownership. Democrats argued that the FY26 request inappropriately cuts nutrition programs that support schools and foreign countries. Further, Democrats raised concerns about staff reductions, funding freezes at the USDA, and how the Trump Administration’s tariff policy has exacerbated financial hardships in rural America. You can watch the Senate Agriculture Appropriations hearing here and the House Agriculture Appropriations hearing here.

Trump Administration Releases Budget Framework:

Late last Friday, President Trump released the Administration’s budgetary framework, calling on Congress to cut non-defense programs by more than $163 billion while leaving defense programs relatively untouched. This FY26 spending framework furthers the Administration's goal to prioritize government efficiency and cut wasteful spending by making major cuts to many agency funds. In particular, this budget would bring $4.5 billion in cuts to the U.S. Department of Agriculture. Additionally, it proposes $500 million in support of the “Make America Healthy Again Movement”, which plans to operate in place of the current Commodity Supplemental Food Program. While the President does weigh in on budget-related decisions, Congress still holds the “power of the purse.” This means that while the Administration has made their initiatives known, members of Congress still have ultimate decision-making power in any upcoming budget decisions. You can find more details on the President’s simplified budget here.

Thousands of USDA Employees Resign:

Recently, it was reported that at least 15,000 USDA employees have resigned as part of the Trump Administration’s deferred resignation program (DRP). Roughly 800 USDA employees signed up for the program during the first DRP in January, while the recent program push received 11,305 resignations. The program allows employees to quit and be paid through September 2025, which has helped the Administration cut USDA’s workforce down by 15%. Of these resignations, 555 are employees at the Food Safety and Inspection Service, over 1,000 from Farm Service Agency county offices, 4,000 employees from the U.S. Forest Service, 1,300 from the Animal and Plant Health Inspection Service, 1,255 employees at the Agricultural Research Service, 78 employees from the Economic Research Service, 54 employees from the National Institute for Food and Agriculture, and 243 employees from the National Agricultural Statistics Service will resign. This is part of a larger initiative by the Trump Administration that aims to eliminate 30,000 jobs within the agency.

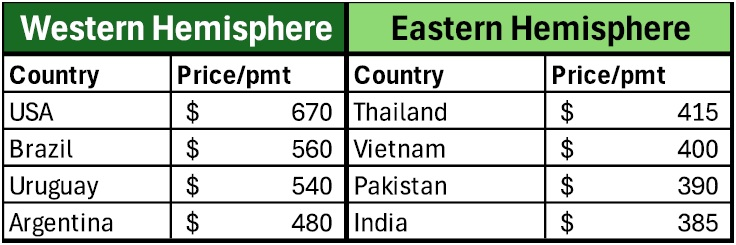

Rice markets are increasingly competitive globally, from the Americas to the Near and Far East. All origins are aggressively fighting for export share. U.S. milled white rice remains the most expensive globally at $670/MT, yet this is still 16% below last year’s price. Many Asian origins have seen price drops of over 30%. Newly announced U.S. tariffs on Thai rice are raising concern in Bangkok. At the same time, U.S. producers and marketers see a rare opportunity to grow domestic market share and possibly regain ground long term.

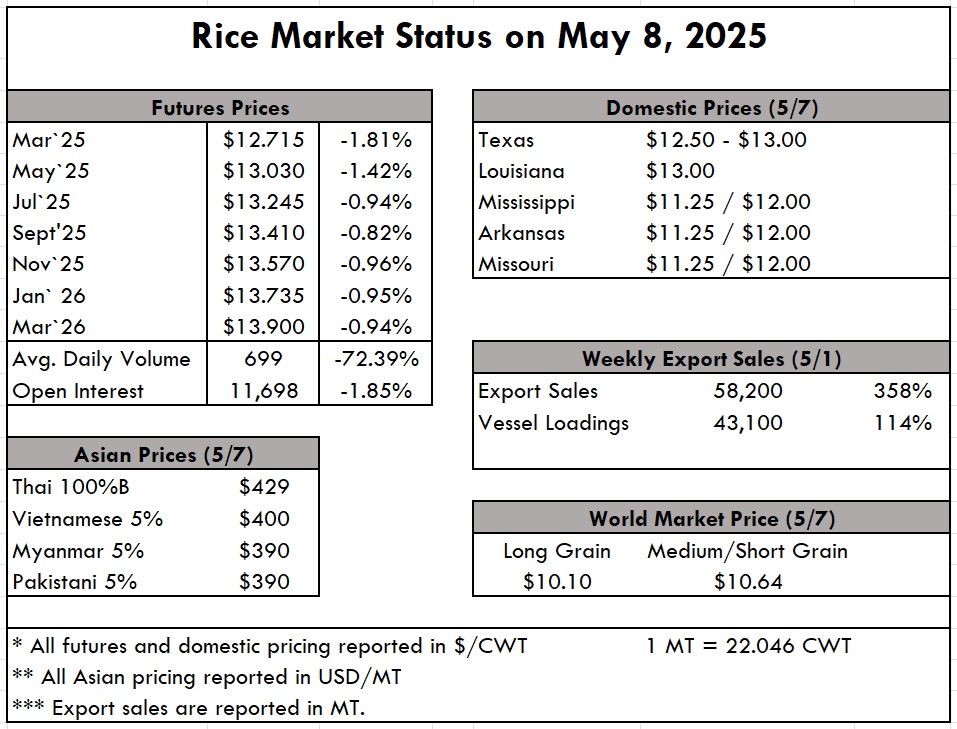

Domestically, a large crop is going into the ground, putting downward pressure on new crop price expectations. Yet the full impact of weather-related acreage losses and weak grower economics is still unfolding. As of May 4, the Crop Progress Report shows rice planting across the six major states is 73% complete, ahead of both last week (64%) and the five-year average (64%). Arkansas (77%) and Mississippi (74%) are ahead of average, while California trails at 35%. Emergence is also ahead of schedule nationally at 54%, compared to the 42% five-year average, with Louisiana (90%) and Texas (85%) leading. California has not yet reported emergence, consistent with its later planting window.

On-the-ground prices remain unchanged. Texas is holding at $12.50–$13/cwt, Louisiana at $13, and Mississippi, Arkansas, and Missouri between $11.75–$12/cwt.

Globally, the April FAO All Rice Price Index edged up 0.8% from March to 104.9, though it remains 22.6% below year-ago levels. The increase was driven solely by modest firming in historically weak Japonica and Fragrant rice markets. Indica prices were mostly flat, while glutinous rice slipped 4.1%.

U.S. weekly Export Sales reached 58,200 MT, up sharply from both the previous week and the 4-week average. Exports totaled 43,100 MT, up week-on-week but 15% below the prior 4-week average.

|

| The countdown is on. Just 25 days until the Rice Market & Technology Convention (RMTC) 2025 kicks off in vibrant Miami! We're launching the convention with a Networking Welcome Reception on Wednesday, May 28, proudly sponsored by RiceTec. This event sets the tone for the conference, offering a relaxed atmosphere to reconnect with colleagues and forge new partnerships. For more information and to register, visit the official RMTC website.  |

| RMTC2025: Featured Speaker |

|

| RMTC2025: Exhibitor Highlight |

|

|

USDA Highlights President Trump's First 100 Days in Office:

This past Tuesday marked President Trump’s 100th day in office, typically an important checkpoint for any presidential administration. The U.S. Department of Agriculture (USDA) released a press statement highlighting the top issue areas the Department has been working on since Trump was sworn into office. One of the main focal points of the release was USDA’s rollout of the five-point plan to lower the cost of eggs for Americans while simultaneously tackling the highly pathogenic avian influenza (HPAI) outbreak. Additionally, the statement highlighted Rollins' upcoming trade missions to expand markets and boost American agricultural exports, ongoing negotiations with Mexico regarding water treaty obligations, the timely rollout of funds coming out of the Emergency Commodity Assistance Program for the 2024 crop year, and the Secretary’s mission to deliver rural prosperity to Americans. In a similar 100 day memo, USDA highlighted steps taken by each agency to reverse the “woke” Diversity, Equity, and Inclusion (DEI) agenda of the previous Biden Administration highlighting efforts related to freezing funds and grants, revaluation of standing contracts, and the deconstruction of the Partnership of Climate Smart Commodities program. You can find the initial 100-day press release here and the following DEI one here.

USDA Announces Major Win for Agriculture with Regards to Water Negotiations with Mexico: On Monday, USDA Secretary Brooke Rollins announced that an agreement was made between the U.S. and Mexican government for Mexico to meet the current water needs of farmers and ranchers in Texas as part of the 1944 Water Treaty, delivering a huge win for American agriculture. In the agreement, the Mexican government committed to transferring water from international reservoirs and increasing the U.S. share of the flow in six of Mexico’s Rio Grande tributaries through the end of the current five-year water cycle. The agreement between the United States and Mexico solidified a plan for immediate and short-term water relief to meet the needs of Texas farmers and ranchers for this growing season. Additionally, the agreement includes water releases and continued commitments through the end of this cycle, which concludes in October. Under the 1944 Water Treaty, Mexico is obligated to deliver 1.75 million acre-feet over five years to the United States from the Rio Grande River. The United States, in turn, delivers 1.5 million acre-feet of water to Mexico from the Colorado River. Mexico’s persistent shortfalls in deliveries have led to severe water shortages for Rio Grande Valley farmers and ranchers, devastating crops, costing jobs, and threatening the local economy. Going forward, the U.S. welcomes further collaboration with Mexico about their treaty agreements, keeping other outstanding water debts in mind.

We have been reporting that demand has remained fairly steady, and this is the week where we change our tone; signals in the export market indicate that demand is weakening. Even if mills are busy with old business, selling barges and generating new business is increasingly difficult. The two main culprits are oversupply and poor quality. Having poor quality is a long-term problem that requires attention, but when it’s coupled with multiple replacement options that possess higher quality characteristics at a lower price point (think Mercosur origins), it spells bad news for the short term. One of the only spots to find reprieve right now is the potential for decreased plantings, and the hope for Iraq to come through with a new MOU for the coming year.

The April 28th crop progress report shows that we are still well ahead of the 5-year average in plantings and rice emergence, both up 14% and 11%, respectively. Louisiana is almost finished with 92% planted and 86% emerged, while Texas is just behind at 89% and 77%. Arkansas is 68/40, Mississippi is 62/31, Missouri is 44/11, and California is now at 20/0. Even though we are well ahead of previous years, the anticipated acreage reduction is looking to exceed 200,000 acres in the wake of poor prices and preventative planting. The cutoff date is May 25 for preventive planting in Northeast Arkansas, the most concentrated long-grain producing area in the U.S. Yield loss starts after May 10th, and right now, farmers are saying they need 14 days of dry weather to plant while rain is in the forecast for the days ahead. Estimates of a reduction in long-grain acres are in the 250,000 to 400,000 range.

With the harvest in South America wrapping up, the strong crop and adequate supply will pose a real threat to the U.S. crop being planted right now. While the domestic milled business, Iraq, and Haiti are crucial to the baseline health of the industry and on-farm pricing, so is the paddy export business to our partners in Mexico, Central, and South America. With ample quality supplies in the southern hemisphere to compete with, we do have concerns about pricing when we get to harvest and begin marketing the new crop.

In Asia, prices continue to bounce along the bottom as they have for the past four weeks. There appears to be no shortage anywhere, and even large demand centers like Indonesia are reporting that they won’t be needing as much rice as in the past. Asian prices are nominally quoted at $ 400 pmt, which is nearly a 20% reduction from a year ago. The weekly USDA Export Sales Report shows net sales of 12,700 MT this week, down 74% from the previous week and 62% from the prior 4-week average. Exports of 20,100 MT--a marketing-year low--were down 75% from the previous week and 70% from the prior 4-week average.

The next USDA Export Sales Report will be released on Thursday, May 8, 2025