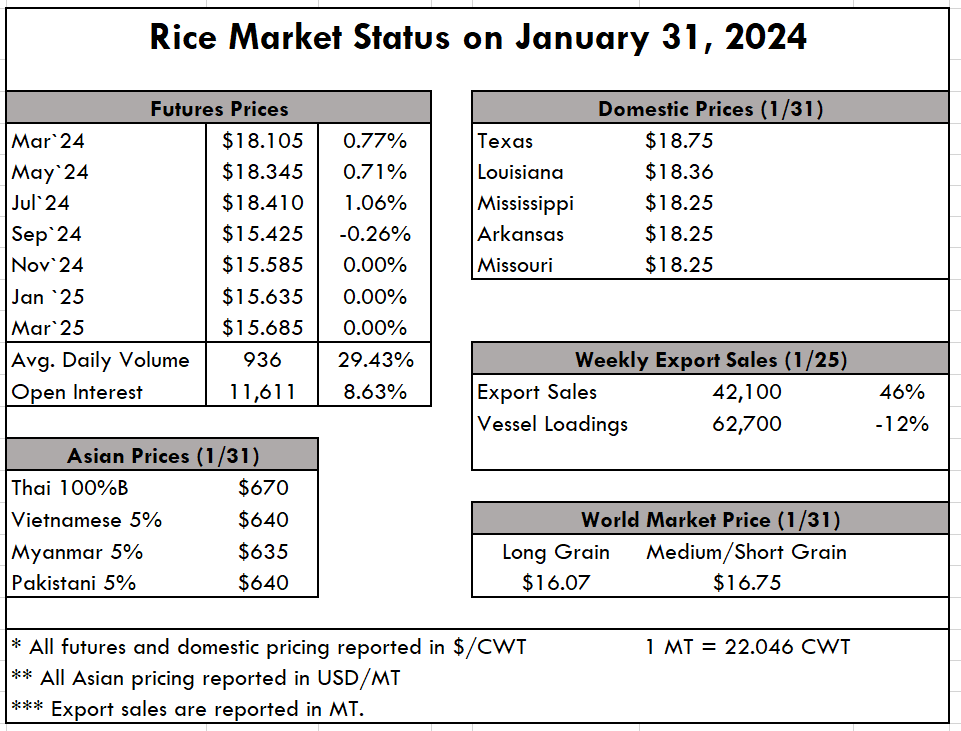

Following the vein from last week where we discussed the increasing pace of exports of US long grain rice, the USDA Economic Research Service Rice Outlook report just released this week is headlined “U.S. 2023/24 Export Forecast Raised 2.0 million cwt to 87 million.” Top-line news like this is especially positive when it trickles down to on-farm pricing, which has been the case thus far into the year. With futures prices pushing new highs, the market is also testing the topside tolerance of domestic buyers. What we are finding is that prices aren’t likely to go up forever, but sustained firm pricing is not only possible but probable. Right now on the ground, we are seeing prices in Texas firm at $19.00/cwt, Louisiana $18.40/cwt, and Arkansas, Mississippi, and Missouri all strong at $18.50/cwt. If we look at prices from last September/October, we see an increase of 17% in the last four months. This increase typifies the reality that the United States has been the only reliable supplier of long grain for months. In Asia, it has been a long-held expectation that prices would remain over $600 pmt on account of the Indian export ban. Prices skyrocketed to over $625 pmt, then $650 pmt, then even above $660 pmt. Thailand and Vietnam have been neck-and-neck vying for exports with strong demand, but the recent and very sizable procurement from Indonesia that didn’t include any Thai rice has poked a hole in the upward narrative. Prices for Thai rice have now dropped down to $625 pmt, and Viet prices at $645 pmt, down significantly from recent weeks. The expectation is that India will lift their ban sometime between April and June of this year. Further investigation into the February ERS Rice Outlook reveals that the rice import forecast was raised by 1 million cwt, to a record 43 million cwt. This 8% increase from last year comes all in the long grain category. More specifically, the lion’s share is Thai jasmine or aromatic varieties. Also increased, as mentioned above, was the export forecast, by 2 million cwt, all of which is not only long grain rice but long grain rough rice. This is 35% above last year and the highest since 2020/21. This fact alone speaks to the value of our partners in Central and South America and the strategic partnerships and relationships that USRPA fostered over the years. The weekly USDA Export Sales report shows net sales of 154,900 MT this week, up 40% from the previous week and up noticeably from the prior 4-week average. Increases primarily for Colombia (88,000 MT), Mexico (22,300 MT), Haiti (22,200 MT), Japan (14,000 MT), and El Salvador (6,000 MT). Exports of 95,600 MT were up 23% from the previous week and 27% from the prior 4-week average. The destinations were primarily Senegal (34,600 MT), Venezuela (27,700 MT), Haiti (22,200 MT), Mexico (4,100 MT), and Canada (2,400 MT). |

Louisiana board members Dustin Watkins and Mark Pousson and Cornerstone Government Affairs' Fred Clark with Louisiana Congresswoman Julia Letlow.

Louisiana board members Dustin Watkins and Mark Pousson and Cornerstone Government Affairs' Fred Clark with Louisiana Congresswoman Julia Letlow. Chairman Neal Stoesser and his wife, Meredith, Gayla Rose (2023 USRPA scholarship recipient), and Texas Rice Council President Tommy Turner met with Texas Senator Ted Cruz.

Chairman Neal Stoesser and his wife, Meredith, Gayla Rose (2023 USRPA scholarship recipient), and Texas Rice Council President Tommy Turner met with Texas Senator Ted Cruz. Missouri board members Alex Clark, Justin Wheeler, Mitchell Thomas, and USRPA COO Mollie Buckler met with Missouri Senator Eric Schmitt.

Missouri board members Alex Clark, Justin Wheeler, Mitchell Thomas, and USRPA COO Mollie Buckler met with Missouri Senator Eric Schmitt. Meeting with California Congressman Doug LaMalfa, who is a rice farmer and was part of the creation of USRPA.

Meeting with California Congressman Doug LaMalfa, who is a rice farmer and was part of the creation of USRPA. FAS Marketing Specialist Curtis McCoy joined FECARROZ to educate the group on how FAS supports USRPA's international promotion efforts.

FAS Marketing Specialist Curtis McCoy joined FECARROZ to educate the group on how FAS supports USRPA's international promotion efforts. A toast from USRPA Chairman Neal Stoesser, thanking FECARROZ for their partnership with USRPA over the last two decades.

A toast from USRPA Chairman Neal Stoesser, thanking FECARROZ for their partnership with USRPA over the last two decades.

Trey Barker and Iris Figueroa at the USRPA booth.

Trey Barker and Iris Figueroa at the USRPA booth. Dr. Justin Benavidez, Chief Economist, U.S. House Committee on Agriculture.

Dr. Justin Benavidez, Chief Economist, U.S. House Committee on Agriculture. Mollie Buckler representing Missouri Rice Council and USRPA.

Mollie Buckler representing Missouri Rice Council and USRPA. Mollie Buckler, USRPA COO, introducing Dr. Justin Benavidez.

Mollie Buckler, USRPA COO, introducing Dr. Justin Benavidez.