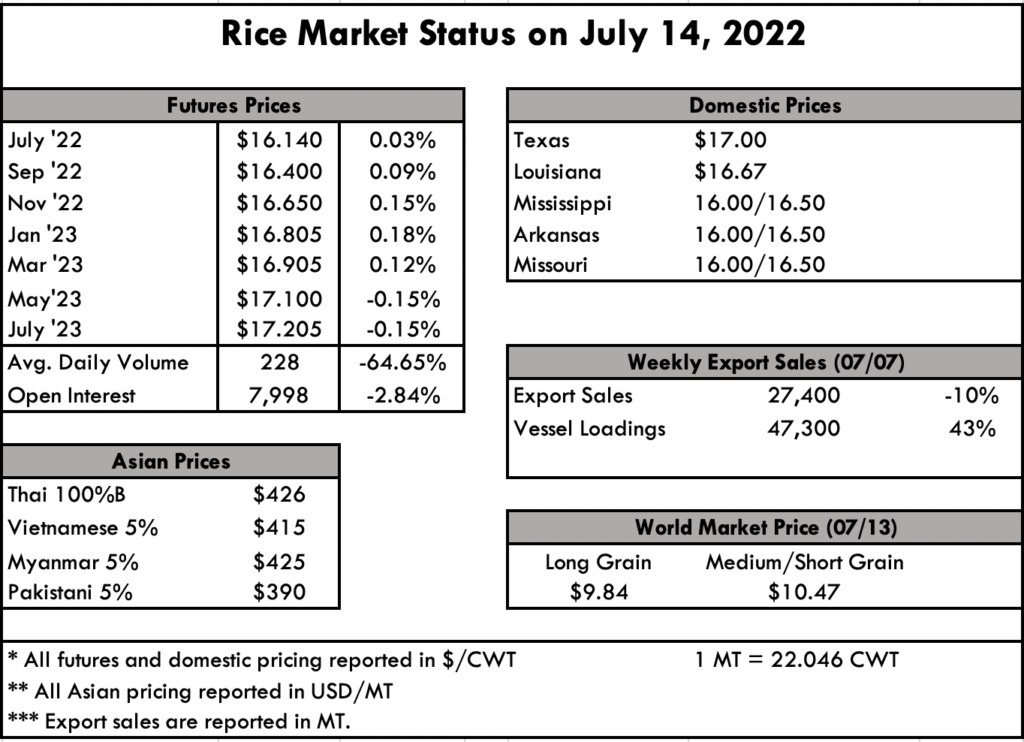

In virtually every rice growing state, the cash market continues to be stagnant, similar to the nearby futures contract which has basically traded sideways since the beginning of the month.

Based on the USDA crop progress report, the crop is in generally lower condition than last year. Currently 75% of Arkansas’ rice is in either good or excellent condition compared to the 88% at this time last year. As for rice headed, the two crop years are on parity with each other. Along the gulf coast of Texas and Louisiana a number of farmers began draining fields a few days ago and unless someone isn’t already cutting this week, then next week for sure, assuming the weather continues dry.

Globally, all eyes are still on Asia where rice demand is believed to be stronger due to the Russian & Ukraine wheat fallout. As the Middle East and North African markets hunt for alternative calories, rice is expected to become one of the key substitutes in this normally heavy wheat consuming region. Another factor that can place strain on the world rice market pertains to the fertilizer issue. Growers in Asia were clearly forced to ration fertilizer on higher prices, but the effects of those agronomical decisions have yet to be seen. China is already reporting increased pest and disease problems with its rice crop and Thailand anticipates lower yields due to the inflated fertilizer and chemical costs. Since the Russia invasion, rice prices have remained rather stable when compared to wheat and corn. However, the last time the grain trade was this disrupted was in 2008, when rice prices ran past $1000 per ton, nearly twice the current value.

For the past year, India has sustained the lowest long grain export prices in all of Asia; according to the USDA Grain: World Markets and Trade report that may change in the months ahead as India, along with Pakistan and Cambodia brace for increased demand. The high domestic prices in Vietnam are pushing traders to source more and more rice each week from India, which should eventually strengthen India’s prices. Pakistan, a large wheat producer and consumer, has been afflicted by hot and dry conditions which will ultimately lead to lower output for both rice and wheat. The European Union is also grappling with severe drought which will force the region to boost imports in 2022/23. Overall, global rice stocks are set to decline in 2022/23 while the global rice trade is forecast to expand.