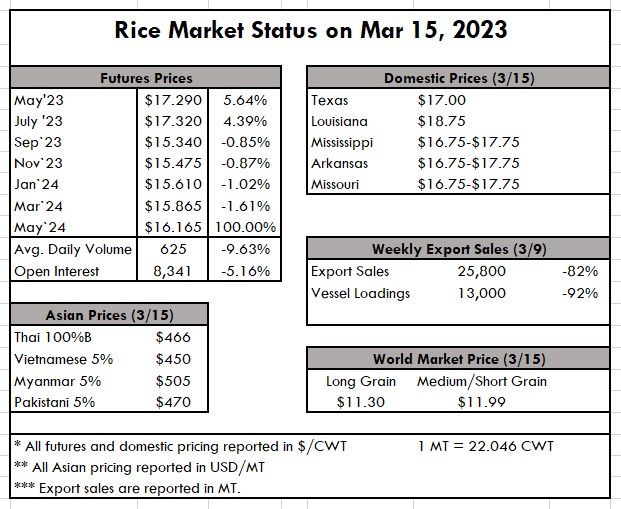

| With planting officially kicked off in a few Southern states, there is muted optimism that this year could be the one where we see Haiti back in the market, and possibly renewed interest from Iraq to keep the mills busy. While the Central and South American markets don’t expect a significant trend change, having additional supply this year should help to make US rice a little more competitive. But the eye-popping export sales report from last week helped point out that there is still good news and good business to be had, despite the drop-off in exports to the Western Hemisphere. Last week we mentioned Panama’s tender, and that it would take hope and a prayer for any U.S. rice to find its way into the business. It is still preliminary, but it appears that U.S. long rice will be utilized to cover at least a portion of the tender. The tender appears to have been awarded to two separate trading houses both of which expected to originate the bulk of the rice from Uruguay and the USA. Mercosur has the rice at attractive prices, but Paraguay’s logistics make it a difficult option, and Brazil lacking a phytosanitary protocol with Panama makes that origin not ideal either. Therefore, U.S. and Uruguayan rice will likely be the quickest solution to fulfilling the business. Given that this was not anticipated demand, it helps bring the carryout number from the USDA into parity with what the industry is expecting. There is more to report on here next week when we have more complete information, but the initial read is “good news.” Louisiana has reported that it is nearly 80% planted already, aided by good weather and a supply chain ready for rice planting. There have been cold weather that has delayed some farmers from getting in the field, but not by a significant margin. Texas is also well into its planting season, now expected to be at approximately 35% complete of its expected short crop. Arkansas, Mississippi, Missouri, and CA are still waiting in the wings to get in the fields. CA, with a drastic change in direction because of multiple atmospheric rivers, is now anticipating water allocations of at least 75%, and as high as 100% for all rice-growing regions. This was unfathomable only weeks ago, but an example of how quickly things can change in rice. In Asia, prices softened a bit again in Thailand, moving down appx $10 pmt to the $450 pmt to level. Vietnam has stayed resilient in the $445-$450 pmt range. Indian prices are below that in the $430-$440 pmt range, but still difficult to ascertain because of the tariff. Last week we dove into the sizeable rabi crop that tipped the scales once again for India for a third consecutive crop; we didn’t mention the unfair subsidies the Indian government is giving its farmers to produce the grain. USRPA has championed the WTO to hold India accountable for the unfair marketplace they are creating, and another record crop is clear evidence there is no intent to take the WTO sanctions seriously. The weekly USDA Export Sales report is back in the doldrums after last week’s exciting jump. Sales returned to this year’s “normal” of 25,800 MT for 2022/2023, down 82% from the previous week and 59% from the prior 4-week average. Increases were primarily for Japan (13,000 MT), Mexico (10,200 MT), Saudi Arabia (1,200 MT), Canada (1,000 MT), and Belgium (100 MT). Total net sales of 13,000 MT for 2023/2024 were for Japan. Exports of 10,400 MT were down 94% from the previous week and 86% from the prior 4-week average. The destinations were primarily to Mexico (5,900 MT), Canada (3,100 MT), Jordan (600 MT), Saudi Arabia (200 MT), and the United Kingdom (200 MT). |

|