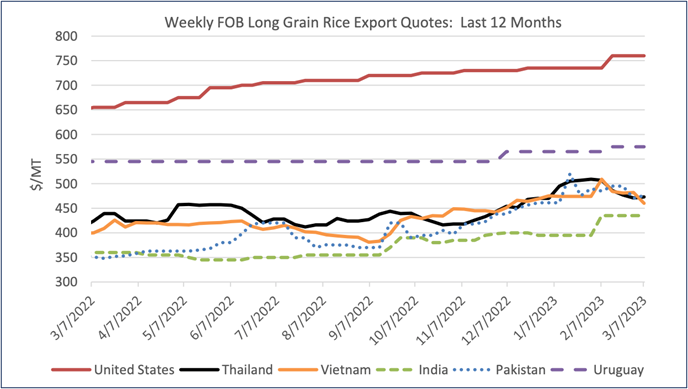

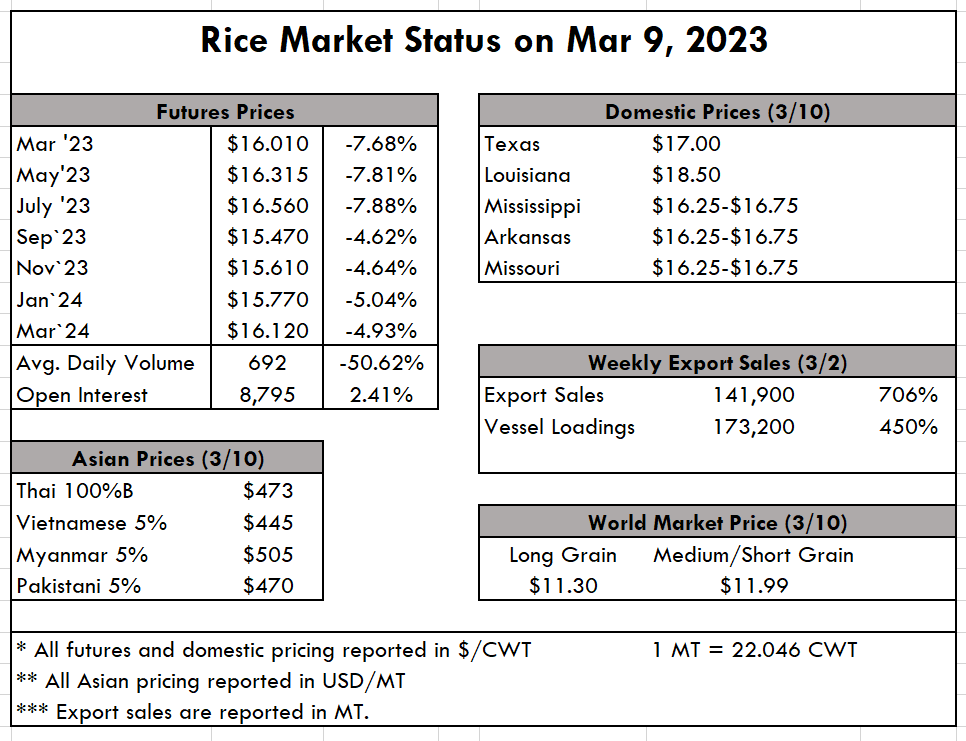

| The USDA World Agricultural Production report had a headline story this week, reporting that because of India’s larger-than-expected Rabi crop, the world’s largest exporter has notched yet another record crop for its third consecutive year. The Rabi crop typically accounts for approximately 30% of India’s total production, however this year it increased by 25%, offsetting losses that occurred during the primary kharif growing season. This doesn’t change the system matrix by any significant margin, but it is still stunning to see a recovery of such magnitude given the dry conditions seen in the earlier part of the year. Harvest of the Rabi crop will begin this month and end in late April where actual yield numbers will be derived. The supply and demand report for us here in the U.S. didn’t have terribly significant changes. The one thing that is being circulated in our conversations, but hasn’t made its way to the balance sheet yet, is the expectation that carryover is significantly higher than the reports are showing. It’s been week after week of dismal export sales reports (except for this week which set a marketing year high), and it’s well known that even with the strength of the domestic market and shorter crop these last two years, it’s not enough to offset the lean exports of rough and milled rice. There is potential for more Iraqi business, as well as the long shot for the Panamanian tender, but those are far from being baked into our calculations. The USDA Grains report corroborates the above news on India, showing that global rice production is now up because of the larger-than-expected Rabi crop being harvested in India. As a result, we anticipate exports will increase out of India, and regions like China, Nigeria, and Vietnam will import. While global consumption is expected to increase slightly, U.S. exports are at their lowest levels since 1985 on account of lost market share in Mexico and other countries in the Western Hemisphere. The below chart taken from the USDA report helps to visually explain why U.S. exports have been so low—it’s a simple function of a high price. And without favorable trade agreements, it is extremely difficult for the U.S. to compete in the current market.  The FAO Rice Price update shows that the All Rice Price Index average dropped 1% this month down to 125.1. This is 22% above its level last year, where last month was the All Rice Price Index’s highest price in the last 12 months. 2022 was also the highest price year, with 2018 coming in second in the last five years. This would indicate that inflation is finally finding its way to rice where it has appeared to have a delayed effect. A small slowdown in demand had the largest impact in Thailand, where prices slid nearly 5%, further influenced by the depreciation of the baht against the U.S. dollar. The weekly USDA Export Sales report shows net sales of 141,900 MT this week, a marketing-year high, which is great news and up significantly from last week and the prior 4-week average. Increases were primarily for Colombia (65,000 MT), Haiti (41,300 MT), Mexico (24,800 MT), Iraq (4,000 MT), and El Salvador (2,500 MT). Exports of 173,200 MT, also a marketing-year high, were up noticeably from the previous week and from the prior 4-week average. The destinations were primarily Colombia (59,000 MT), Iraq (44,000 MT), Mexico (26,300 MT), Haiti (22,200 MT), and Guatemala (12,100 MT). |

|