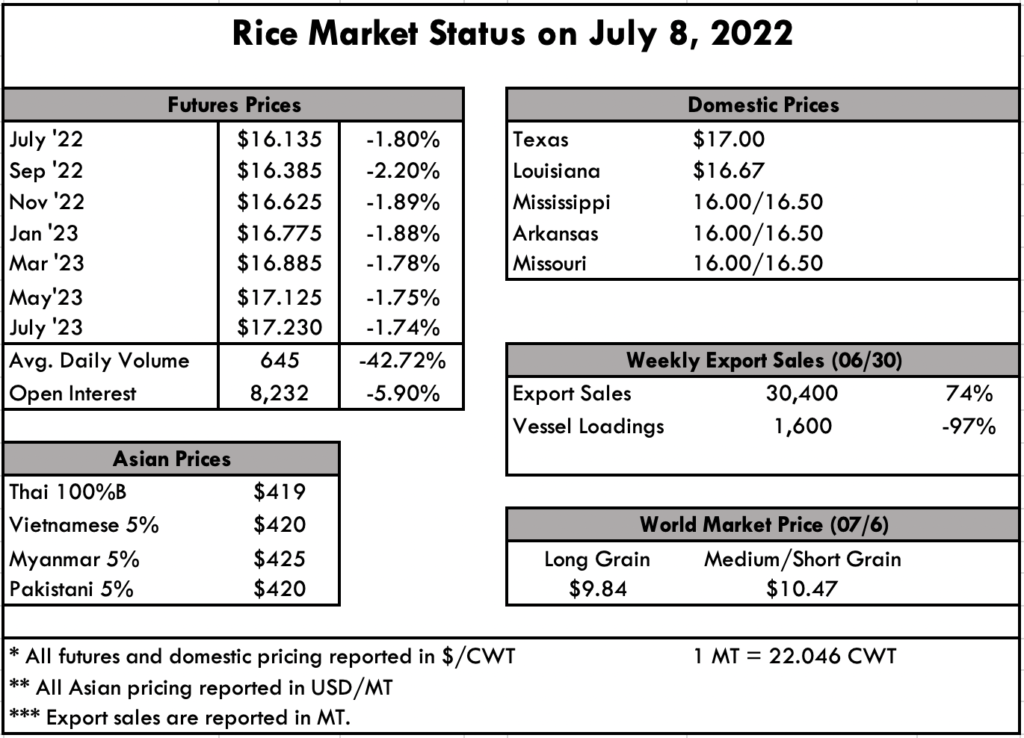

Steady as she goes. On the ground, the crop is progressing well in all regions at this point. Mississippi did have problems with planting and will likely experience a decrease in their total acres. But the crop in Arkansas is trending nicely, as is Louisiana. The heat that plagued Texas in previous weeks alleviated a bit, but industry remains cautiously optimistic. Managing weather and water conditions are always a challenge. As one farmer says, “until the crop is cut and in the bins we don’t know what we have.” The holiday week led to a quiet market environment, with little change from previous reports. Paddy prices on the farm remain high, as do milled rice prices compared to other origins in the Western Hemisphere, and even more so when compared to the Eastern Hemisphere.

The price disparity that we continue to discuss between U.S. prices and Asian prices has not yet resulted in an intrusion of Asian rice into historic U.S. markets. However, the intrusion of rice from both Brazil and Uruguay has taken a direct bite out of U.S. market share. This of course is exacerbated by the removal of tariffs from countries like Mexico to help fight food inflation. Our milled rice exports continue to be dismal, while paddy exports are holding steady from previous reports. The U.S. market finds itself in an interesting spot as trading companies are actively offering and selling Mercosur origin rice to U.S. customers like Mexico and others in Central America. All the while, the cost of inputs are so high for U.S. producers, profit margins have been squeezed to bare minimums.

A USDA GAIN report on Brazil that was published on July 1 posts a minor reduction of only 1% in expected acreage in Brazil because of decreased rainfall and increased input costs. More importantly than that small reduction, however, is that the yield is expected to decline as well—both because of decreased inputs because of their high costs, along with drier than normal weather. The higher price of corn and soybeans in the region is also pulling farmers away from planting rice in the irrigated area that comprises the majority of the rice growing region. The report projects an increase in exports in the 2022/23 marketing year by 100,000, moving from the expected 600,000 metric tons up to 700,000 metric tons, which is a 17% increase. This increase in exports directly eats into the US market share in Mexico and other Central American customers. There will be some hindrances in exports, however, that include a clogged logistics system, as well as the internal decision of supplying the domestic market while balancing exports—the reduction in acreage in the past two years makes it difficult for Brazil to supply both.

Finding a savior in a new milled rice customer is the focus of mills while service core domestic business. Farmers focus on growing their crop as they balance input costs against yields at the time of harvest.