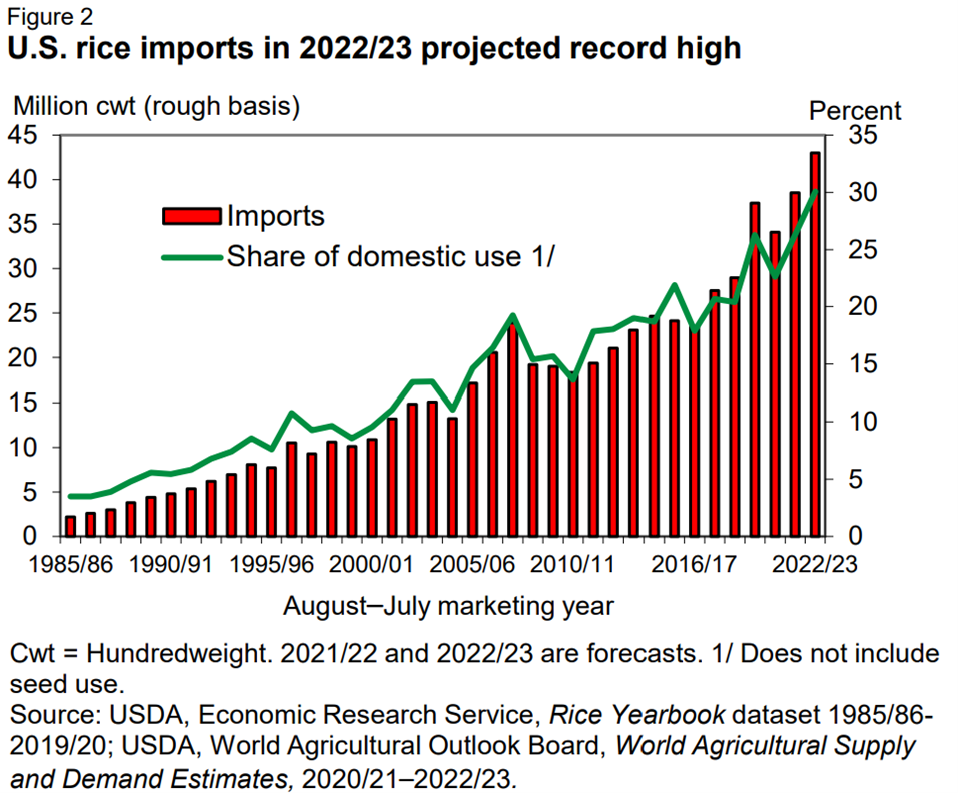

It is encouraging to see Iraq hold up to its end of the MOU with the U.S. despite prices being nearly double that of competing origins. Iraq has confirmed that they will complete their MOU with the United States and have purchased an additional 44,000 mt of US long grain milled rice with scheduled delivery in November. This will help stabilize the milling schedule in Arkansas, but the announcement of the business wasn’t enough to put upward pressure on the futures market after last week’s supply and demand report. Stocks for long grain bumped 500,000 cwt, production bumped 400,000 cwt, and ending stocks jumped by 1.8 million cwt. The announcement of the Iraqi business came at a perfect time to balance out these supply-side increases. The USDA’s July Rice Outlook raised its 2021/22 import forecast to a staggering 38.5 million cwt. That is a 13% increase in a year. Long grain increased 15% to 31.5 million. This puts imports at 30% of the U.S. domestic consumption. This is not what U.S. farmers like to hear.

On the ground, Louisiana has passed the halfway point in harvest, with qualities looking good at this point. The market is liquid in the $17.30/cwt range, but most of the focus remains on cutting. Harvest is a bit more of a struggle in Texas, where rain and wind have created problems. Several hybrid lots to date have had poor milling quality, which garnered $10 premiums, resulting in total prices below $17/cwt. Conventionals have performed better thus far, with premiums closer to $11.50/cwt. Mississippi is looking good despite their concerns earlier in the year, with 87% of the crop noted in fair to good condition, and most of the harvest expected to be complete in September. Arkansas is in a similar spot, with harvest expected to begin in September, where 17% of the crop is rated as excellent, and the remaining balance is in good to fair condition.

In Asia, prices are holding steady in Thailand after a few weeks of volatility; the price remains at $430 pmt. Iraq continues to be an active buyer there, and Thailand has been their supplier of choice for much of this year. Vietnam is significantly cheaper at $395 pmt, with the Philippines being their primary customer and exceeding all expectations at this point, as the Philippines appear to exceed the 3 million metric ton mark. India remains the lowest at $355 pmt, with the news of a potentially light monsoon not having any impact on prices at this point. Pakistan is registering at $370 pmt with its record crop of 9 million metric tons.

The Reconciliation Package that Congress passed includes approximately $18 billion for the USDA conservation programs, with a directive to “mitigate or address climate change through the management of agricultural production.” This will be broken down into our buckets, which include Environmental Quality Incentives Program, Regional Conservation Partnership Program, Conservation Stewardship Program, and the Agricultural Conservation Easement Program.

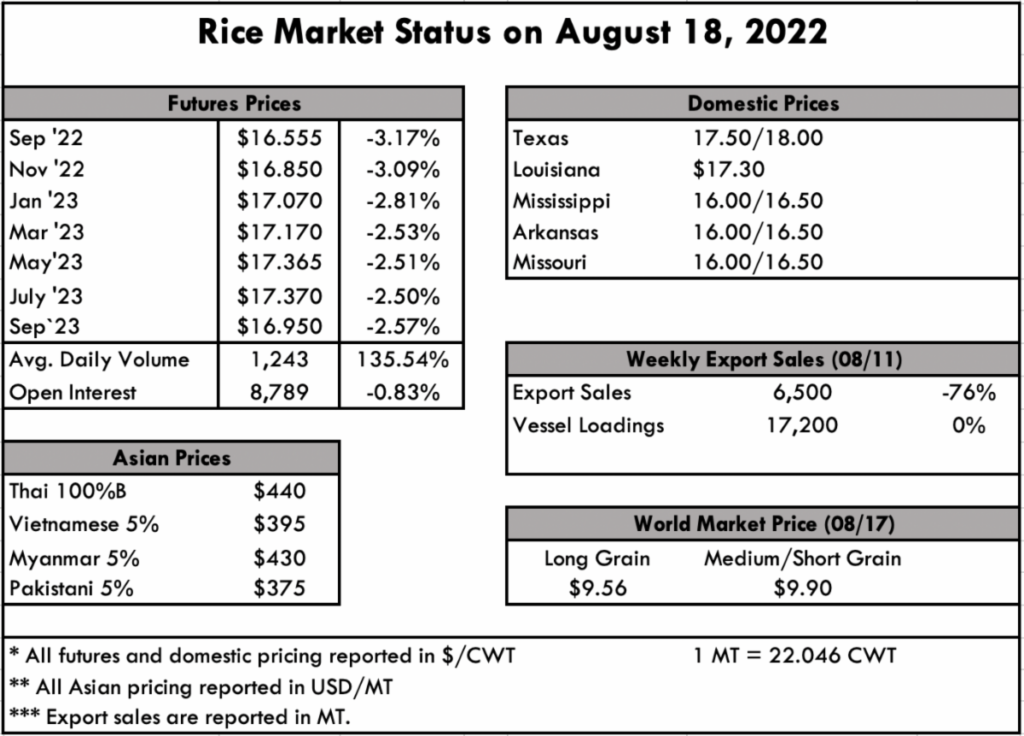

The futures market has remained relatively flat as harvest has gotten underway. Open interest this week is at 8,789, flat from last week, while average daily volume took a huge jump, up to 1,243, or 135% higher than last week.

The weekly USDA Export Sales report shows net sales of 6,500 MT this week, primarily for Canada (3,900 MT) and Mexico (1,600 MT). Exports of 17,200 MT were primarily to Guatemala (8,600 MT), Canada (3,200 MT), El Salvador (2,100 MT), Mexico (1,800 MT), and Belgium (500 MT).