After several weeks of the cash market trading sideways, it looks like slower export demand and domestic use has finally caught up. Rice prices soften in each state, albeit by minimal amounts. Rice acres are looking to be flat as corn and beans steal the show. Early guidance suggests growers will consider corn and bean acres as demand is forecast to be strong moving into the 2021 marketing year.

Export demand for US long grain rice remains suppressed as the market struggles to compete with Asian and even South American origins. The latest USDA export sales report cited total long grain demand to be down over 18% YTD.

Between sluggish demand in rice and robust demand in corn and beans, it’s no surprise that growers intend to supplant rice ground for these other commodities. Early projections are that long grain acres in Arkansas will decline by 210,000, Louisiana down 35,000, and Mississippi is forecast down 21,000. Only Texas is expected to match last year’s planted area. California acres are expected to see a sharp reduction as well, however that is not market driven, it is strictly water related. There is some potential risk for US farmers attempting to chase corn and bean prices as reports are coming in that suggest China plans to increase acreage by over 1.65 million acres in the upcoming marketing year.

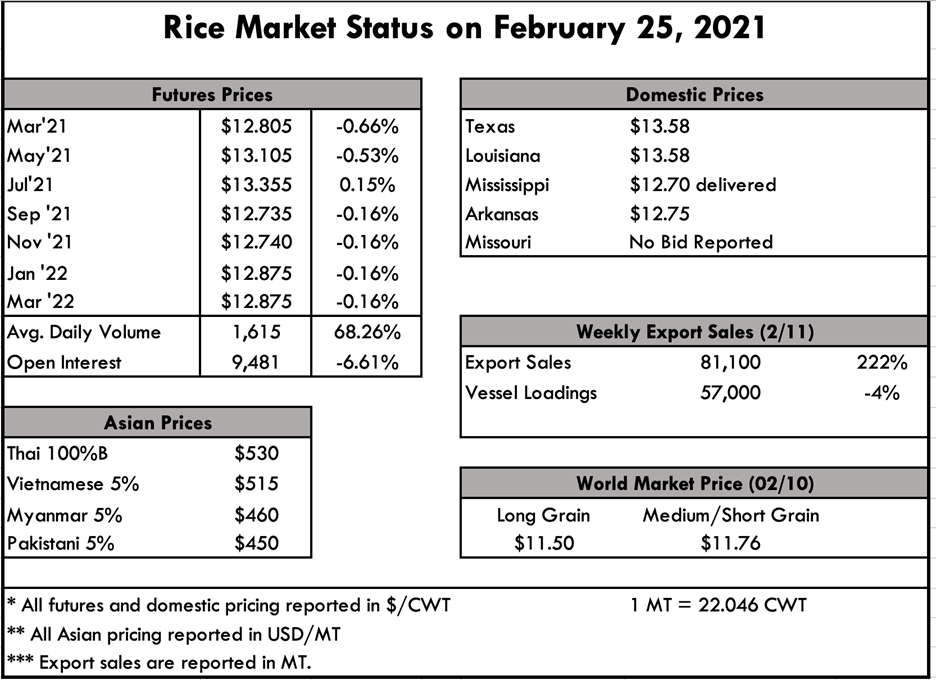

With the exception of India, most of the major Asian exporters have seen few market developments over the past couple of weeks. While Vietnam is rumored to be in talks with Iraq regarding a tender, that sale has yet to come to fruition and in the meantime, Viet prices have slipped further to $505-510 per metric ton. Thailand is experiencing some market volatility as the local market reached 10-month highs on supply scarcity. Ultimately, this price action has kept many Thai exporters at bay, paving the road for India to capture additional market share.

The nearby contract closed at $12.805 per cwt in Thursday’s trading session which marks a $0.20 per cwt decline over the past 2-weeks. Volume is also down significantly, recorded at only 496 while open interest was relatively steady at 9481. With little change in pricing for the June ’22 and March ’22 contracts the board seems to be signaling that more acres aren’t needed in the market.