Field reports coming in from Arkansas are mixed in a good way; some are seeing average, while others are reporting above average. Reports of below-average are starting to sneak in, but they are few and far between with early reports being solid. Harvest is just about 5% behind last year, but 9% behind the five-year average. The expectation is that things will catch up relatively quickly in the next two weeks, where we will get an initial read on millings as well. With old crops still in first hands, we could see an interesting price dynamic emerge for on-farm pricing as the market will begin deciphering old crops from new crops. Mississippi, like Arkansas, is still in the middle of harvest with 60% cut, which is right in line with last year and the five-year average. It was a small crop this year, and initial reports have not been so bright with some milling results coming in with head rice in the low 50’s.

Domestic millings remain steady, but the high prices may be bumping against a ceiling. In the most recent months, red-hot inflation provided the cover fire (and justifiably so) for increasing prices. Now that inflation is resting at over 8%, price increases aren’t being so readily accepted in the market. This doesn’t necessarily signal a price decrease coming anytime soon for US long grain rice, but it should make growers who are holding paddy consider selling at current prices before the domestic market gets covered and the market turns to depend on exports.

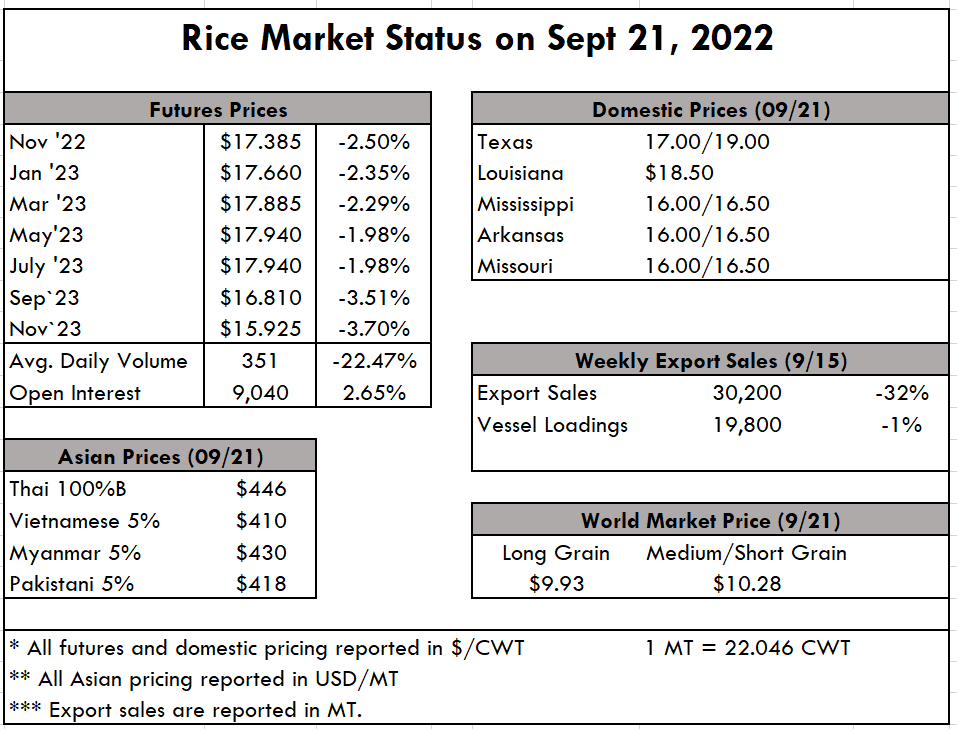

The 20% tariff on Indian rice exports is still having muted impact on Thai and Viet prices, but we expect to see them augment in the coming weeks. In years past, announcements like the ones India just made have jolted markets and prices into a panic—we are happy to see that level heads are prevailing this time. Buyers are discerning their way to dependable suppliers despite the tariff. And it can’t be overlooked either, that rice prices in the Middle East and far east haven’t risen like other grains have in the past six months, so on a parity basis, Indian rice, even with a 20% tariff, is still cheap in a relative sense. Thai prices are at $445 pmt, Viet prices at $410 pmt, and Indian Prices now rising to $390 pmt.

The USDA Export Sales report is finally back online, showing sales of 30,200 metric tons. Highlights are that 15,500 mt were long grain rough, and Saudi Arabia bought 8,800 mt milled. Exports for the week registered at 19,800 mt, with long grain milled in the amount of 8,500 mt to Saudi Arabia taking the lion's share.

In the futures market, average daily volume dropped by 22% down to 351, and open interest bumped 2.65% to 9,040. It would appear that the market is poised for a slight pullback, but there may still be some legs in the current action. Reports are indicating strength through harvest and the end of the year, but things can change quickly.