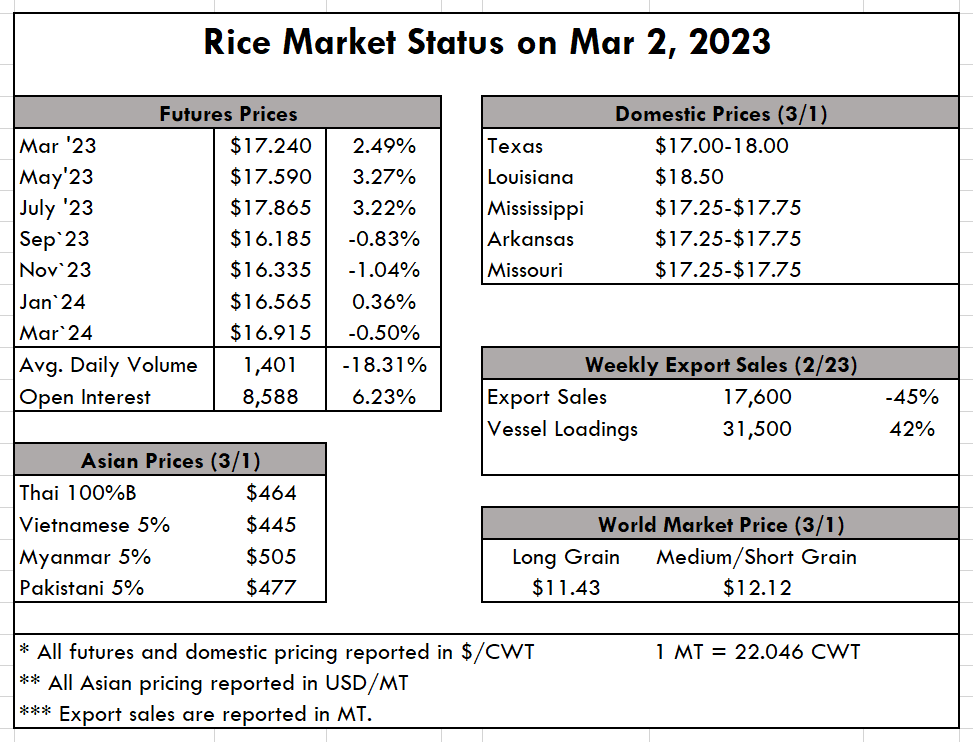

| It’s the moment we’ve all been waiting for — we are far enough into the year that we can put some numbers around the expected acreage this year. The good news is it is expected to be up from last year. The bad news is that it’s still far short of normal, and likely not enough to garner significantly more exports all things being equal. All acreages are estimates, and could still vary quite a bit in the coming weeks and months, but this will at least help offer some context as we move into next year’s intentions. To kick it off, we expect Arkansas to have increased its long grain acreage by 13%, up to approximately 1.15 million acres from 1 million acres last year. Medium grain acres are expected to increase by almost 15%, up to 150,000 acres from 106,000 acres last year. In all discussions medium grain related, save for California, acres are limited by seed availability this year. In Louisiana, long grain acres are looking to decrease about 5%, down to 350,000 acres, while the medium grain is expected to jump 25% up to 75,000 acres from 55,000 acres a year ago. So overall, Louisiana will produce the same acreage, just more of it will go to medium grain. Mississippi looks to be rebounding this year, expected to increase about 25% up to 115,000 acres from only 85,000 acres last year. All are expected to be long-grain. Missouri is expecting a significant bump in acres as well, to the tune of a 20% increase. All of that will come in the form of long-grain rice, moving from 150,000 acres last year up to 190,000 acres this year. Texas is the stand-alone reduction of all the rice-producing states but on account of drought. It’s expected that the Lone Star State will decrease by nearly 30%, down to 145,000 acres from last year’s number of 190,000 acres. And moving to the west coast, the rain and snow in California have finally arrived, and expectations are that medium grain acres will reach at least 425,000 acres this year, with many optimistic it will be even more than that. In summary, total long grain acreage is expected to be about 1.9 million acres in the coming year, up 8% from last year’s 1.8 million acres. Medium grain acres are expected to be 660,000 acres, up 35% from last year’s 420,000 acres. And in total, all acres are looking to be 2.6 million acres, up 15% from last year’s 2.22 million acres. In 2020 when long grain acres were 2.33 million, the average farm price was $12.60, and in 2021 when long grain acres dropped to 1.97 million, the average farm price bumped a dollar up to $13.60. In the current marketing year with 1.8 million acres of long grain, the average farm price sits at $16.90. The 2023 estimates of 1.96 million acres of long grain look most like the 1.97 million acres of 2021 when the average farm price was $13.60; however, a lot has changed since then with inflation and cost of inputs, so it is difficult to gauge with accuracy specific pricing. What we do know is that exports have reached all-time lows, and we need additional supply, trade servicing, and strong trade relationships to see a re-energized export market. The weekly USDA export sales report shows net sales of 17,600 MT for this week, down 45% from the previous week and 69% from the prior 4-week average. Increases primarily for Japan (13,200 MT), Canada (3,400 MT), Saudi Arabia (600 MT), and Austria (300 MT), were offset by reductions for Honduras (100 MT). Exports of 31,500 MT were up 42% from the previous week, but down 14% from the prior 4-week average. The destinations were primarily Japan (26,000 MT), Canada (2,400 MT), Mexico (2,100 MT), Austria (300 MT), and Saudi Arabia (300 MT). |

|