The good news is that the crop is progressing well it looks solid across all regions. Producers can take solace in that fact after a bumpy planting season plagued with volatile prices and uncooperative weather. Now that the crop is in the ground, the exporters and marketers are left to deal with an extremely difficult market environment. Export sales reports in recent weeks have been dismal, and while this week is better than previous, it is unlikely to be a new trend. Iraq has found its trading partner in Thailand for milled rice. With prices of U.S. Long Grain far outpacing that of the competition, there is not an easy path forward in the near term.

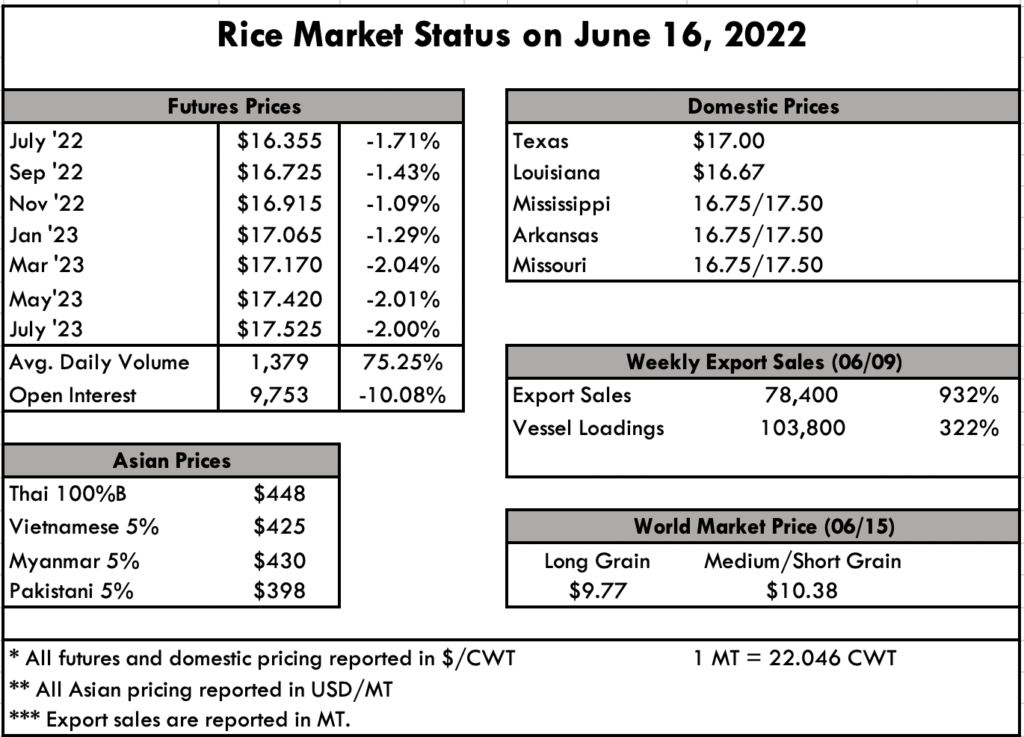

On the ground, new crop bids in Texas still lead the way at $17/cwt, but they are all out of old crop, so new sales won’t surface until we get closer to harvest. Louisiana is indicating bids of $16.67/cwt but doesn’t seem to be attracting much attention at this point in time from sellers. Mississippi is still struggling through planting in some regions, and old crop is all gone. Bids are expected to be in the $16.75/17.50 range. The crop in Arkansas is looking solid, notching 24% excellent and 55% good, which is higher than normal. Missouri is in a similar situation.

In Asia, prices held firm in Vietnam at $425 pmt, while they softened a bit in Thailand largely based on currency fluctuations. Indian rice continues to be the lowest at $350 pmt, and their exports outpace all others.

All in all, the market is relatively quiet despite the wild fluctuations in the stock market and interest rates. The value of the dollar could have a significant impact on the price of the coming crop, as well as its exportability based on currency fluctuations at harvest. Because the price is currently so high, stocks have the potential to build beyond expectation, which could result in more competitive pricing in the months ahead as the crop progress becomes clearer.

The futures market is likely reflecting the slow milled, barge, and paddy business right now. Average daily volume was 4,379, up 75% from last week, and Open Interest was 9,753, down 10% from last week.

The USDA Export Sales report shows net sales of 78,400 MT which is up noticeably from the previous week and from the prior 4-week average. Increases primarily for Mexico (24,400 MT), Haiti (22,400 MT, including decreases of 100 MT), Colombia (17,700 MT, including decreases of 100 MT), Panama (9,900 MT), and Canada (2,500 MT), were offset by reductions for Saudi Arabia (900 MT). Exports of 103,800 MT were up noticeably from the previous week and from the prior 4-week average. The destinations were primarily to Mexico (27,000 MT), Colombia (26,900 MT), Japan (12,100 MT), Panama (9,900 MT), and Nicaragua (9,500 MT).