This will be about the last week we report on crop plantings as the majority will be at 100% next week, except for California and maybe Texas. It’s been a relatively painless planting season, save a few isolated weather events. Rice emerged is progressing nicely as well, still 10% ahead of the 5-year average with Louisiana at 94%, Mississippi at 89%, Texas at 88%, Missouri and Arkansas both at 85%, and California down at 15%.

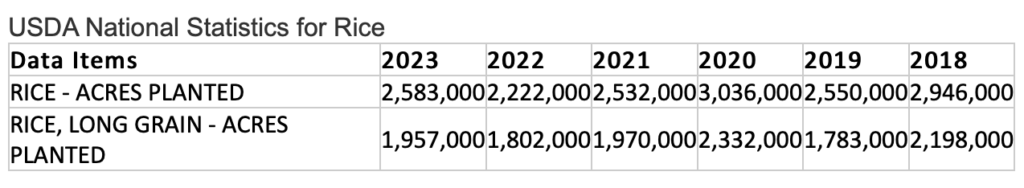

We do have enough information with these reports though, to lay out a decent idea of acreage we have in each state by long grain and medium grain. In Arkansas, surveys have brought us to approximately 1.3 million acres of long grain and 165,000 acres of medium grain. Louisiana is reporting 390,000 acres of long grain and 60,000 acres of medium grain. Mississippi is just over 100,000 acres of long grain, with no medium grain expectation. Missouri is 195,000 acres of long grain, and 5,000 acres of medium grain reserved for seed. Texas is looking at 130,000 acres long grain, and 3,000 acres of medium grain, also reserved for seed. California is now projected at 470,000 acres of medium grain. This gives us a long grain total of 2.115 million acres, a medium grain total of 703,000 acres, and a grand total projected U.S. rice production of approximately 2.818 million acres of rice. This is welcome news to a market that has been battered by decreased production two years in a row. Input suppliers and allied industries domestically are thankful for the return to normal, and the battle will now be regaining the market share that has been lost due to high prices and short supply.

A look at USDA acreage numbers since 2018, particularly long grain rice reinforces what all farmers know: until the rice is cut, dried and stored we don’t know what we have in hand.

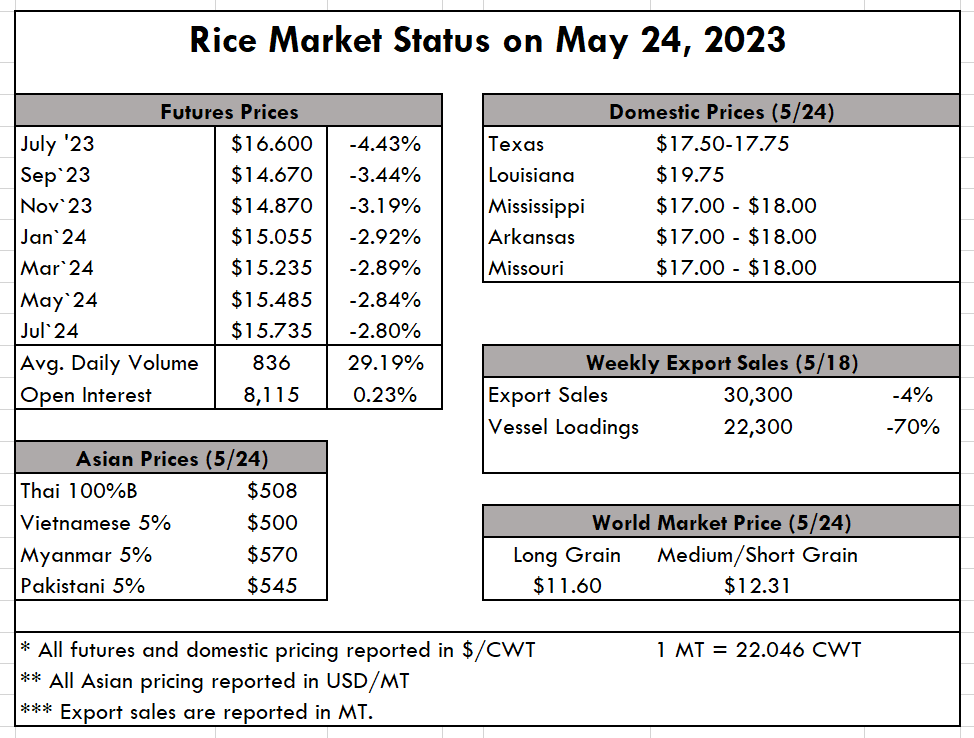

The market will be going through an adjustment where, much like the stock market, bad news will be good news. As we know, tight supplies have led to high prices and constricted exports. All industry members keep saying that a larger crop will bring U.S. long grain back to a competitive nature. However, that means prices will have to drop significantly to compete with Paraguay, Brazil, Uruguay, Argentina, and heaven forbid—Viet/Thai/Paki rice. With the expiration of CAFTA-DR and most tariffs being suspended to reduce food inflation, prices will need to come down at least $140 pmt — and this makes us competitive with just Brazil. While a decrease of that magnitude is “bad news,” that’s the only way to claw back our export customers and see our export numbers climb once again. This is a farm bill year, and its passage and implementation will be more important then ever going into a climate with so many factors at play.

In Asia, prices continue to hover around the $500 pmt for both Vietnam and Thailand. India is holding firm in the $440 pmt range, and recently announced a special relaxation of their export restrictions on broken rice to help provide 200,000 mt of broken rice to Indonesia, 500,000 mt of broken rice to Senegal, and 50,000 mt of broken rice to Gambia.

The most recent FAO Rice Price Index reports that against the backdrop of rising inflation, input costs, Russia’s war on Ukraine, drought in major rice producing regions (namely Brazil, China, and the U.S.), global rice exports are expected to contract for the first time in four years for calendar year 2023. The report expects a global export contraction of 4.4%, down to 53.6 million metric tons.