Steady as she goes. Oftentimes, we find ourselves on pins and needles awaiting new information to illuminate the future of the market. Right now, however, there is relative stability with most stones turned over and the market is operating smoothly. Mills are busy with domestic business and small amounts of exports. Paddy sales and prices are firm, without reasons for significant volatility in the short term. The primary question that remains to be answered that could have impacts on the futures market and the current matrix would be planting intentions for the coming year, and we are still too early to make any predictions with confidence. It is the hope, however, that acres will increase significantly and return to a more “normal” number for the coming year.

With our domestic market on relative cruise control, we can turn our attention to our South and Central American markets where drought is impacting the rice supply, and a GAIN Report was published in Brazil. Looking first at Brazil, Post has reduced the expectation for rice planted area for MY 2022/23 because of high input costs and low profitability from 4 million acres down to 3.78 million acres, a reduction of 5.5%. This continues a downward trend that began in 2000, saving a minor blip in 2004/2005, that an increase in yields has not been able to entirely offset. On the export side of the equation, Post forecasts an uptick of 200,000 metric tons, from 900,000 mt to 1.1 million metric tons. This is in part due to the benefit that Brazilian rice exporters experienced from the favorable exchange rate and tax exemption adopted by Mexico, which opened a market of almost 500,000 metric tons of Brazilian rice in 2022, in direct detriment to the United States. Harvest has just begun in only a few regions in Brazil, but is behind schedule because of unusually low spring temperatures in October and November.

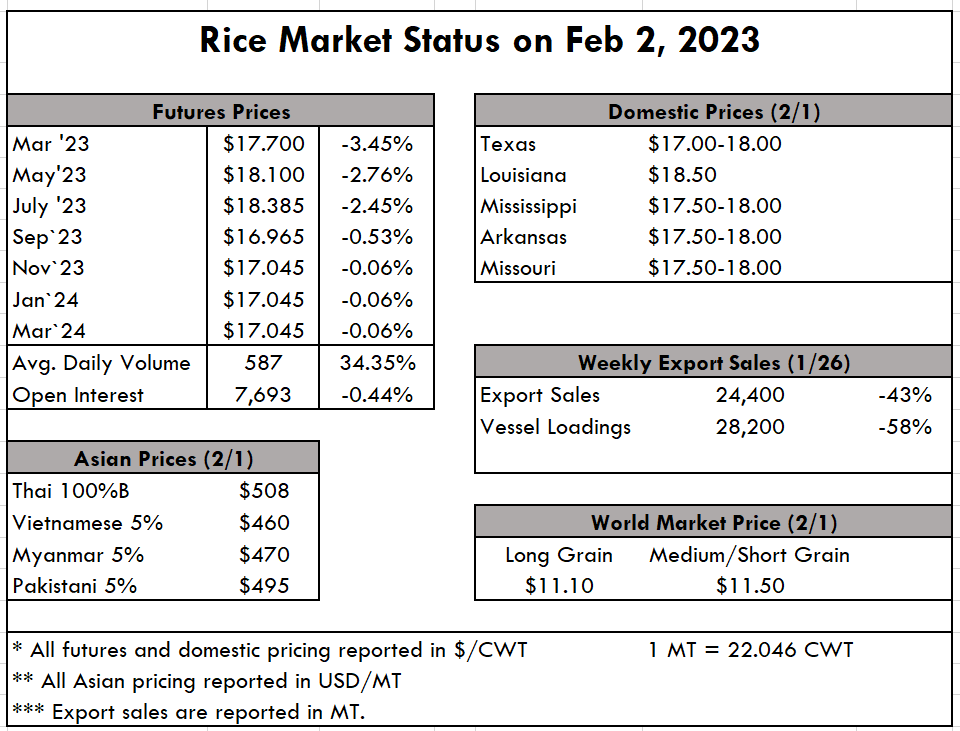

Asia is following the same vein in reference to stable pricing, as Vietnamese and Thai prices both held firm at $495pmt and $465pmt respectively; right in line with previous weeks. India, on the other hand, is working through the machinations of reinstating their 20% tariff on milled rice and the ban on brokens. This makes it hard to ascertain exact pricing but will appear more expensive when sorted out.

The weekly USDA Export Sales report shows net sales of 24,400 MT this week, down 43% from the previous week and 21% from the prior 4-week average. Increases were primarily for Haiti (15,100 MT, including decreases of 200 MT), Honduras (5,600 MT), Canada (1,100 MT, including decreases of 100 MT), Guatemala (1,000 MT), and Mexico (500 MT). Exports of 28,200 MT were down 58% from the previous week and 33% from the prior 4-week average. The destinations were primarily Haiti (22,200 MT), Mexico (2,900 MT), Canada (2,200 MT), Belgium (200 MT), and the Netherlands (100 MT).