Market Update: A Year Like No Other Continues

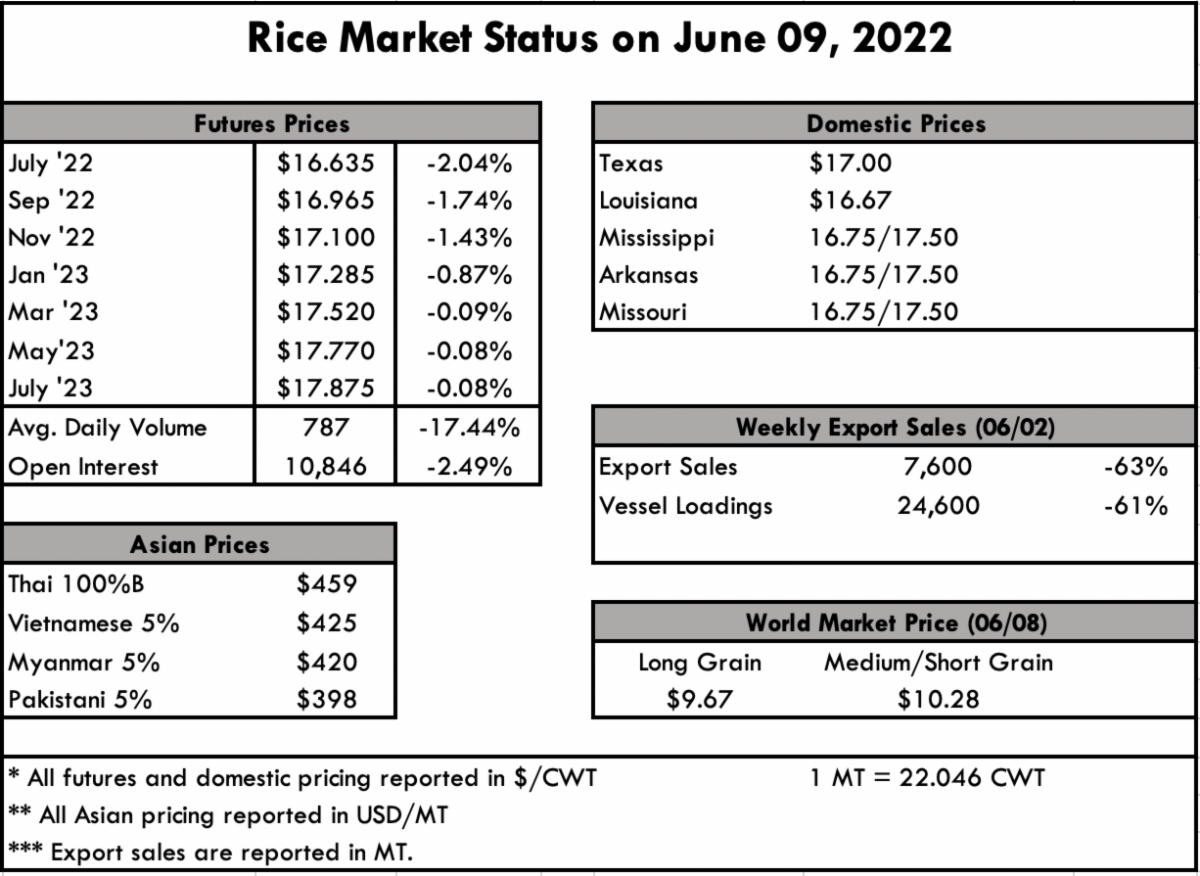

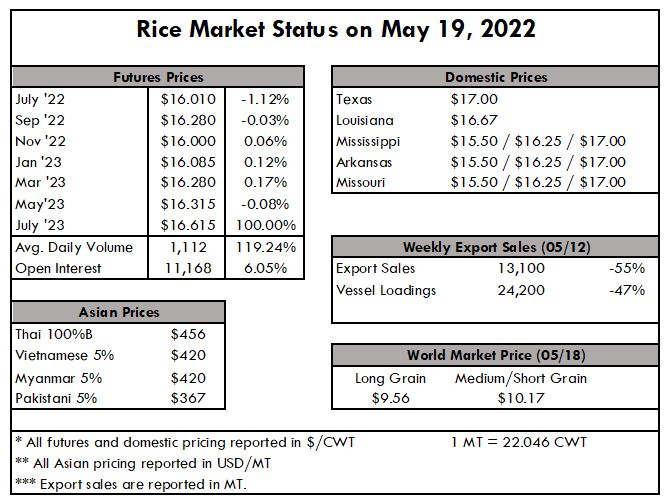

| On the ground, all seems to be going as planned now that planting has wrapped up in each state. Sure, there is plenty of consternation about inflamed input costs and where the rice will be marketed once it’s put in the barn, but for now rice is emerging on schedule. The biggest concern is the price of diesel, and possibility for another shortage based on a forecasted heavy hurricane season. Refineries are already dealing with chokepoints from previous shutdowns from hurricanes, and further weather-driven phenomena will only exacerbate the problem of fuel price volatility. The summer milling schedules have set in, which means fewer hours and servicing primarily core domestic customers. This week did notch the marketing-year low for export sales; this is a result of pricing as high as $500 pmt for U.S. LG 5%, which is 22% higher than Uruguay, 27% above Argentina, and 16% premium to Brazil. It’s no wonder our exports are dwindling. Prices in Texas continue to lead the pack at $17/cwt. This has been relatively unchanged for weeks now. Louisiana is quoted at $16.67/cwt, while Mississippi, Arkansas, and Missouri are each quoted at $16.75/$17.50. The RMTC sponsored by the USRPA held in Cancun last week revealed several key factors looking at trade in the Western Hemisphere. One of the most significant is the high price of U.S. rice when compared to other origins, and Mexico’s emergency order to cancel tariffs on many products—including rough rice—to battle inflation-driven food cost increases. Quality troubles from U.S. rice among other concerns have resulted in a slow but steady erosion in the Central American markets. While the U.S. used to enjoy nearly 100% market share in Central America, we now struggle to retain over 65% given current market constraints and dynamics. This is why the RMTC is such an excellent platform to openly discuss solutions and new opportunities in the Western Hemisphere. In Asia, Thai prices are at $459 pmt, still well above Viet prices at $425. Only three weeks ago, these two origins were almost equal in pricing, but with Iraq coming in and building a strategic partnership with Thailand, that has put upward pressure on the price. Demand is steady in the Asian region, which would indicate pricing is firm to up. Reports of India possibly tapering, or even banning their rice exports, are unfounded and pure speculation based on their announcement of a wheat export ban. Prices in India are actually dropping amidst all of the other global food inflation. Only ten weeks ago, Indian rice was trading at $365 pmt, but current reports peg the price down to $350 pmt. As discussed above, the weekly USDA Export Sales report is dismal this week. Net sales of 7,600 MT for 2021/2022 notch a marketing-year low, down 63% from the previous week and 67% from the prior 4-week average. Exports of 24,600 MT were down 61% from the previous week and 38% from the prior 4-week average. The destinations were primarily to Colombia (14,300 MT), Jordan (4,300 MT), Canada (1,800 MT), Saudi Arabia (1,700 MT), and Mexico (1,200 MT). |