|

The market is shaking off its holiday slumber with both good and bad news.

The good news — exceptional, really — is the announcement of the Rice Farmer Bridge Payment rate at $132.89 per acre. While this payment will not solve the financial challenges rice farmers are facing, it is on the higher end of expectations. The payment will be made on 2025 certified acres and is scheduled to be distributed prior to February 28, 2026, with a payment cap of $155,000 per farmer. We recommend confirming individual eligibility and details directly with your local FSA office.

It is estimated that rice farmers lost in excess of $350 per acre in 2025. While this FBA payment is not a complete solution, it does help reduce the current debt burden and is intended to provide lenders some breathing room as they finance the 2026 crop.

On the negative side, the rice industry, and the nation as a whole, lost a true friend and ally with the unexpected passing of Congressman Doug LaMalfa of California. Doug was a fourth-generation rice farmer and a board member in the early days of USRPA. His friendly presence on Capitol Hill will be deeply missed, as will his steady and consistent advocacy for rural America and rice farmers.

Market dynamics remain highly fluid. While the 2025 crop is settling into a known position, the primary concern is generating sufficient demand to liquidate inventories. Iraq has provided a meaningful outlet, as has Haiti, and there are high hopes for a large Colombian tender later this month, in excess of 100,000 metric tons. However, Colombia is blending 100 percent of U.S. rice purchases with domestic rice due to grain quality concerns. Similar complaints are being reported by other Central and South American buyers, creating ongoing challenges around disappearance.

These issues, combined with poor economics, are weighing heavily on 2026 planting decisions. Traditionally, February soybean prices play a major role in determining rice acreage, but this year there are additional variables at play. Current expectations suggest planted acres could decline by more than 30 percent. One potential benefit of this reduction is improved quality: a smaller crop with fewer seed varieties could result in a more homogenous product, particularly if fewer varieties move through individual dryers.

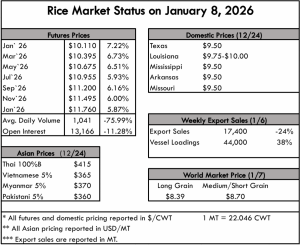

Internationally, prices in Asia remain well below $400 per metric ton, with no meaningful movement during the holiday period. The same is true in South America. Domestic pricing remains challenging as January begins, with bids reported at $9.50 per cwt in Texas, Mississippi, Arkansas, and Missouri, while Louisiana is holding at $9.75 to $10.00 per cwt. Louisiana has carved out a niche by tightly managing product quality and consistently meeting customer preferences, allowing it to capture a price premium.

|