|

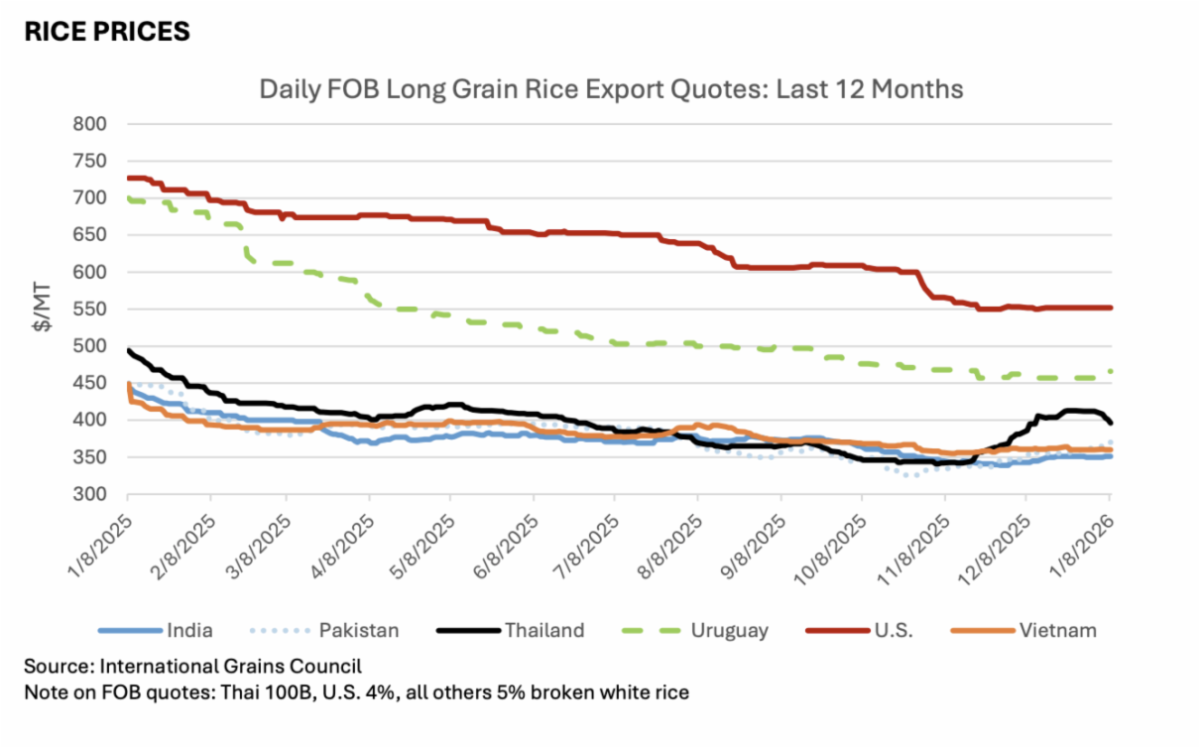

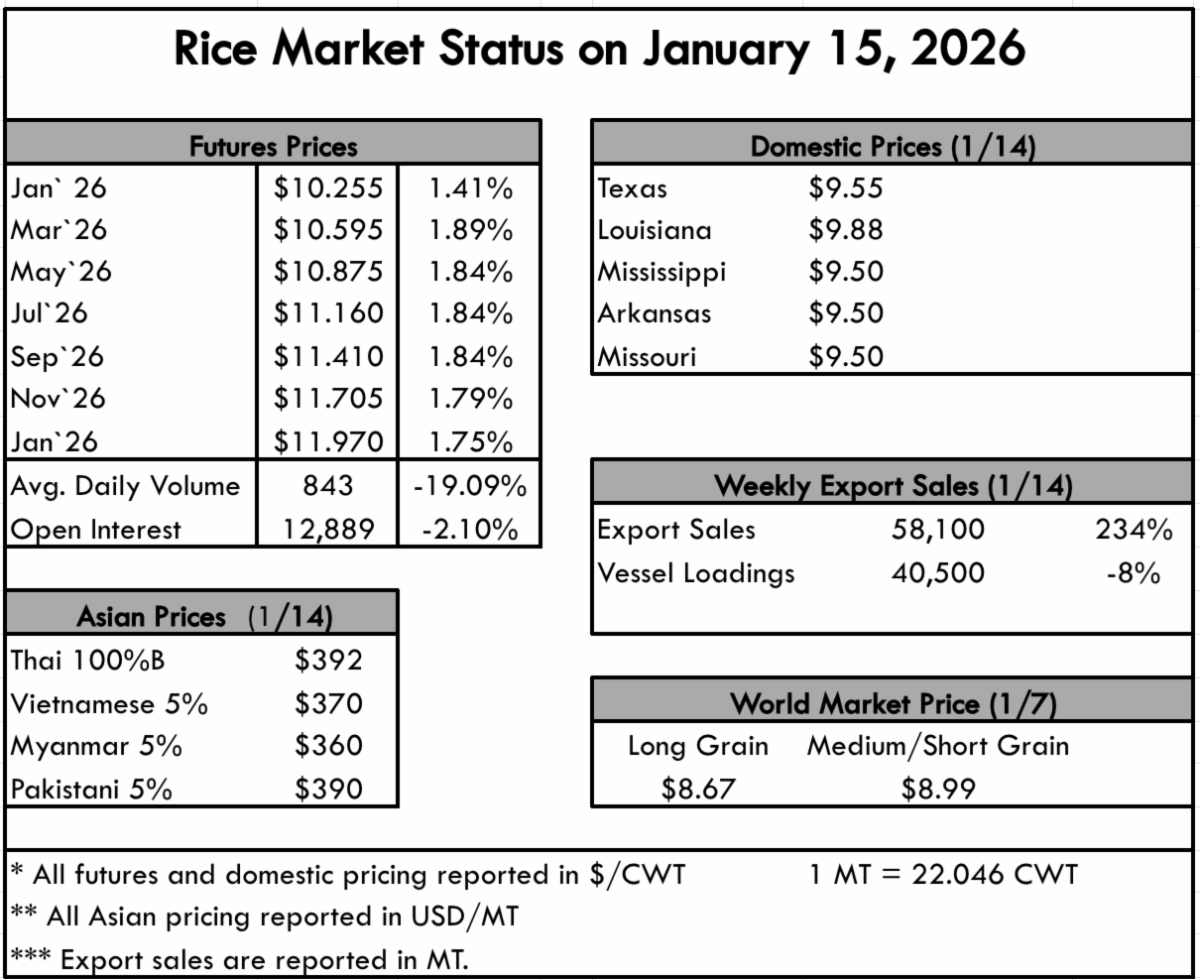

The lack of cash flow is the first thing on all producer minds since we made the turn into 2026. The second thing is planting intentions and the actual drop in acreage. Industry has estimated at least a 30% reduction since November, and things have not deviated much since then. The bulk of the loss will come from Arkansas, where the state is not expected to breach 1 million acres. Barring a horrific storm in India that could put a damper on rice supplies, we don’t foresee any market-driven stimulus that could motivate producers to grow more rice if they have a viable crop alternative. Prices on the ground remain painful to report, where Texas is sitting at $9.55/cwt. Louisiana is able to achieve a slight premium due to their ability to deliver a homogenous and quality product, but the price is still $9.88/cwt. The market is reporting $9.50/cwt for Mississippi, Arkansas, and Louisiana. We touched on the Colombian TRQ coming later this month in last week’s report, along with steady Iraqi and Haitian business. The rumors cycling this week is the real possibility of gaining access to Venezuela in either paddy or milled form, which is desperately needed to aid in the disappearance of the recently harvested crop. Venezuela continues to import rice from Mercosur, mostly if not all is paddy rice. The WASDE report was released this week, and while it didn’t move the needle on prices, it is still a bullish report if you isolate the US. The January WASDE lowered the 25/26 carryover by 2.4 million cwt, down to 34.6 million cwt. This is a welcome surprise, but the decrease was due to a yield reduction by USDA, not a demand increase. World stocks, excluding China, were raised by 1 MMT up to 85.3 MMT. But despite the carryover reduction, global stocks are still so high that prices have not, and are unlikely to react. Along with the WASDE, the USDA released its January Grains report. The below graphic shows the consistent slide of global rice prices, where the U.S. has been, and remains the highest priced rice, despite the back-breaking loss to Producers. Prices have dropped approximately 25% from this time last year. Global rice production, trade, and consumption are all up since December, but so are stocks, so we can’t expect relief from the global markets. |

|