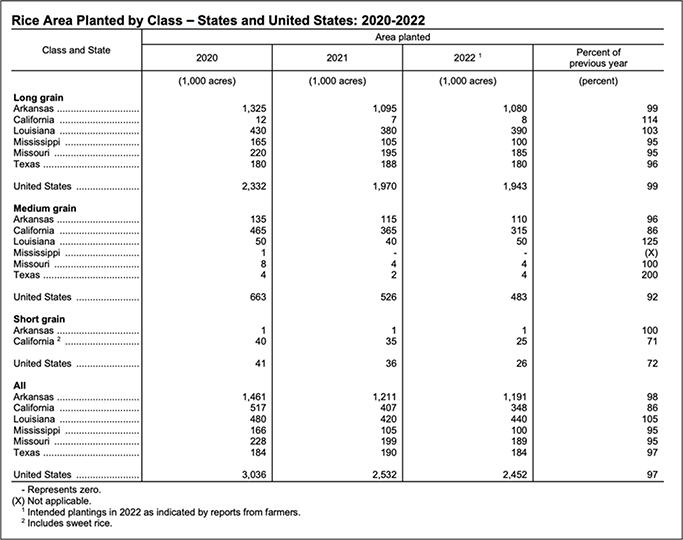

Prices remain firm as planting gets underway. The initial USDA Prospective Plantings report just published this week has a much rosier picture than the industry is currently projecting. The table below shows that the total long grain production is expected to be 99% of last year’s total. The industry is predicting a 10-15% decline, or acres looking much closer to 1.65 million acres. This lower acreage number would appear to be baked into paddy prices right now, which are holding firm across all regions despite scant offshore demand. Louisiana is the only region that is expected to gain acres with any significance, and the rest are expected to taper.

Looking at Medium Grain, the big drop will be coming from drought-plagued California. The USDA is projecting a 315,000 acre medium grain crop from the west coast, but recent water allocations coming out of GCID, the State’s largest water district, are dismal. Initial signals are showing that acreage could fall well below even a 270,000 acre level. Medium grain across the rest of the states will hold relatively constant. It will be interesting to watch planting progress as the weeks tick by and the actual numbers come to light.

As far as planting goes, Louisiana has crested the 60% planted now, approaching as high as 70%. Texas is now approximately nearly 50% planted as well, though rain has slowed progress there a bit last week. They are itching to get started in Arkansas, and we expect to have first plantings by this time next week.

The March rice stocks report was released this week, showing rough rice stocks in all positions down by 8% from this time last year. To break things out, long grain rough is down by 11%, and long grain milled almost 6% down, medium rough about equal, and medium grain milled rice stocks down nearly 40%.

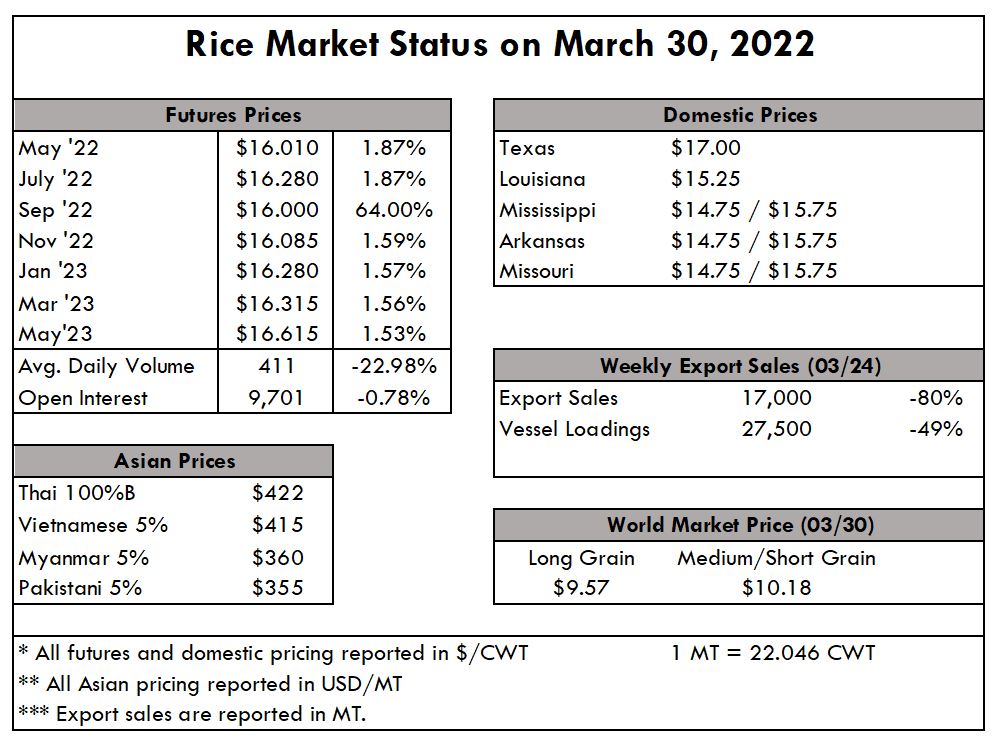

In Asia, Thai prices firmed slightly up to $415pmt, and Viet prices softened just a bit to come down to $415pmt. This is largely based on currency fluctuations and strong demand coming out of China and the usual suspects like the Philippines. India is still holding at steady at $365pmt, and Pakistan is coming in just below at $360pmt.

The weekly USDA Export Sales report shows net sales of 17,000 MT for this week, down 80% from the previous week and 71% from the prior 4-week average. Increases were primarily for Guatemala (5,500 MT), Honduras (3,500 MT, including decreases of 400 MT), Mexico (3,300 MT), Canada (2,600 MT), and Saudi Arabia (800 MT). Exports of 27,500 MT were down 49% from the previous week and from the prior 4-week average. The destinations were primarily to Guatemala (11,000 MT), Honduras (6,000 MT), Canada (3,300 MT), Mexico (2,700 MT), and Jordan (1,600 MT).