Drought is not only a California problem; lack of water is plaguing barge traffic on the Mississippi river as well. Low water levels are inhibiting the flow of goods right at the harvest of corn, soybeans, and rice. Tows moving barges has decreased by 31% because of the low water levels, and the current rate of unloading grain barges is 39% below the five-year average. The below-average rainfall is rationing the supply of barges, further increasing costs along the supply chain to deliver a final product to processors and consumers. In a year where inputs have skyrocketed, this climate-induced cost increase is not a welcome complication in the food matrix. The conditions could not come at a worse time and the forecast calls for continued dry weather. Lack of rail availability and with trucks largely booked, “you are going to see people in dire straights” says Lucy Fletcher of AGRIServices of Brunswick.

Harvest in Arkansas is approaching 80% complete, with Mississippi just ahead of them. Missouri is only approaching 60%, which is close to the five-year average. California is only reported to be 30% complete, which is in line with normal but will likely finish more quickly since only half of the state got planted. Late-harvested millings continue to impress, which will help balance out some of the weaker milling yields from the start of harvest. This rings true in CA as well, where the earliest rice was cut in nearly 110-degree weather; the rice cut in this heat will be counted as an outlier by the time the year is finished.

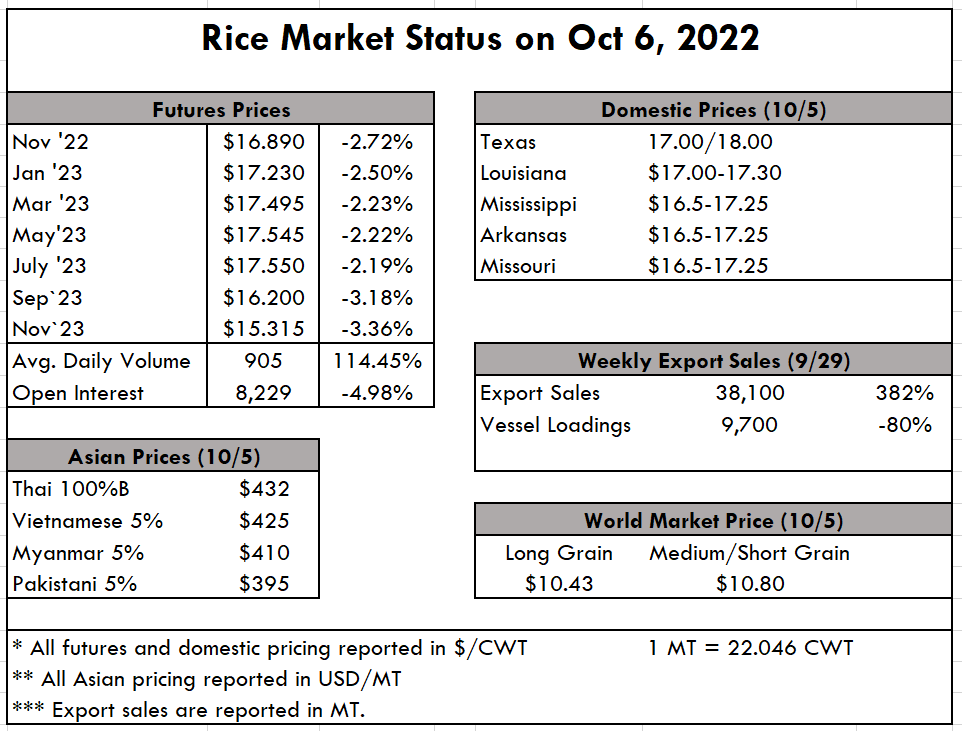

In Asia, prices have remained flat this week despite the expectation that the Indian tariff would put upward pressure on Thai and Viet rice. Perhaps the delay in any increase is a result of India announcing multiple extensions of their tariff and extending the date on which the ban of brokens will kick in. Right now it’s business as usual, despite the ominous expectation of volatility ahead. Thai prices are reported to be $420 pmt this week, Viet $425, and Indian up to $390pmt.

There is a bipartisan bill to expand USDA funding to promote exports that are gaining traction. There is support from both sides of the aisle to put more money in the hands of farm groups, including the rice industry, to double the Market Access Program and Foreign Market Development Program. The thrust of the bill is to be considered part of the farm bill and is needed to expand the presence and sale of US agricultural products. A large reduction in rice exports to Mexico and Central America is the result of high prices caused by strong domestic demand, high production costs, and the smallest rice crop since 1993/94.

The weekly USDA Export Sales report shows net sales of 38,100 MT this week, primarily for Japan (13,000 MT), Canada (9,500 MT), Guatemala (5,000 MT, including decreases of 1,000 MT), Nicaragua (4,400 MT), and Jordan (3,900 MT). Exports of 9,700 MT were primarily to Canada (2,800 MT), Mexico (2,300 MT), Saudi Arabia (1,700 MT), South Korea (1,600 MT), and Austria (700 MT).