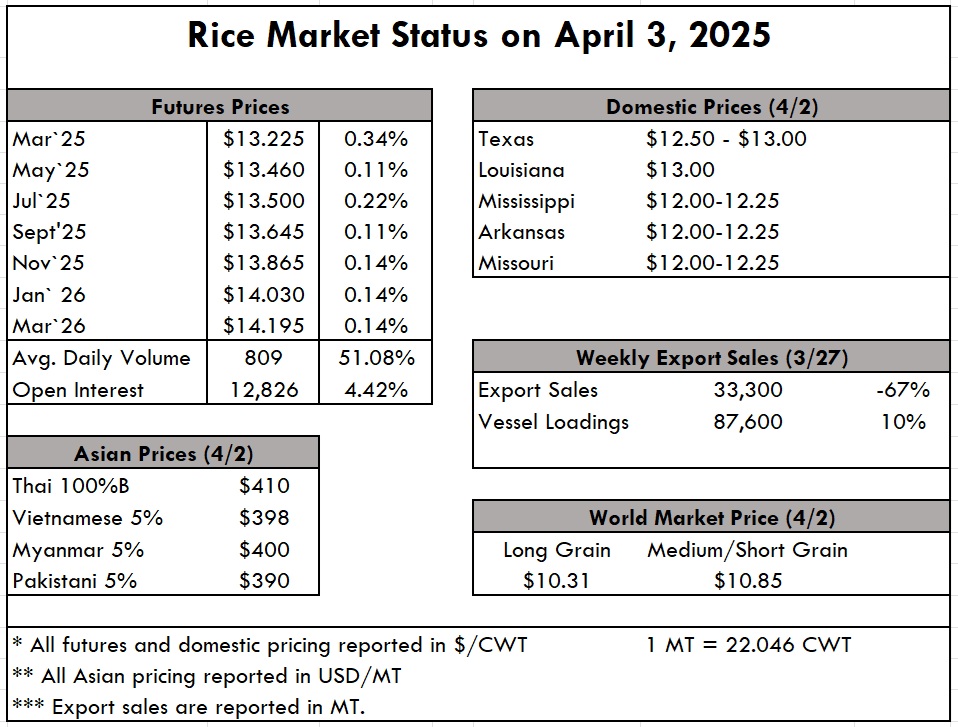

| Get your life preserver. Former USRPA CEO Dwight Roberts has said this market “isn’t just a perfect storm, it’s a tsunami.” He said this even before Trump’s Liberation Day, where tariffs will now dictate market flows, so we will focus on the rice market pre-tariff in what we know and why this is appearing more like a tsunami. This all started when India released their export ban. Since then, prices in the Far East and Middle East have dropped well over 30%, now trading in the sub-$ $400 pmt range for milled rice. There was some strong resistance in the Western Hemisphere, where U.S. long grain prices held around $800 pmt for most of last year. But with the poor milling quality, that began to weaken. Now add what is shaping up to be a very strong harvest in South America (Mercosur specifically) to a projected sizable crop and large carryover stocks (according to the USDA) in the United States. Next week’s (April 10) USDA-WASDE report should get us some insight as the March report raised carryover by 1 million cwts, putting stocks higher than the previous year. Rice farmers will likely be underwater (to keep with the tsunami theme) for another year. This week’s heavy flooding and tornadoes during planting season in northeast Arkansas and southeast Missouri, the largest long grain producing area, further complicates the situation. Might the tariffs help the U.S. farmer, though? There is a scenario in which this could be a resounding yes! In round numbers, nearly one-third of U.S. rice consumption is imported rice, led by Thai Jasmine and then Basmati. Tariffs on Thailand are 36%, and on India 26%. That could add anywhere from $200-$300 pmt in cost, making domestic U.S. products more competitive, ideally driving up domestic demand and reducing our reliance on imports. The news is doing a fine job of explaining everything that could go wrong, so we felt it prudent to inject some “hope” into what otherwise feels like a wildly chaotic situation. In the end, consumers will decide. In Asia, the low rice prices have Thai farmers in protest and Vietnamese farmers looking for relief through some sort of government or private market valve. As aforementioned, Thai prices have dipped below $400 pmt to $395 pmt, and Viet prices are just hanging on at $400 pmt. India is again the low price leader, down to $385 pmt. While this is “excellent” news for countries desperate for cheap rice in West African regions, it is wreaking havoc on rice producers at large, an unfortunate circumstance when the USTR is trying to minimize unfair subsidies in the rice market. In that vein, just this week, USTR dropped its nearly 400-page report on U.S. foreign trade barriers. This report is an annual directive and carries special prominence this year to an administration that is extremely focused on trade. USRPA has repeatedly assisted in outlining trade barriers and expressed frustration in the previous administration’s lack of action. We can’t complain about any “lack of action” for this administration — especially since rice has been highlighted both by the President and his Press Secretary as an example of unfair trade tariffs that the U.S. has endured. Still, much is to be uncovered as these policies play out before all of our eyes. On the ground, paddy prices haven’t changed, which in this market can be taken as a sign of softening. We look forward to next week when we have the first published Crop Progress report of the year. The weekly USDA Export Sales report shows net sales of 33,300 MT this week, down 67% from the previous week and 37% from the prior 4-week average. Exports of 87,600 MT were up 10% from the previous week and 65% from the prior 4-week average. |

|

| Our prayers are with the people of Lake City, AR, where an EF-3 tornado ripped through the community on Wednesday. Lake City is approximately 20 miles east of Jonesboro. Photo Source: KATV |

|