| The global rice market remains under pressure as trade policies emanate from Washington, DC. A significant development for the U.S. rice industry is President Trump’s recent announcement of a 25% tariff on Indian goods (effective August 1), which includes an unspecified penalty for India’s trade with Russia. India poses a dual threat to the U.S. rice market: first, through rice dumping, and second, through increasing imports of basmati rice, which are eroding the domestic market share of U.S. long-grain rice. Without tariffs, Indian basmati has flowed into the U.S. market unchecked. While the impact of the 25% tariff won’t be immediate, it could encourage consumers and distributors to favor domestically produced long-grain rice over Indian basmati in the medium and long term. In Latin America, Brazil faces escalating trade tensions with Trump’s administration imposing a 50% tariff on Brazilian goods, effective August 1. Citing Brazil’s digital trade policies and the prosecution of Bolsonaro for allegedly plotting a coup, Trump invoked the International Emergency Economic Powers Act (IEEPA) to declare a national emergency, addressing Brazil’s unfair trade practices that threaten U.S. economic and national security. Current talk includes a 40% ad valorem tax, but more clarity is necessary as to how this will play out. While these tariffs do not directly target rice, they are likely to disrupt rice trade flows in the Western Hemisphere, particularly as Brazil is a key player in regional agricultural exports. Currently, U.S. rice exports to Central American countries, Nicaragua, Panama, Costa Rica, El Salvador, Guatemala, and Honduras, are lagging, running approximately 25% behind last year’s pace. Exports to Mexico lag behind as well. |

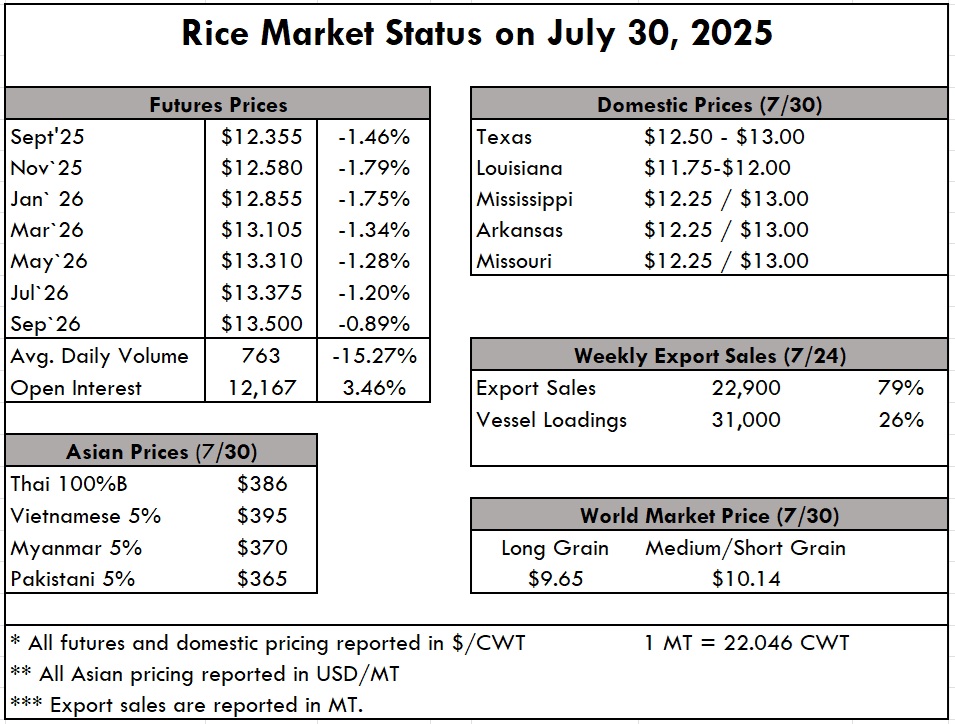

Harvest continues in southwest Louisiana On the ground, the U.S. rice crop is progressing well, with nearly 80% rated in the Good or Excellent categories. Louisiana is ahead of schedule, with some harvesters already in the fields. Harvest is expected to accelerate over the next two weeks. Weather comments in Arkansas and the concentrated growing area of northeast Arkansas are certainly of concern due to the intense heat that many feel will reduce field yields. Folks are reluctant to talk about grain quality at this point, but weather conditions with a 126 heat index this week aren’t constructive. There are hushed reports of new-crop offers from Louisiana, but prices are reportedly unattractive. This reflects a broader global issue, not just a U.S. one. The domestic outlook is further clouded by rumors that remaining old-crop rice may be of such poor quality that it fails to meet the No. 2/4 standards for packaged product, adding another challenge to an already pessimistic market. There have been recent sales of new crop from Southwest Louisiana (SLRF) with good milling yields to Central America and Texas trucking paddy rice to Mexico. In Asia, rice prices continue to decline, with Thailand at $375 per metric ton (pmt) and Vietnam at $390 pmt for 5% broken white rice. Surprisingly, India’s price sits between them at $385 pmt. U.S. long-grain rice export prices have softened by at least $10 pmt as exporters attempt to counter dismal sales figures. According to the USDA Weekly Export Sales report, net sales reached 22,900 metric tons (MT) this week. Exports totaled 31,000 MT, up 26% from the previous week and 40% above the prior four-week average. Primary destinations included Japan (14,300 MT), Honduras (5,400 MT), Mexico (4,100 MT), Saudi Arabia (2,300 MT), and Canada (1,500 MT). |

|