Today, December 18, 2020, marks the 23rd anniversary of the founding of the US Rice Producers Association. Today it’s impossible to not think of Mr. Jack Wendt, a Texas rice farmer and former President of the US Rice Council that was based in Houston, Texas, and a man who traveled the world promoting U.S. grown rice. He also made his share of trips to Washington, D.C. to remind Capitol Hill of the contribution made by rice farmers to our national food security in his genuine effort to feed the world.

While Jack grew more than 60 rice crops, he was an original member of the USRPA board of directors. Respected and known by everyone in the U.S. rice industry, Mr. Wendt played an instrumental role in the development of those original by-laws dated December 18, 1997. The same principals installed by Jack in 1997 ring true today- an organization comprised of producers, elected by producers, and representing rice producers in all rice-producing states.

The new rice association was told at the time the effort would never materialize, considered a group of “rebel farmers” who will not last. Someone forgot to tell folks like Mr. Wendt, Raymond Franz, Hal Koop, Sonny Martin, Penn Owen and Rex Morgan apparently. These gentlemen stood by their principals and always spoke as if 1,000 rice farmers were listening over their shoulders. Just like Ray Stoesser!

Over the years change became inevitable and while the USRPA developed unique relationships with the most important markets and the buyers for long-grain rice, it is satisfying to know that these men had so much to do with our current day leadership in the US rice industry.

Comments written last month by the leadership of the USA Rice Federation apparently confirm what these men knew all along.

“All of those issues are long gone and most of the people involved are not around anymore.”

“The leadership on the USA Rice board & committees has changed and the attitude and philosophy has changed.”

“That might have been the case 20 years ago and now is far from the truth.”

Looking back over the past 23 years, this has to be the biggest accomplishment of the USRPA- raising awareness and creating change for the better.

Congratulations to all of you who have been involved in this process and continue to represent rice farmers. 2021 will bring new challenges but like has been the case for the past 23 years, they will be met. After all 2020 has taught us that farmers are officially “essential.”

To accommodate the global travel restriction and adapt to rapidly developing cloud technology, USRPA held its first public virtual event via Zoom in China on Wednesday 10 am -12 pm, August 26th, 2020 (US Central time is Tuesday, August 25, 9-11pm).

The educational seminar on US rice was the first of a series virtual events that benefit both international rice buyers as well as US companies that are particularly interested in expanding their global markets. The seminar attracted dozens attendees in China which primarily consist of rice importers, food processors and Chinese rice industry leaders. This 2 hour event began with a presentation on the latest US rice market and different topics presented by renowned industry speakers followed by a Q&A session. USDA FAS has also accepted the invitation was one of the guest speakers.

China is open to US rice thanks to the efforts of USRPA, the first rice organization to venture into this market. After the successful completion of trade mission in China in 2019, USRPA continues to monitor the market, communicate to trade contacts and plans to conduct promotional programs.

In partnership with the US Rice Producers Association, the Stoesser family is offering a $5,000 scholarship each year to one deserving high school senior or current college student interested in or pursuing a career in an agriculture-related field.

In addition to the monetary award, the selected recipient will serve as a student ambassador for USRPA in 2026, expecting to participate in at least two activities during the calendar year. The recipient will be invited to participate in various USRPA activities, including but not limited to Field Days, legislative activities, Texas Rice Council meetings, conferences, and more.

* Applicants should intend to pursue a career in an agriculture-related field. Applications will be accepted from high school seniors, college students, and college graduate students.

* In addition to completing the online application form, applicants should submit a video no longer than 5 minutes answering the following question:

US Rice Producers Association was proud to participate in the 2025 Stuttgart Rice Field Day, held on a clear and breezy morning in the heart of Arkansas rice country. Hosted by the University of Arkansas Rice Research and Extension Center, this annual event brought together farmers, researchers, industry leaders, and stakeholders to explore the latest innovations in rice production and sustainability.

Attendees began the day by selecting from two field tour tracks, each offering a deep dive into critical aspects of rice research. Tour A focused on genetics and plant health, with stops covering rice breeding updates, disease pathology, grain quality and milling yields, and improving rice’s tolerance to environmental stress. Meanwhile, Tour B highlighted best management practices in rice production, including insect control, agronomic strategies, weed management, and water-saving irrigation innovations. Each tour ran twice during the morning, giving participants flexibility to explore the topics most relevant to their work.

Throughout the morning, researchers also presented a wide range of poster and oral sessions, with topics such as pre-breeding rice germplasm, enhancing yield and stress tolerance, and recent genetic discoveries. These sessions provided attendees with a closer look at the science behind the next generation of rice varieties and production tools.

The day concluded with a luncheon program attended by a packed house of producers and guests. Dr. Alton B. Johnson, Director of the Rice Research & Extension Center, opened the session, followed by a crop overview from Dr. Jarrod Hardke, Extension Agronomist. Industry insights were shared by Mr. Keith Glover, President & CEO of Producers Rice Mill, and Mr. Kevin McGilton, President & CEO of Riceland Foods. Dr. Deacue Fields III, Vice President of the University of Arkansas System Division of Agriculture, closed the program with a division update highlighting the university’s ongoing support for rice innovation.

The Stuttgart Rice Field Day continues to serve as an essential platform for advancing the U.S. rice industry through collaboration, education, and cutting-edge research. USRPA remains committed to engaging with growers and supporting the research that drives progress from field to table.

On Monday, USRPA's Mollie Buckler spent most of the day with Missouri Congressman Jason Smith and team on his annual Farm Tour. A tradition started by his predecessors, Bill and JoAnn Emerson, Congressman Smith takes time during the August Congressional recess to visit with farmers and ranchers throughout the eighth congressional district. Smith is Chairman of the House Ways and Means Committee.

Congressman Smith visited the Missouri Rice Research Farm, where Missouri Rice Council members and other local rice producers sat down for a conversation on ag issues and shared more about the Council’s research and promotion work.

"We've helped coordinate Congressman Smith's rice stops on his Farm Tour for the last few years, but it was extra special to have him and his team visit the Rice Research Farm," Buckler said. "We're grateful to have leadership in D.C. who values and understands Missouri agriculture."

From the research farm, Buckler attended a luncheon for Congressman Smith hosted by Missouri Soybeans at Strawberry's in Holcomb. After lunch, the final rice stop of the tour was a visit with rice producer Ryan Riley, along with his family and other farmers and leaders from the New Madrid area.

Conversations throughout the day largely focused on trade issues, debriefing the One Big Beautiful Bill, and the reality of today's farming conditions.

The day ended with the University of Missouri's Fisher Delta Center's Advisory Board Dinner, kicking off their Field Day festivities for the week. Their annual Field Day Breakfast was held on Tuesday morning, where Congressman Smith, Governor Mike Kehoe, Missouri Department of Agriculture Director Chris Chinn, and State Senator Jason Bean gave remarks. On Wednesday, the Center held their "Ag Research Expo," which included field tours and presentations. Buckler visited with attendees throughout the day at the Missouri Rice Council booth.

US Rice Producers Association (USRPA) extends its deepest condolences on the passing of Manuel Jiménez Mercado, a distinguished leader and steadfast advocate for the Colombian rice sector.

He will be remembered with great respect and gratitude by all who had the privilege of working alongside him. USRPA joins his family, colleagues, and the broader rice community in honoring his life and mourning his loss.

Senate Confirms USDA Trade Under Secretary Luke Lindberg: On Saturday, August 2, the full Senate voted to confirm Luke Lindberg to be the next U.S. Department of Agriculture’s (USDA) Under Secretary for Trade and Foreign Agricultural Affairs (TFAA). In this role, he will be responsible for advising Agriculture Secretary Brooke Rollins and other USDA officials on trade issues, as well as running point for the Foreign Agricultural Service (FAS) and U.S. Codex Office. Previously, he was the Chief Executive Officer of South Dakota Trade, a public–private partnership focused on expanding international market access for South Dakota’s agricultural exporters. He also served as Chief of Staff and Chief Strategy Officer at the U.S. Export-Import Bank during the first Trump Administration. Lindberg now joins Secretary Brooke Rollins, Deputy Secretary Stephen Vaden, and General Counsel Tyler Clarkson as the only USDA nominees to clear the Senate confirmation process thus far. After the August Recess, the Senate will resume session and look to continue confirming USDA nominees that remain in the queue.

USDA Opens Public Comment Period on Department-Wide Reorganization Plan: On Friday, August 1, U.S. Department of Agriculture (USDA) Secretary Brooke Rollins announced the launch of a 30-day public comment period for stakeholders to share feedback regarding the Department's large-scale reorganization plan. This comes after the Secretary's memorandum on July 24, 2025, that outlined the intent and direction behind the Department's plan to relocate USDA employees within the Washington D.C. area across five regional hubs and the Senate Agriculture Committee's hearing featuring Deputy Secretary Stephen Vaden's testimony on the matter. The comment period is open through August 26, 2025, and stakeholders interested in submitting comments can do so by emailing reorganization@usda.gov.

DOL Temporarily Suspends H-2A Certification Fee Collection: Last week, the Department of Labor (DOL) announced its intent to pause fee collections from employers using the H-2A farmworker visa program. DOL said the suspension is due to a transition to an electronic payment system. Current practices require employers who participate in H-2A to mail physical money orders and checks as payment. DOL collects up to $1,000 per temporary agricultural labor certification. DOL said it will use the suspension period to upgrade its technology and coordinate the new system with the Treasury Department. The suspension is supposed to be temporary, and its temporary status will go into effect 30 days after it is published in the Federal Register. The 30 days also allow for invoices with due dates before the suspension to be paid. You can find the official regulatory filing regarding the temporary suspension of H-2A fees here.

More exciting news for the rice industry emerged from Washington, D.C., this week, though it may heighten tensions among the U.S., India, and Russia. President Trump signed an Executive Order authorizing an additional 25% tariff on imports of certain goods, including rice, from India. As of August 7, a 25% reciprocal tariff will apply to Indian rice imported into the U.S. Then, on August 27, the additional 25% tariff enacted by this Executive Order will take effect, resulting in a total 50% tariff on Indian rice. This 50% tariff on basmati imports is expected to reduce demand, hopefully encouraging customers to purchase more U.S.-grown rice. These tariffs indirectly address the WTO suits filed by the U.S. rice industry against India’s subsidies and price distortions, achieving a similar outcome. Additionally, reciprocal tariffs of 19% are now in effect for imports of Thai rice.

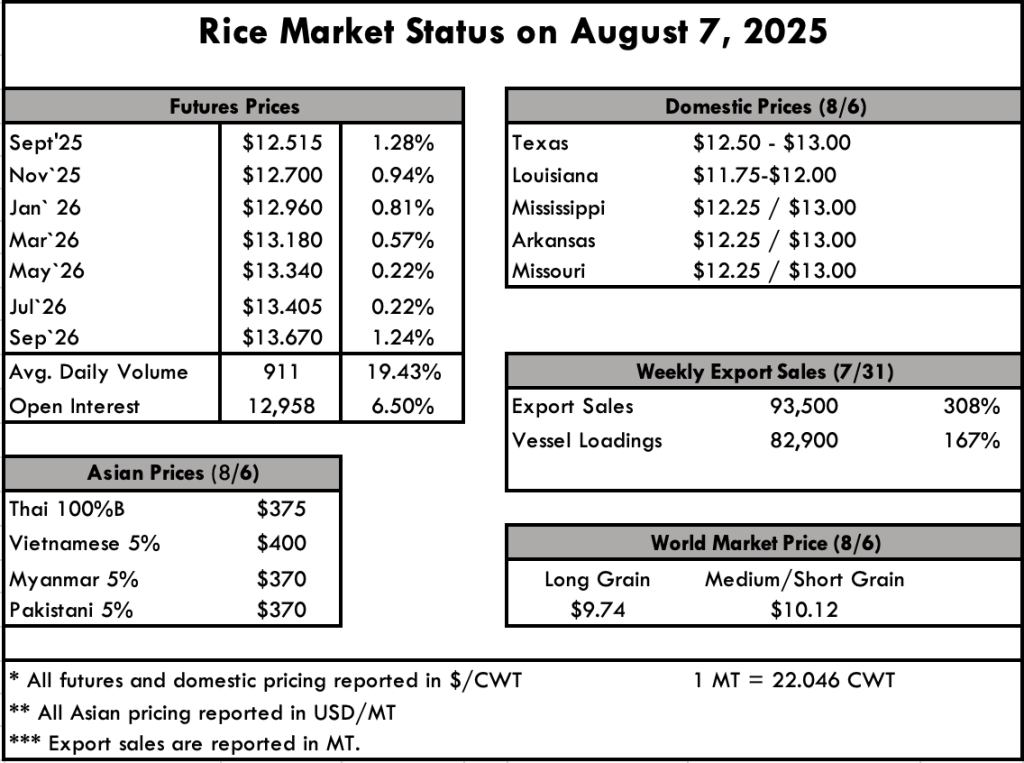

On the ground, harvest is progressing, with Louisiana nearing 30% completion as of this writing. Reports indicate 84% of Louisiana’s rice is in good to excellent condition, though significant milling yield data is not yet available. In Texas, just over 15% of the crop has been harvested, with 78% rated as good to excellent. For the broader industry, 75% of the crop is headed, surpassing the five-year average of 67% but trailing last year’s 79%. We are hearing good reports out of southwest Louisiana regarding field and milling yields. The near term will give us a good reading on the overall quality of the long grain crop once farmers begin cutting in northeast Arkansas in particular.

New crop paddy purchases are starting to emerge, with initial price discovery in Texas and Louisiana. Texas reports prices of $12.50–$13.00/cwt, while Louisiana shows $11.75–$12.00/cwt. There is little to report for new crop activity in Mississippi, Arkansas, or Missouri, which is typical until harvest intensifies by late August. Little demand for old crop contributes to the ongoing farm problems. California remains quiet, with cash prices for old crop at $11/cwt over loan and no bids yet for new crop.

In Asia, prices remain steady within their low range. Thai white rice 5% saw the largest decline, now trading at $375 per metric ton. Vietnamese 5% white rice experienced minimal depreciation and is approaching $400 per metric ton. Indian rice prices fall between these, slightly closer to Thai prices at $385 per metric ton.

Beyond the new Executive Order and tariff on Indian rice, details of the “skinny farm bill” from the Big Beautiful Bill’s passage are becoming clearer. Key points effective from the 2026 crop year include a loan rate of $7.70/cwt, a reference price of $16.90/cwt, program payment limitations increasing from $125,000 to $155,000 starting in 2025, 30 million new base acres, crop insurance remains intact, and a permanent increase in estate, gift, and GST exemptions to $15 million per individual. Overall, some very big wins for ag in general, and rice producers specifically. Now we will see how tariffs impact market dynamics as the new crop season gets underway.