Today, December 18, 2020, marks the 23rd anniversary of the founding of the US Rice Producers Association. Today it’s impossible to not think of Mr. Jack Wendt, a Texas rice farmer and former President of the US Rice Council that was based in Houston, Texas, and a man who traveled the world promoting U.S. grown rice. He also made his share of trips to Washington, D.C. to remind Capitol Hill of the contribution made by rice farmers to our national food security in his genuine effort to feed the world.

While Jack grew more than 60 rice crops, he was an original member of the USRPA board of directors. Respected and known by everyone in the U.S. rice industry, Mr. Wendt played an instrumental role in the development of those original by-laws dated December 18, 1997. The same principals installed by Jack in 1997 ring true today- an organization comprised of producers, elected by producers, and representing rice producers in all rice-producing states.

The new rice association was told at the time the effort would never materialize, considered a group of “rebel farmers” who will not last. Someone forgot to tell folks like Mr. Wendt, Raymond Franz, Hal Koop, Sonny Martin, Penn Owen and Rex Morgan apparently. These gentlemen stood by their principals and always spoke as if 1,000 rice farmers were listening over their shoulders. Just like Ray Stoesser!

Over the years change became inevitable and while the USRPA developed unique relationships with the most important markets and the buyers for long-grain rice, it is satisfying to know that these men had so much to do with our current day leadership in the US rice industry.

Comments written last month by the leadership of the USA Rice Federation apparently confirm what these men knew all along.

“All of those issues are long gone and most of the people involved are not around anymore.”

“The leadership on the USA Rice board & committees has changed and the attitude and philosophy has changed.”

“That might have been the case 20 years ago and now is far from the truth.”

Looking back over the past 23 years, this has to be the biggest accomplishment of the USRPA- raising awareness and creating change for the better.

Congratulations to all of you who have been involved in this process and continue to represent rice farmers. 2021 will bring new challenges but like has been the case for the past 23 years, they will be met. After all 2020 has taught us that farmers are officially “essential.”

To accommodate the global travel restriction and adapt to rapidly developing cloud technology, USRPA held its first public virtual event via Zoom in China on Wednesday 10 am -12 pm, August 26th, 2020 (US Central time is Tuesday, August 25, 9-11pm).

The educational seminar on US rice was the first of a series virtual events that benefit both international rice buyers as well as US companies that are particularly interested in expanding their global markets. The seminar attracted dozens attendees in China which primarily consist of rice importers, food processors and Chinese rice industry leaders. This 2 hour event began with a presentation on the latest US rice market and different topics presented by renowned industry speakers followed by a Q&A session. USDA FAS has also accepted the invitation was one of the guest speakers.

China is open to US rice thanks to the efforts of USRPA, the first rice organization to venture into this market. After the successful completion of trade mission in China in 2019, USRPA continues to monitor the market, communicate to trade contacts and plans to conduct promotional programs.

At their recent summer meeting in Galveston, TX the US Rice Producers Association (USRPA) Board of Directors selected Mollie Buckler to serve as the new President and CEO, replacing Marcela Garcia, who is stepping down effective September 1, 2025. Buckler joined the USRPA staff in 2021 and has held the position of Chief Operating Officer since 2022.

A two-time graduate of the University of Missouri and native of the Missouri Bootheel, Buckler’s agricultural roots run deep on both sides of her family, including rice production. Buckler and her family currently reside in Sikeston, MO, making her the first USRPA President and CEO to reside in the Delta.

“After 16 incredible years with USRPA, including the past four as President and CEO, I’m filled with pride at all we’ve accomplished together and confidence in what lies ahead,” Garcia said. “Mollie has been a true leader at USRPA since day one, and her commitment to our producers is unmatched. Her strategic mindset and ability to build relationships will serve the organization well.” Garcia will serve in an advisory role for the organization, beginning September 1.

The USRPA board also elected new officers for 2023-2025. Eric Hover of Harviell, MO will serve as Chairman. Mark Pousson from Welsh, LA, will serve as Vice Chairman and Galen Franz of Victoria, TX is the new Secretary-Treasurer. The board thanked Neal Stoesser from Raywood, TX for his service to the association during the past two years.

The leading voice for the U.S. rice producer, US Rice Producers Association, representing rice producers in Arkansas, California, Louisiana, Mississippi, Missouri, and Texas, is the only national rice producers’ organization comprised of producers, elected by producers, and representing producers in all six major rice-producing states.

|

| Alex Brinkmeier, a fourth-generation farmer and Ph.D. student at Saint Louis University, is conducting a brief 5-minute survey to explore how family farms make decisions about adopting new technology. Your insights will help deepen the understanding of what drives innovation on family farms and support research that could shape the future of agriculture. Take the Survey |

|

| Congratulations to 2024 Ray Stoesser Memorial Scholarship Recipient Ryan Williamson on his selection as a Fulbright Scholar! We are incredibly proud of Ryan and all that he has accomplished. A recent graduate of Texas A&M with a Bachelor of Business Administration focused on international trade and agriculture, Ryan will teach English and U.S. culture in the Czech Republic while gaining a deeper understanding of the host country’s culture and agricultural system. We wish him the very best as he embarks on this exciting new chapter! Read More |

Senate Finance Committee Releases Reconciliation Text:

On Monday, the Senate Finance Committee released legislative text within the Finance Committee’s jurisdiction for inclusion in Senate Republicans’ budget reconciliation bill. Similar to that of the House Ways and Mean reconciliation text, Chairman Mike Crapo (R-ID) and his Committee’s bill reforms the tax code by extending the 2017 Trump tax cuts, provides additional tax relief to working families and small businesses, boosts the economy through pro-growth tax policy, and achieves net government savings. Looking at the bill from an agricultural perspective, the package expands and extends 199A deductions, restores bonus depreciation, increases Section 179 expensing, and raises the estate tax exemption level. Now, with all the committees having released their respective reconciliation texts, the Parliamentarian and Committee staff continue to vet provisions using the “Byrd Rule”, which restricts what can be included in reconciliation legislation in the Senate. The Senate’s complete reconciliation package could be considered on the floor as early as next week as lawmakers race against the pressure of a July 4 deadline imposed by the White House. You can find the complete Senate Finance reconciliation text here.

House Appropriations to Resume Ag-FDA Bill Next Week:

This week, the House Appropriations Committee released its upcoming markup schedule for the next few weeks while in session. On the calendar, the Committee rescheduled the markup for the Fiscal Year 2026 Agriculture, Rural Development, Food and Drug Administration, and Related Agencies Bill for Monday, June 23. This comes after the Full Committee initially started to markup the bill on June 11, but, due to Congressional events and the coinciding markup of the FY26 defense appropriations bill, the markup has been postponed for a later date. Now, the Committee will look to resume where the left off with amendments, and it is more than likely that the bill will pass out of Committee along a party line vote. You can watch the markup once it streams live here.

A person would be hard pressed to drive through Louisiana rice country and not see at least some rice beginning to head out, as 27% is reported headed this week per the USDA Crop Progress Report. Texas is reported at 18%, with both states being ahead of the 5-year average. The rice condition is on par with last year, which offered 83% in the good/excellent categories. Last week, it was 77%, and this week it is 74%. While the trend isn’t ideal, the rice isn’t rated as poor or very poor, but fair.

Actual planted long grain acreage continues to be debated as wet conditions in NE Arkansas and SE Missouri, and seed availability, contributed to lower than expected plantings. Prices haven’t changed—for paddy or milled—significantly in the last week. Iraq business remains the key driver for milled business right now, and the saving grace at that. With South America coming on strong with a large crop, stable quality, and lower prices, the United States is hard pressed to find new business at the moment. And with India gobbling up the cheaper markets around the globe with its unfairly subsidized rice, competition will be fierce for the coming crop.

A recent GAIN report on India highlights the dire situation they are putting the global rice trade in. Multiple concurrent record crops are depressing prices, even while Indian rice producers get unfairly subsidized to flood the export market and balloon domestic stocks. India’s rice production forecast for MY 2025/2026 has been raised to 150 million metric tons due to an increase in area harvested, now projected at 126 million acres. This growth is driven by an early and well-distributed 2025 monsoon, which is expected to boost both planting and yields. Farmers are likely to choose rice over other crops due to its resilience and government subsidies. For MY 2024/2025, production is also revised upward to a record 149 MMT from 127 million acres, based on higher-than-expected yields for kharif rice and expanded rabi/summer planting. These projections have increased despite weak market prices, spelling more pain for Vietnam, Thailand, and other rice exporters.

India’s rice exports for MY 2024/2025 are projected to reach a record 24.5 million metric tons, driven by strong export momentum through March 2025, with 12.7 MMT already shipped compared to 7.1 MMT during the same period last year. With monthly exports averaging around 2 MMT, this pace is expected to continue. Looking ahead, MY 2025/2026 exports are forecast higher at 25 MMT, assuming stable export policies and favorable price parity, supported by abundant domestic supplies and weak domestic prices that may prompt the government to release additional stocks into the market.

We will report on bright spots as they become available, but until there is an updated farm bill that addresses the price distortions and input costs that rice producers are suffering through, it will continue to be a financially tight season

| As the 2025 Stoesser Scholarship recipient and a Florida resident, the Rice Market & Technology Convention provided a wonderful opportunity for Kayla Braggs to meet the Stoesser family in person and connect with members of the U.S. rice industry. "Attending the Rice Marketing and Technology Convention this past month was nothing short of amazing," Braggs said of her RMTC experience. "As a first-time attendee, I had no idea what to expect, and it was nothing short of surprises around every corner. From the production exhibition to the informational speaker sessions, the week provided a great mix of industry updates, with reconnecting with old and new friends. One of the high points was meeting the Stoesser Family. They were all so welcoming, and it made me even prouder to have been a scholarship recipient in memory of someone so instrumental in the US Rice Producers Association."  Left to right: Meredith Stoesser, Kayla Braggs, & Neal Stoesser. Left to right: Meredith Stoesser, Kayla Braggs, & Neal Stoesser. |

| Kayla is currently a second-year PhD student at the University of Florida studying Agriculture Communications. Her research focuses on producer-centered policy education and finding ways that practitioners and other stakeholders can work together to make better communication tools for agriculture policy. After graduation, she plans to move to Washington, D.C., to dive into the ag policy in policy communications/stakeholder engagement at a trade association or corporate company. "I also enjoyed getting a glimpse at how many countries U.S. rice impacts," she said. "Even with only six major producing states, it is without question the industry’s impact is exponential. If I was to give advice to someone interested in attending the conference for the first time, be prepared to come with open ears and be prepared to leave with an even greater appreciation for the growers, processors, millers, and marketers that propel the rice industry forward." On behalf of the U.S. Rice Producers Association and the Stoesser family, we extend our heartfelt thanks to Kayla for her kind words and for sharing her experience at the Rice Marketing and Technology Convention. It was a pleasure to have her join us, and we are incredibly proud to count her among the recipients of the Stoesser Memorial Scholarship. Her passion for agricultural communication and her commitment to advancing the industry’s future through research and policy are truly inspiring. We look forward to seeing the impact she will make in the years to come. |

|

This week’s USDA Trade Mission to Peru marked a successful step forward in strengthening agricultural trade between the United States and Latin America. Led by Daniel Whitley, Administrator of the USDA Foreign Agricultural Service, the mission brought together U.S. agribusinesses, trade associations, and government officials to foster partnerships, explore market opportunities, and promote high-quality American products, including U.S. rice. “Participating in this trade mission was an excellent opportunity to connect directly with key buyers and industry partners in Peru,” said Iris Figueroa, Western Hemisphere Marketing Manager and mission participant. “There is clear interest and enthusiasm for U.S. products, and we’re excited about the potential for continued growth in this market.” The strong engagement and collaborative spirit throughout the mission underscored Peru’s importance as a strategic and growing market for U.S. agriculture. I Iris Figueroa and Daniel Whitley, Administrator of the USDA Foreign Agricultural Service. |

|  |

| B2B meetings are a critical element of trade missions like this one, as they provide a direct platform for exporters and buyers to connect, discuss needs, and negotiate potential deals. These face-to-face interactions build trust, clarify expectations, and help tailor products and services to specific market demands. For U.S. rice producers, such meetings are invaluable in expanding their reach, understanding local market dynamics, and establishing long-lasting relationships that drive sustainable growth. |

Left to right: Luis Enrique Manayay Llaguento from Grupo Valle Norte, Iris Figueroa and Jose Luis Jimenez, wholesale sales executive at Mercado San Anita. While in Peru, we had the valuable opportunity to meet with a representative from APEMA, Asociación Peruana de Molineros de Arroz, and visit Mercado San Anita, one of Lima’s largest and most vibrant traditional markets. Overall, the trip to Peru was an invaluable and we extend our sincere thanks to the USDA for making this important mission possible. |

|

|

| USRPA cosponsors agriculture industry event in DC: On Wednesday, Congress hosted its annual bipartisan Congressional Baseball Game for Charity at Nat’s Park in Washington, DC. USRPA, alongside a handful of other agricultural trade associations, sponsored a pre-game event that garnered lots of participation and engagement from the Hill and other working professionals within the DC agriculture policy bubble. USRPA’s own, Mollie Buckler, represented producers and the organization at the event, along with USRPA’s lobbying arm Cornerstone Government Affairs. |

| Senate Ag Committee releases reconciliation bill text: On Wednesday, the Senate Committee on Agriculture, Nutrition, and Forestry released legislative text to contribute towards the Senate’s broader budget reconciliation package. At the beginning of the reconciliation process, Senate Ag was instructed to cut at least $1 billion from within the Committee’s jurisdiction, which was vastly different than the House Agriculture Committee’s instruction of $230 billion. Chairman John Boozman (R-AR) and the Committee market the bill as reining in runaway spending in the nutrition title while promoting fiscal responsibility and investing in rural America and America’s farm families. In the Senate’s version, the bill has a net savings total closer to $140 billion, whereas the House’s version meets their instruction of $230 billion in net savings. From the perspective of USRPA, the bill increases reference prices for Title I commodities, including long and medium grain rice, reforms payment limits, and bolsters funding for trade promotion programs. You can find the Senate Agriculture Committee’s complete legislative text here and a section-by-section summary here. House Appropriation delays Ag-FDA FY26 markup: On Wednesday, the full House Appropriations Committee convened to markup the Fiscal Year 2026 Agriculture, Rural Development, Food and Drug Administration, and Related Agencies Bill. This bill provides a discretionary spending total of $25.523 billion, $1.163 billion (4.2%) below the FY25 enacted level. Members engaged in hotly partisan debates regarding funding levels for rural infrastructure, the Supplemental Nutrition Program for Women, Infants, and Children (WIC), and the foreign influence on farming in the U.S. Republicans supported efforts for the federal government to assume more fiscally responsibility while simultaneously supporting rural communities access to broadband, water infrastructure, and affordable housing. Democrats criticized the spending cuts, arguing that the proposed cuts to rural infrastructure will harm farmers, vulnerable communities, and subside development. The Committee initially started the markup on Wednesday morning, recessed for the Congressional Baseball Game later in the afternoon, and then returned in the evening after the game to resume the rest of the markup. Despite all this, the Committee was unable to finish up the markup, with the FY26 Defense bill that was scheduled to markup before the full Committee on Thursday, the following day. While the Committee managed to get through a bulk of the amendments, a handful remain, and a continuation date has yet to be confirmed. You can find a copy of the bill text here and the report language here. Senate confirms Stephen Vaden as Deputy Secretary of Agriculture: On Tuesday, the Senate confirmed Stephen Vaden to be the next Deputy Secretary of Agriculture along a 51-44 party vote. He will now head down to the U.S. Department of Agriculture where he will serve as Secretary Brooke Rollins’ number two in command. This vote comes two months after his nomination hearing before the Senate Committee on Agriculture, Nutrition, and Forestry. Before this new role, he served as a judge on the U.S. Court of International Trade and was at the USDA during President Trump’s first term as a general counsel. The Senate has yet to schedule confirmation votes for several other USDA nominees in the queue, such as Luke Linberg, Tyler Clarkson, and Dudley Hoskins., |

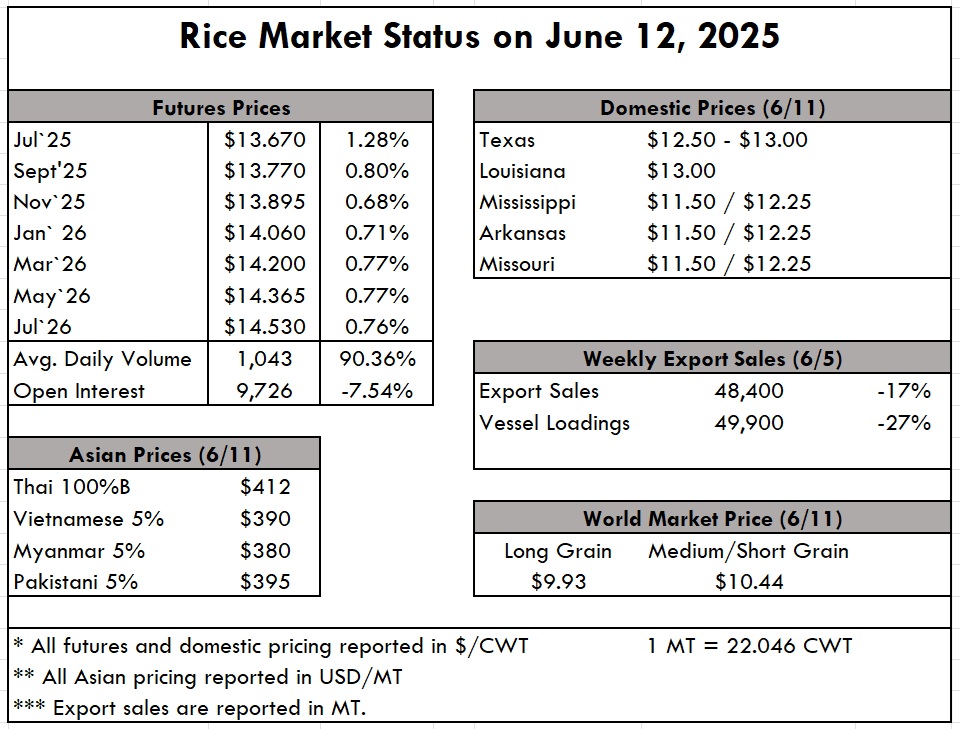

| The rice market continues to move along without major disruptions in either direction. While we haven’t described prices as “strong” in quite some time, we wouldn’t call them weak either. For now, the market remains steady, though with both upside and downside potential. However, with a large crop on the horizon and low global prices, any upward movement appears unlikely. According to the FAO Rice Price Update, prices have been hovering near the bottom for a while. The All Rice Price Index averaged 106.3 points in May, up 1.4% from April, but still 22.6% below levels seen this time last year. The slight bump is attributed mainly to aromatic and Basmati rice, rather than conventional long grain.This month’s WASDE included a special update on Thailand, a country that once led global exports but has been overtaken by India in recent years. Thailand’s rice exports are projected to fall to a multi-year low of 7.0 million tons in 2025 due to plummeting demand from Indonesia, tighter exportable supplies, and increased competition from cheaper exporters. Despite a higher production forecast, beginning stocks are at their lowest since 2005, largely due to elevated exports during India’s 2024 export ban. With India back in the market, Thai rice — especially white rice — has become less competitive, further burdened by a stronger baht. As a result, key markets like the Philippines and Malaysia have shifted toward more affordable options, causing steep declines in Thai milled rice shipments. Still, there are bright spots: exports to Iraq and China are up, parboiled shipments to South Africa remain steady, and fragrant rice exports, especially to the U.S., continue to grow. Per this month’s WASDE, global rice production has been revised upward on the back of a large Indian crop, driven by government subsidies and favorable weather. Global stocks and consumption forecasts are also higher, again largely due to India’s strong performance. As mentioned, the U.S. long grain market hasn’t been described as strong in over a year, back when prices reached $800/MT. Today, $650/MT is a more common quote. See the attached price chart from FAS for recent trends. The weekly USDA Export Sales report shows net sales of 48,400 MT this week, down 17% from the previous week and 2% from the prior 4-week average. Exports of 49,900 MT were down 27% from the previous week and 3% from the prior 4-week average. Crop Progress is looking solid, with 23% of the crop registering in the Excellent category, 54% in Good, 20% in Fair, 3% in Poor, and 0% in Very Poor. Overall, a good place to be this time of year. We can only hope that heat units and weather events are advantageous to crop and milling qualities as we move through the summer. |

|