| House Appropriations Subcommittee on Agriculture advances FY26 bill to Full Committee: On Thursday, the House Appropriations Subcommittee on Agriculture, Rural Development, Food and Drug Administration, and Related Agencies convened to markup the Fiscal Year 2026 Agriculture, Rural Development, Food and Drug Administration, and Related Agencies Bill. This markup comes after President Trump released additional guidance regarding the Administration’s ‘skinny’ FY26 budget request. The bill provides a discretionary spending total of $25.523 billion for programs under the subcommittee's jurisdiction, $1.163 billion (4.2%) below the FY25 enacted level. Republicans expressed support for the bill, claiming that it prioritizes protecting the food and drug supply, supporting farmers, ranchers, and rural communities, expanding broadband access, investing in critical agricultural research, and ensuring access to nutrition programs for low-income individuals and families. Democrats argued that the proposed cuts to rural development, nutrition assistance, and international aid undermine support to vulnerable communities. The Subcommittee favorably reported the bill to the Full Committee on a party-line vote of 9-7. The bill is scheduled for Full Committee consideration next Wednesday, June 11. You can watch the full Subcommittee markup here. President Trump shares additional FY26 budget request and agency resources: Last Friday, President Donald Trump released a 1,224-page appendix with more details and agency instructions regarding the Administration’s initial fiscal year (FY) 2026 ‘skinny’ budget request that was released in the beginning of May. In addition to the White House’s published materials, several individual agencies also posted their own “budget in brief” resources. In the released budget, Trump seeks non-defense funding cuts of more than 22% in the upcoming fiscal year alongside a flat military budget. From the lens of the U.S. Department of Agriculture (USDA), the Administration is requesting $23 billion for USDA, which amounts to a $7 billion cut from the current year’s budget. While the appendix provides additional details surrounding targeted cuts across the federal government, the White House still owes Congress several other pieces of its budget. Despite this, the Director of the White House Office of Management, Russ Vought, has indicated that a completed proposal is not expected to be released until Congress manages to pass the GOP-led reconciliation package. You can find a copy of the appendix to Trump’s May budget request here and copy of the USDA’s FY26 budget summary here. |

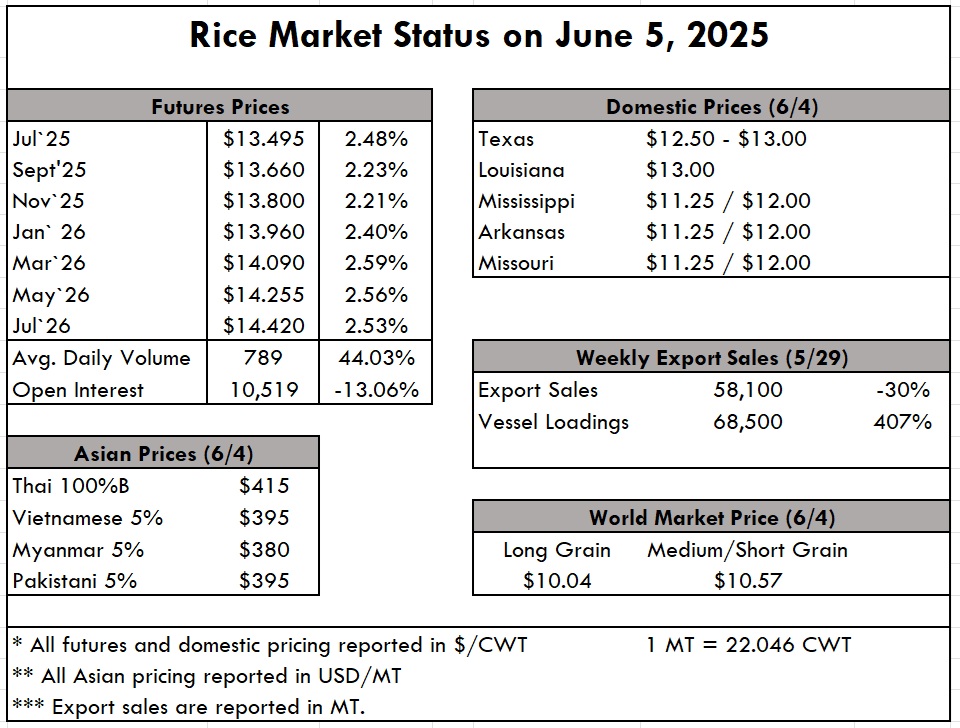

| This week’s rice market update comes with a side of drama — because what’s global trade without a little political spice? While tariffs tiptoe their way back into headlines, the real showstopper is the very public breakup between Donald Trump and Elon Musk. Once the poster boys of free-market bravado and social media swagger, their bromance has officially soured. What does this mean for rice? Maybe nothing... maybe everything. When the world’s loudest voices clash, markets twitch — especially when tech, trade, and policy start to tangle. Buckle up, because it’s going to be a weird growing season. So with planting and emergence largely behind us, we turn our sights more directly to crop condition across the rice-producing states. The good news is that we are 75% in the Good to Excellent condition this year, compared to 77% last year. It is still too early to make any prognostications, but not having any significant weather events early on is always a plus. That being said, weather has caused an obvious reduction in the concentrated area of long grain in northeast Arkansas, with an estimated 250,000 acres going to preventive planting. Keep your eye on the weather throughout the northern rice delta as the forecast calls for wet, stormy conditions. Prices on the ground here in the U.S. for any scant amounts of old crop are being reported with Texas at $12.50-$13. Louisiana is showing $13/cwt, while Mississippi, Arkansas, and Missouri are reporting in at $11.25-$12/cwt. Many of the mills are entering a summer slowdown, while others are busy milling the Iraq business so desperately needed to keep liquidity present. Check out June's FAO Rice Update here. In Asia, prices are still dismal, but at least steady. Thailand and Vietnam are both competing in the $400 pmt +/- $5, while India is sub-$400 at $390 pmt this week. Business is relatively steady in the Far East, with many destinations ordering at ease because of the low prices with no threat of an increase on the horizon. The weekly USDA Export Sales report shows net sales of 58,100 MT this week, down 31% from the previous week, but up 17% from the prior 4-week average. Increases primarily for South Korea (22,200 MT), unknown destinations (17,500 MT), Saudi Arabia (9,000 MT), Haiti (8,000 MT), and Japan (1,000 MT) were offset by reductions for Guatemala (1,200 MT). Exports of 68,500 MT were up a whopping 407% from the previous week and up 52% from the prior 4-week average. |

|

|

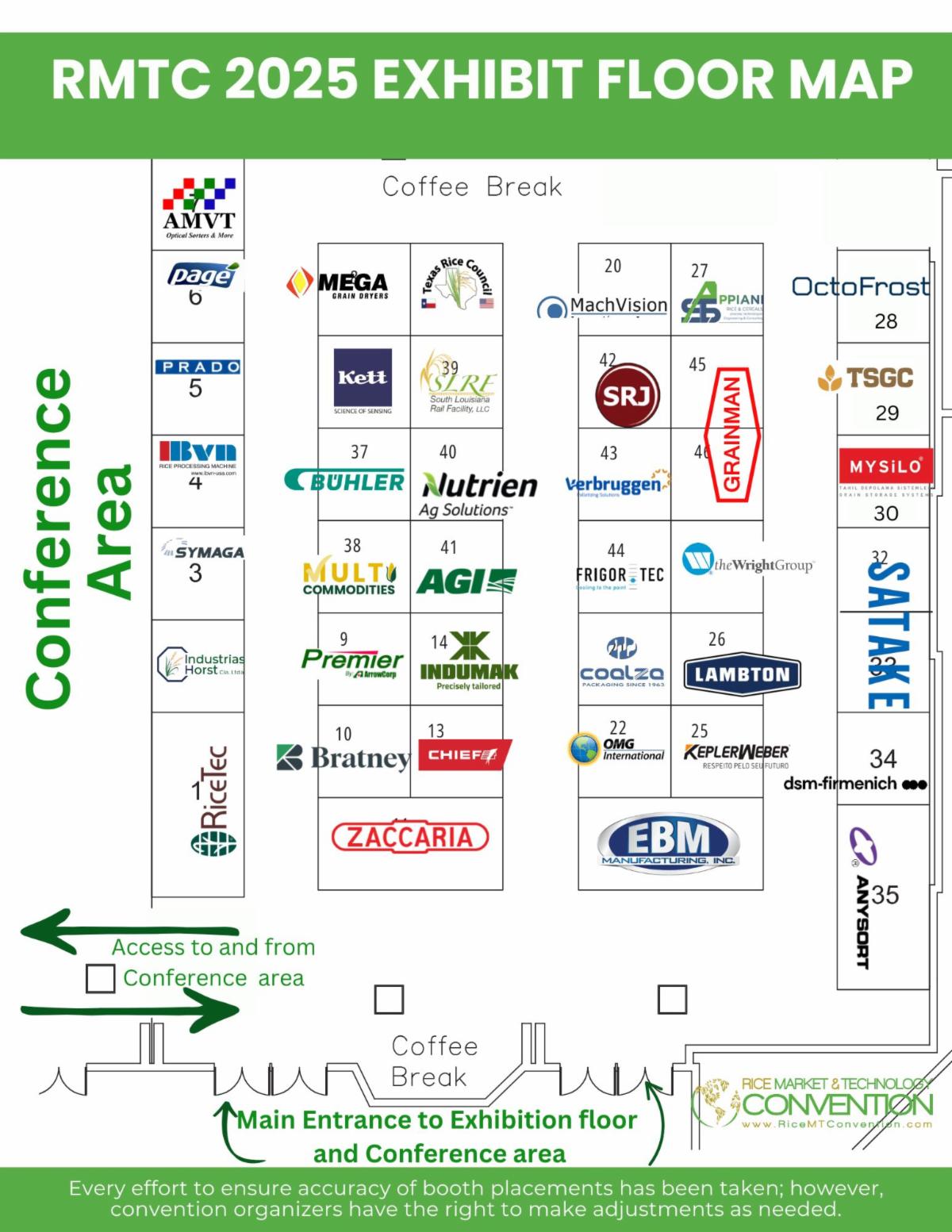

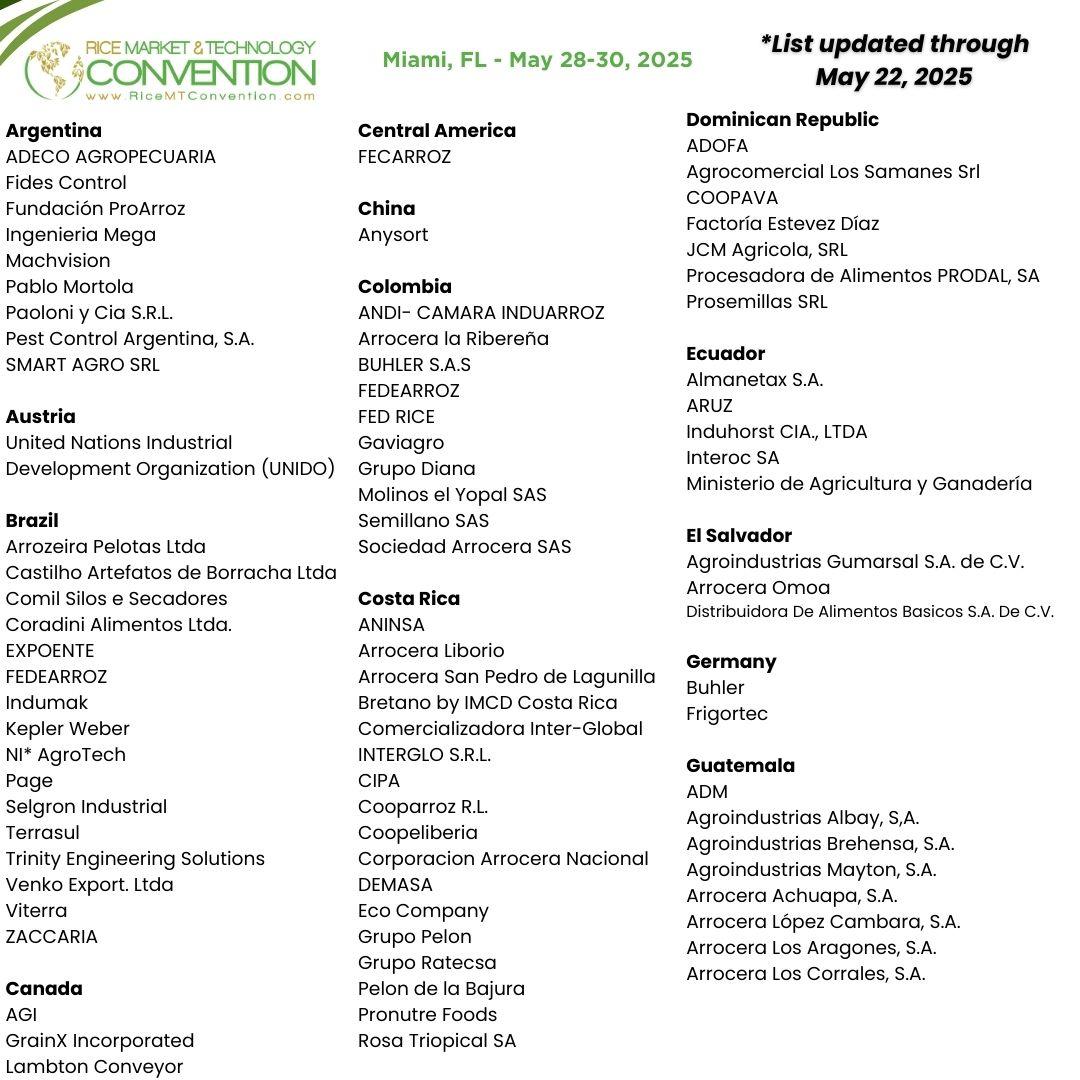

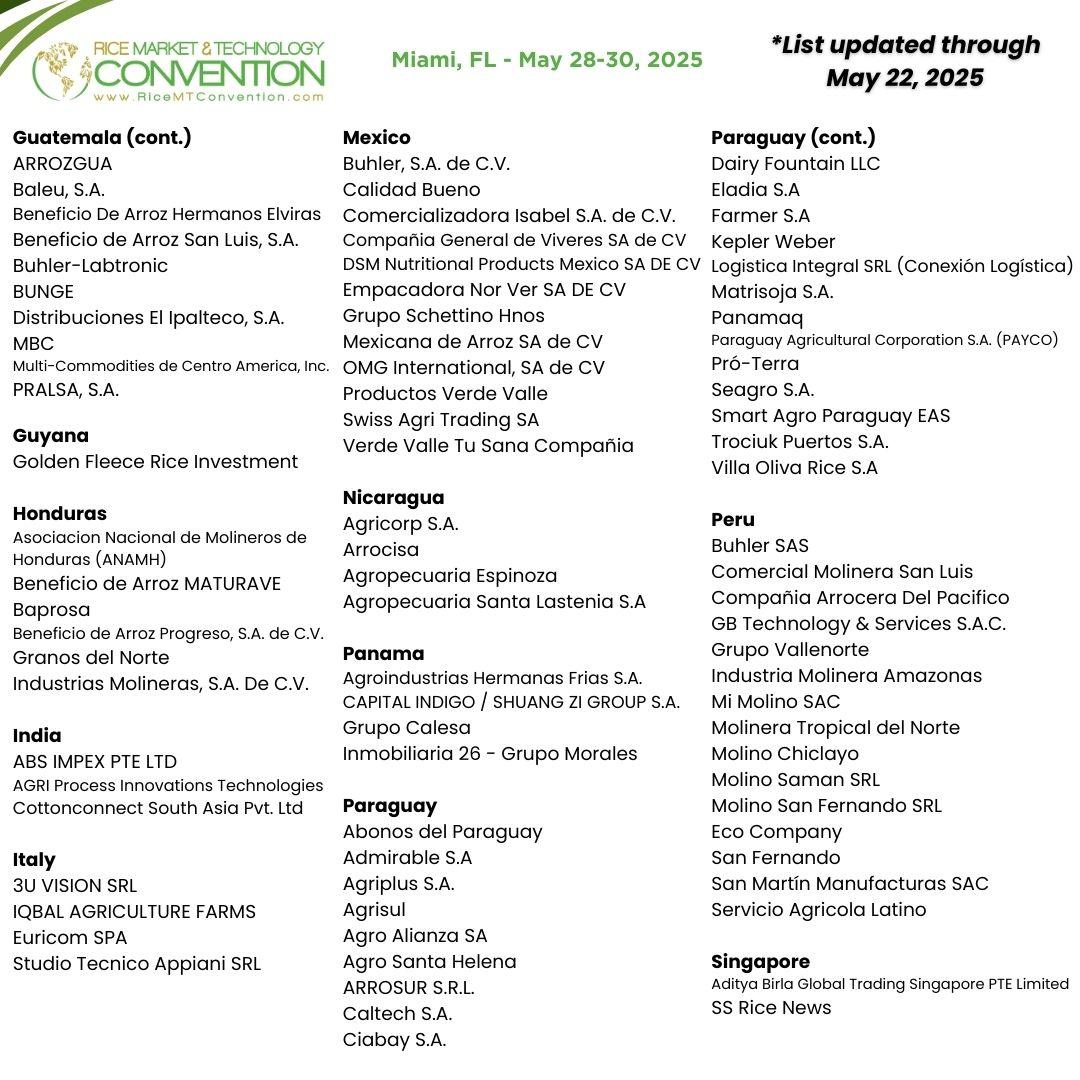

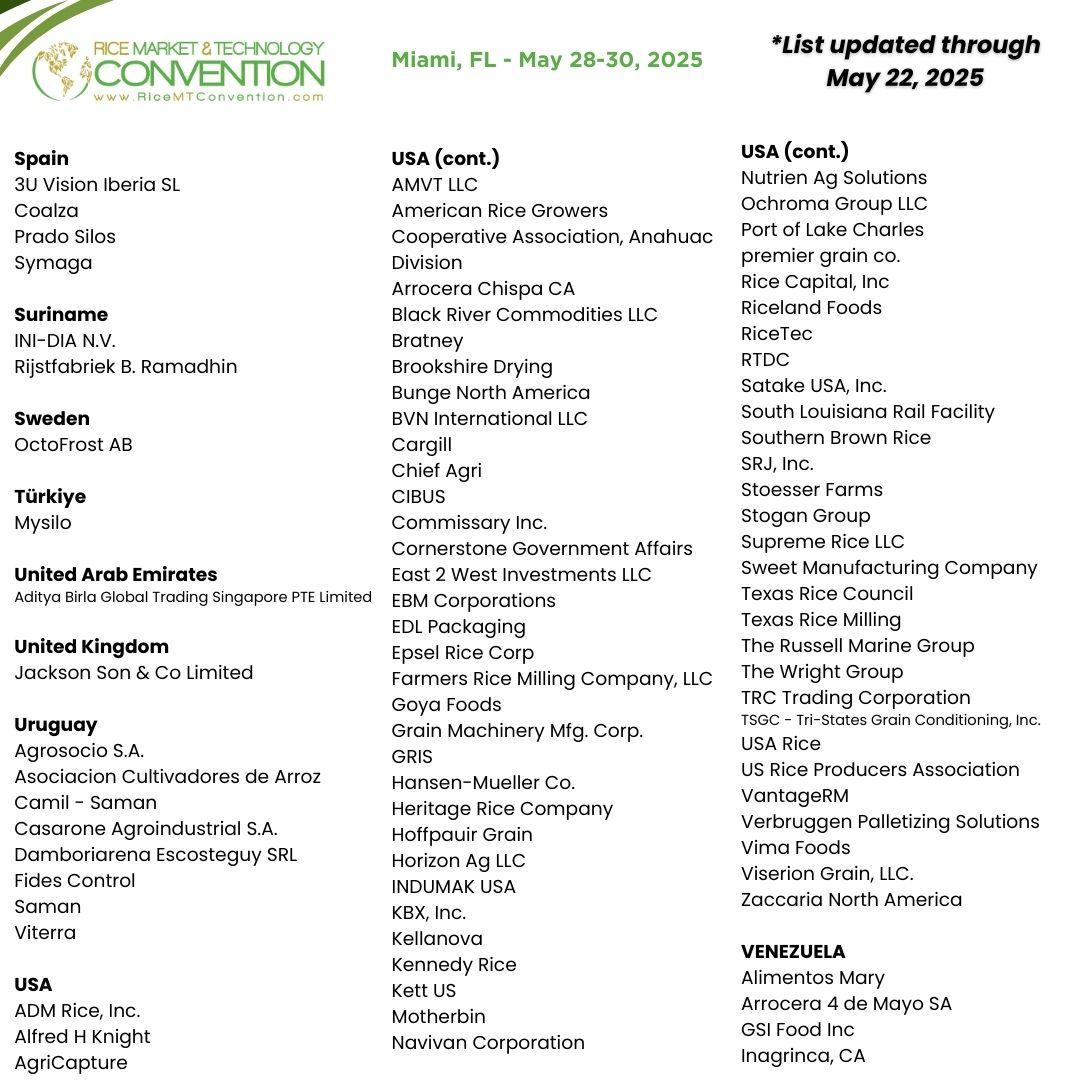

| RMTC 2025 brought together more than 30 countries and over 250 companies for an impactful and energizing week in Miami. From start to finish, the event was filled with strategic dialogue, technical insight, and industry-shaping announcements that will resonate far beyond the convention floor. Attendees experienced expert-led sessions, cutting-edge technology demonstrations, and unparalleled networking opportunities. The exhibition floor buzzed with activity, highlighting the latest in rice milling, grading, packaging, and sustainability solutions. “The energy, collaboration, and vision present at RMTC 2025 reflect the strength and resilience of our industry. Together, we are shaping a stronger future for rice,” Marcela Garcia, President & CEO of US Rice Producers Association, said. THANK YOU to all our incredible sponsors, exhibitors, speakers, and attendees. Your support and participation made RMTC 2025 a true success. “This year’s RMTC demonstrated the power of partnership and innovation in driving the global rice sector forward. We are proud to provide a platform where meaningful progress begins,” Iris Figueroa, Western Hemisphere Marketing Manager for US Rice Producers Association, said. We look forward to welcoming you to RMTC 2026. Stay tuned for details coming soon! |

| We were proud to feature this video at this year's RMTC, amplifying the U.S. rice producers' voice for industry members from around the world. Hear why USRPA is the best partner to the U.S. rice producer, directly from producers themselves: |

|

| US Rice Producers Association’s Asia representative participated in the USDA Agricultural Trade Mission (ATM) to Hong Kong as part of ongoing efforts to explore and expand market opportunities for U.S. rice in the region. The mission provided a valuable platform to engage directly with key stakeholders and industry leaders in Hong Kong’s food and agricultural sectors. In addition to on-the-ground activities, USRPA participated in a series of one-on-one trade meetings conducted virtually via Zoom. These meetings enabled productive dialogue with several trade partners and importers, offering insights into current market trends, buyer preferences, and potential areas for collaboration. The participation in this mission underscores USRPA’s continued commitment to strengthening its presence in Asia and promoting high-quality U.S. rice in one of the world's most dynamic markets. |

| Trump Administration Releases Preliminary MAHA ReportOn Thursday, the Trump Administration’s Make America Healthy Again (MAHA) Commission released a report addressing the pressing childhood chronic disease crisis in this country and outlines government-wide efforts to help ‘Make Our Children Health Again.’ Spearheaded by Human and Health Services Secretary Robert F. Kennedy Jr., the report largely attributes blame for the current health crisis likely due to ultra-processed foods, exposure to chemicals, lack of exercise, stress, and overprescription of drugs. Throughout the report, the MAHA Commission acknowledges the significant role played by American farmers in the agricultural sector, noting their contribution to ensuring food abundance and affordability. It states that mechanization, synthetic fertilizers, and industrial-scale farming has elevated the agricultural output of the United States, transforming it into the largest food exporter globally. In the chemical exposure portion of the report, pesticides are recognized as essential for crop protection and as a critical component of maintaining a healthy, abundant, and affordable food supply, which supports American farmers and the MAHA agenda. However, concerns regarding potential links between pesticides and adverse health effects, especially in children, were raised and highlighted through the citing of various studies. Additionally, the report reiterates some of Kennedy and the MAHA movement’s criticisms about the role ultra-processed foods, added sugars, food dyes and additives play in American’s diets. Overall, the report suggests a shift toward a whole-food diet and touts the nutritional benefits of foods like whole milk, dairy, beef, leafy greens, legumes and more. Looking ahead, the Commission is expected to build upon the report and form a federal strategy over the next 100 days that is likely to include more definitive policy recommendations. You can find the full MAHA report here. House Passes ‘One Big, Beautiful Bill’ Reconciliation PackageEarly Thursday morning, the House of Representatives managed to pass its budget reconciliation bill by a vote of 215-214-1, after surviving a contentious 21-hour House Rules Committee markup to advance it to the floor. The bill passed with majority support from House Republicans, excluding Reps. Thomas Massie (R-KY) and Warren Davidson (R-OH) who voted no along with all present Democrats, Rep. Andy Harris (R-MD) who voted present, and Reps. Andrew Garbarino (R-NY) and David Schweikert (R-AZ) who abstained from voting altogether. The bill H.R.1 – the One Big Beautfiul Bill Act largely reflects President Trump’s fiscal policy agenda and includes tax reforms, spending adjustments, and policy changes across various sectors. Specifically, the bill extends the 2017 Tax Cuts and Jobs Act, introduces new tax breaks and exemptions such as lower individual tax rates and increased standard deductions. From the lens of the agricultural sector, the package expands and permanently extends 199A deductions, restores bonus depreciation, increases Section 179 expensing, and raises the estate tax exemption level. Acting as offsets, the bill also enacts cuts to social programs, including Medicaid and the Supplemental Nutrition Assistance Program (SNAP). Within the Agriculture Committee’s jurisdiction and over a 10-year period, the bill cuts $294.6 billion mainly from the nutrition title, while also reinvesting $58.792 billion into vital farm bill programs and titles. Notably, the bill increases Title I reference prices for rice, enhances crop insurance, and provides doubled funding for trade promotion programs like Foreign Market Development (FMD) and Market Access Program (MAP). Now, the House reconciliation package heads to the Senate for consideration where Republicans hold a narrow 53-47 majority. USDA to Dismantle Several Advisory CommitteesOn Monday, the Federal Register released a notice that the U.S. Department of Agriculture (USDA) intends to disband seven advisory committees aligning with President Trump’s Executive Order (EO), “Commencing the Reduction of the Federal Bureaucracy,” which works to minimize waste, fraud, and abuse by reducing federal bureaucracy. The named committees on the chopping block include:Advisory Committee on Agriculture StatisticsAdvisory Committee on Universal Cotton StandardsFruit and Vegetable Industry Advisory CommitteeNational Advisory Committee on Meat and Poultry InspectionNational Advisory Committee on Microbiological Criteria for FoodsNational Wildlife Services Advisory CommitteeNorthwest Forest Plan Area Advisory CommitteeThe notice also acknowledged several advisory committees that the Secretary had initially flagged for termination under memorandum, “Restructuring of Federal Advisory Committees within the Department of Agriculture,” that now have been paused until further notice. Those paused committees include:Agricultural Technical Advisory Committee for Trade in Animal and Animal ProductsAgricultural Technical Advisory Committee for Trade in Fruits and VegetablesAgricultural Technical Advisory Committee for Trade in Grains, Feed, Oilseeds, and Planting SeedsAgricultural Technical Advisory Committee for Trade in Processed FoodsAgricultural Technical Advisory Committee for Trade in Sweeteners and Sweetener ProductsAgricultural Technical Advisory Committee for Trade in Tobacco, Cotton, Peanuts, and HempBlack Hills National Forest Advisory BoardGeneral Conference Committee of the National Poultry Improvement PlanFor more information, you can find the notice posted to the Federal Register here. |

| Rice Farmers Need Favorable Prices |

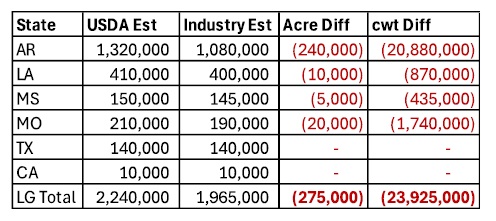

| There has been growing frustration in the market over delays in USDA reporting, and the impact this is having on pricing is substantial. This year in particular, planted acreage estimates appear to be significantly overstated, placing heavy pressure on prices for paddy rice still in first hands. To bring more clarity, we’ve surveyed planting expectations across key rice-producing states and taken a conservative but realistic approach to estimating total long-grain acreage losses. In reality, the shortfall could be even greater. |

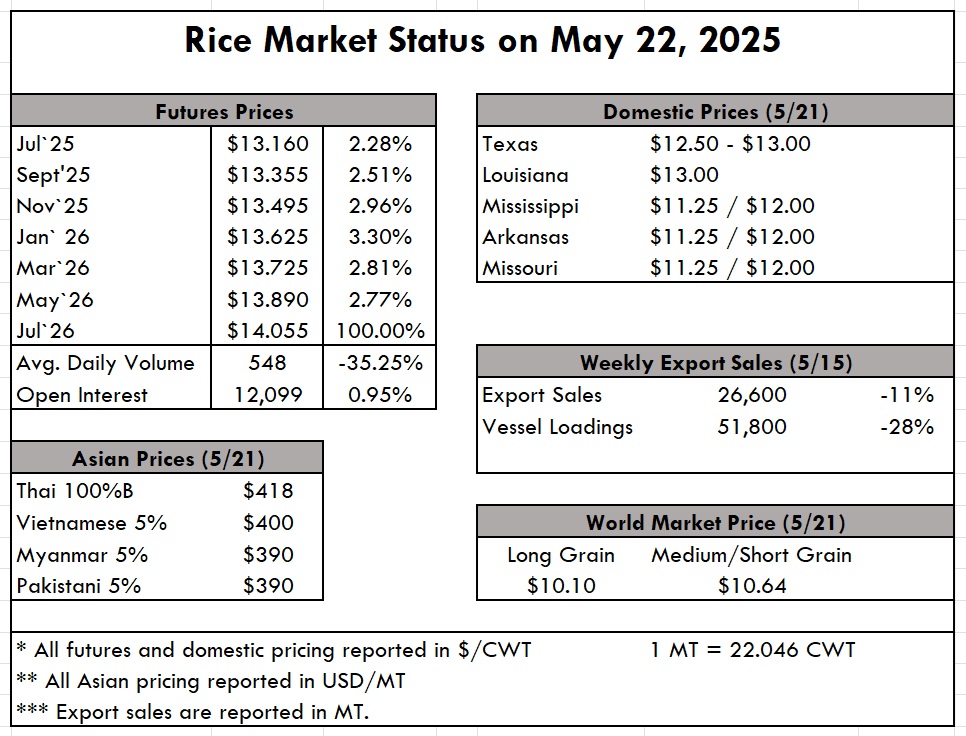

As the table illustrates, by not adjusting for lost acreage in this month’s WASDE, current production projections are overstated by at least 275,000 acres, or roughly 24 million cwt. This disconnect is materially affecting growers still trying to sell and mills attempting to manage inventory. While the true numbers will eventually surface, for many, it may be too late to influence favorable pricing. As the table illustrates, by not adjusting for lost acreage in this month’s WASDE, current production projections are overstated by at least 275,000 acres, or roughly 24 million cwt. This disconnect is materially affecting growers still trying to sell and mills attempting to manage inventory. While the true numbers will eventually surface, for many, it may be too late to influence favorable pricing.With planting largely in the books and on par with the four-year average of 87%, we turn now to initial crop quality reports. As of the May 18 USDA report, 28% of the overall rice is rated Excellent, 51% rated Good, 18% Fair, 2% Poor, and 1% Very Poor. It’s still early to place too much stock in these numbers, but a positive sign that nearly 80% of the crop is rated Good or Excellent. In Asia, market conditions remain soft. Demand out of Indonesia has cooled, pushing Indian prices as low as $385/MT, with Vietnam and Thailand holding around $400/MT but showing little upward momentum. Iraq continues to fulfill its MOU obligations with U.S. suppliers despite the pricing disadvantage, driven largely by geopolitical ties. Iraq is now the second-largest buyer of U.S. milled rice, trailing only Haiti. There are encouraging signals that Iraq may remain a consistent buyer in the coming years, though formal G2G agreements are still pending. This week’s USDA Export Sales report shows net sales of 26,600 MT, down 11% from the previous week and 29% below the prior 4-week average. Exports totaled 51,800 MT, down 28% from the previous week and 4% from the 4-week average, reflecting the broader slowdown in market momentum. |

|

| With over 30 countries and over 250 companies already registered, RMTC 2025 is set to be a truly international event, bringing together leaders from every segment of the rice industry. This strong global presence reflects the event’s importance as a networking, innovation, and market insight hub. We sincerely thank all our sponsors and exhibitors for their invaluable support. Your commitment makes RMTC 2025 possible, and we’re excited to showcase your contributions to the future of the rice industry. Please Note: The Rice Advocate will be on hiatus next week as our staff will be all hands on deck in Miami. Our next edition will be Friday, June 6. |

|