As expected, over the holiday’s there was minimal movement in the cash market. Prices are largely reported to be sideways since mid-December but that may begin to shift as we proceed into the New Year. There is already growing chatter concerning the strong bean and corn prices which may drag on 2021 U.S. rice acres unless the rice market begins to develop some momentum in the near future. Some believe that momentum will be influenced by the rice crop conditions in Mercosur where extremely dry conditions are going to cause a significant reduction in the harvest in these four countries’ exports.

Export demand for long-grain is down 4% year to date, which is mainly the result of milled rice demand being down 10.5% YTD. In terms of paddy, gross sales are on par with last year, but shipments are ahead of schedule. Although the US Dollar has not lost much value against the Thai Baht, it has against other currencies. Based on the ICE futures US Dollar Index, the currency weakened by more than 5% since October against major global currencies. Should the US Dollar decline further, there may be additional exporting opportunities in Latin America, however, to gain increased market share in the Middle East and Asia, the Dollar will have to lose value against key Asian exporting origins such as Thailand, India, Myanmar.

Next week the USDA will be releasing another World Agriculture Supply & Demand report as well as their Crop Production Annual Summary report which publishes the actual area planted, harvested, and the yields by rice type and state. The industry uses that data, in addition, to carry in and imports to establish a definitive beginning supply figure. From that point, the export shipments and domestic millings can be deducted in order to determine the state of supply for US long-grain at any given point throughout the marketing year.

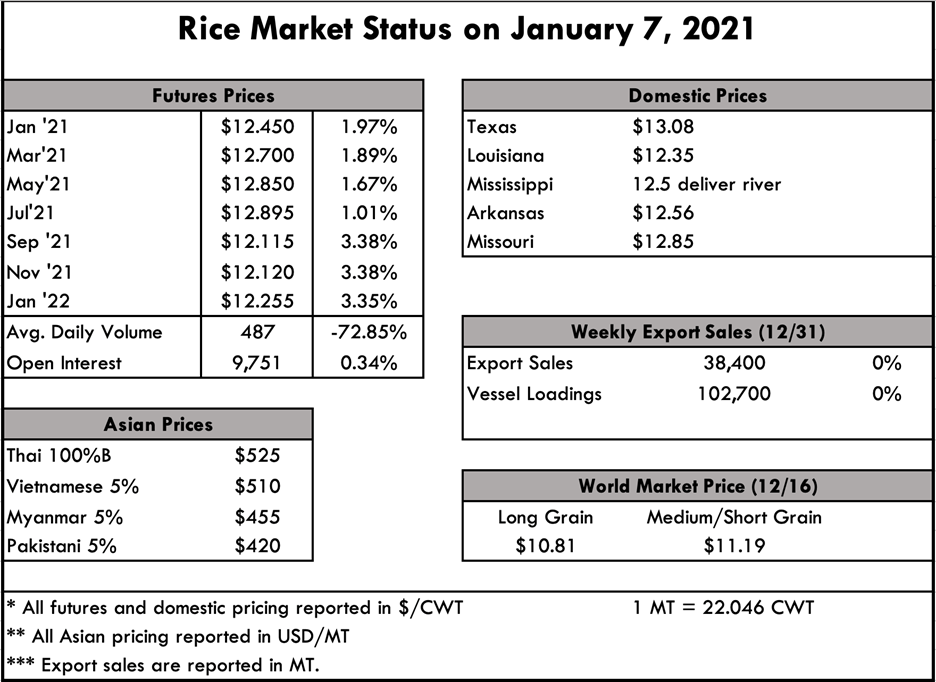

Asian prices have shown some signs of improvement over the past few weeks, as nearly all Asian origins have posted gains since early December. While appreciation is minimal, it is nonetheless present and may be indicative of what’s to come in the weeks ahead.

Futures continue to be relatively stagnant; the nearby contract softened some in late December but is now back to $12.45 per cwt and is accompanied by relatively favorable open interest levels but with a lower trading volume.