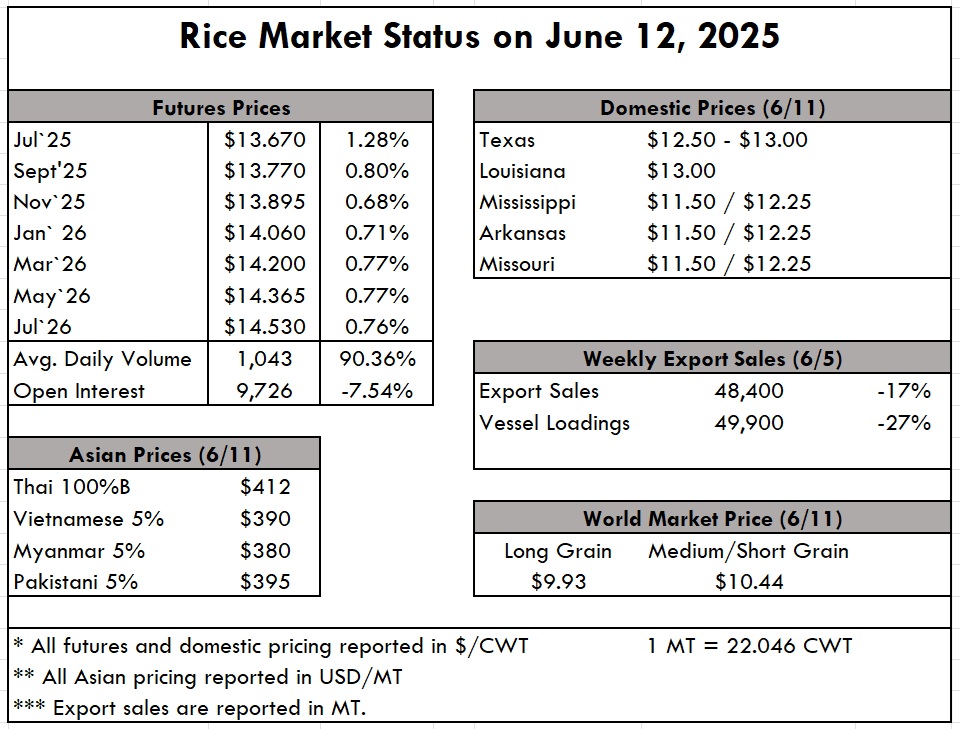

| The rice market continues to move along without major disruptions in either direction. While we haven’t described prices as “strong” in quite some time, we wouldn’t call them weak either. For now, the market remains steady, though with both upside and downside potential. However, with a large crop on the horizon and low global prices, any upward movement appears unlikely. According to the FAO Rice Price Update, prices have been hovering near the bottom for a while. The All Rice Price Index averaged 106.3 points in May, up 1.4% from April, but still 22.6% below levels seen this time last year. The slight bump is attributed mainly to aromatic and Basmati rice, rather than conventional long grain.This month’s WASDE included a special update on Thailand, a country that once led global exports but has been overtaken by India in recent years. Thailand’s rice exports are projected to fall to a multi-year low of 7.0 million tons in 2025 due to plummeting demand from Indonesia, tighter exportable supplies, and increased competition from cheaper exporters. Despite a higher production forecast, beginning stocks are at their lowest since 2005, largely due to elevated exports during India’s 2024 export ban. With India back in the market, Thai rice — especially white rice — has become less competitive, further burdened by a stronger baht. As a result, key markets like the Philippines and Malaysia have shifted toward more affordable options, causing steep declines in Thai milled rice shipments. Still, there are bright spots: exports to Iraq and China are up, parboiled shipments to South Africa remain steady, and fragrant rice exports, especially to the U.S., continue to grow. Per this month’s WASDE, global rice production has been revised upward on the back of a large Indian crop, driven by government subsidies and favorable weather. Global stocks and consumption forecasts are also higher, again largely due to India’s strong performance. As mentioned, the U.S. long grain market hasn’t been described as strong in over a year, back when prices reached $800/MT. Today, $650/MT is a more common quote. See the attached price chart from FAS for recent trends. The weekly USDA Export Sales report shows net sales of 48,400 MT this week, down 17% from the previous week and 2% from the prior 4-week average. Exports of 49,900 MT were down 27% from the previous week and 3% from the prior 4-week average. Crop Progress is looking solid, with 23% of the crop registering in the Excellent category, 54% in Good, 20% in Fair, 3% in Poor, and 0% in Very Poor. Overall, a good place to be this time of year. We can only hope that heat units and weather events are advantageous to crop and milling qualities as we move through the summer. |

|