More exciting news for the rice industry emerged from Washington, D.C., this week, though it may heighten tensions among the U.S., India, and Russia. President Trump signed an Executive Order authorizing an additional 25% tariff on imports of certain goods, including rice, from India. As of August 7, a 25% reciprocal tariff will apply to Indian rice imported into the U.S. Then, on August 27, the additional 25% tariff enacted by this Executive Order will take effect, resulting in a total 50% tariff on Indian rice. This 50% tariff on basmati imports is expected to reduce demand, hopefully encouraging customers to purchase more U.S.-grown rice. These tariffs indirectly address the WTO suits filed by the U.S. rice industry against India’s subsidies and price distortions, achieving a similar outcome. Additionally, reciprocal tariffs of 19% are now in effect for imports of Thai rice.

On the ground, harvest is progressing, with Louisiana nearing 30% completion as of this writing. Reports indicate 84% of Louisiana’s rice is in good to excellent condition, though significant milling yield data is not yet available. In Texas, just over 15% of the crop has been harvested, with 78% rated as good to excellent. For the broader industry, 75% of the crop is headed, surpassing the five-year average of 67% but trailing last year’s 79%. We are hearing good reports out of southwest Louisiana regarding field and milling yields. The near term will give us a good reading on the overall quality of the long grain crop once farmers begin cutting in northeast Arkansas in particular.

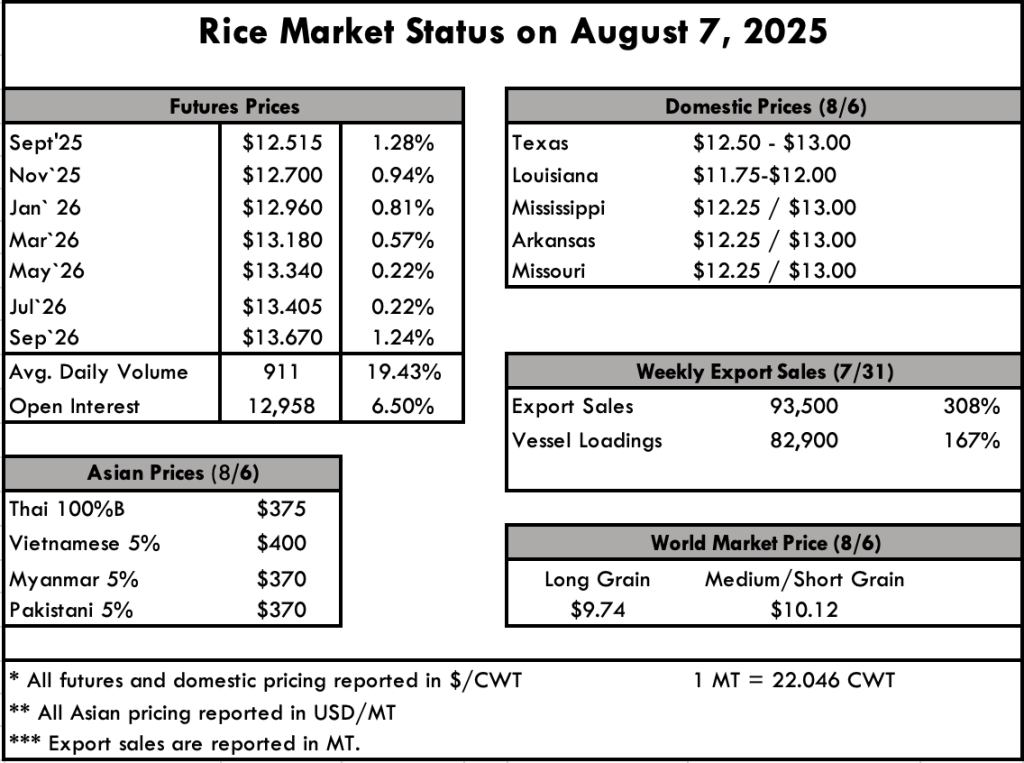

New crop paddy purchases are starting to emerge, with initial price discovery in Texas and Louisiana. Texas reports prices of $12.50–$13.00/cwt, while Louisiana shows $11.75–$12.00/cwt. There is little to report for new crop activity in Mississippi, Arkansas, or Missouri, which is typical until harvest intensifies by late August. Little demand for old crop contributes to the ongoing farm problems. California remains quiet, with cash prices for old crop at $11/cwt over loan and no bids yet for new crop.

In Asia, prices remain steady within their low range. Thai white rice 5% saw the largest decline, now trading at $375 per metric ton. Vietnamese 5% white rice experienced minimal depreciation and is approaching $400 per metric ton. Indian rice prices fall between these, slightly closer to Thai prices at $385 per metric ton.

Beyond the new Executive Order and tariff on Indian rice, details of the “skinny farm bill” from the Big Beautiful Bill’s passage are becoming clearer. Key points effective from the 2026 crop year include a loan rate of $7.70/cwt, a reference price of $16.90/cwt, program payment limitations increasing from $125,000 to $155,000 starting in 2025, 30 million new base acres, crop insurance remains intact, and a permanent increase in estate, gift, and GST exemptions to $15 million per individual. Overall, some very big wins for ag in general, and rice producers specifically. Now we will see how tariffs impact market dynamics as the new crop season gets underway.