Harvest is in full swing now, and seeing rice come into the barn is a great success. Texas and Louisiana have reached what most agree is the halfway point, and the market has remained fairly quiet through this point at the $17.50/cwt mark. Arkansas farmers are optimistic about the way their crop looks and are excited to get in the field in the coming days to begin recording their qualities and supplying new crop to the mills and paddy exporters.

On the milling side, Iraq has helped generate business, Haiti orders continue to be filled, and domestic customers remain strong. There isn’t any storm front in the news at the moment that should drop the market, nor is there a wildly optimistic horizon either. Steady as she goes would be an easy way to put it, though things may look different after our harvest is complete here domestically, and the effects of the weak Indian monsoon are realized in production, exportable supply, and pricing in the months ahead.

We have had several conversations in the past week with folks who were interested in more details about the situation regarding the Indian monsoon and its impact on the global rice market. While the potential for a significant crop reduction is real, we need to point out that the monsoon is presently affecting planting. There is still time for weather to change, and then overall production numbers won’t surface until the crop begins to mature — therefore the reports from last week are more of a “warning bell” of what could be, and the time horizon is months out for any official reporting.

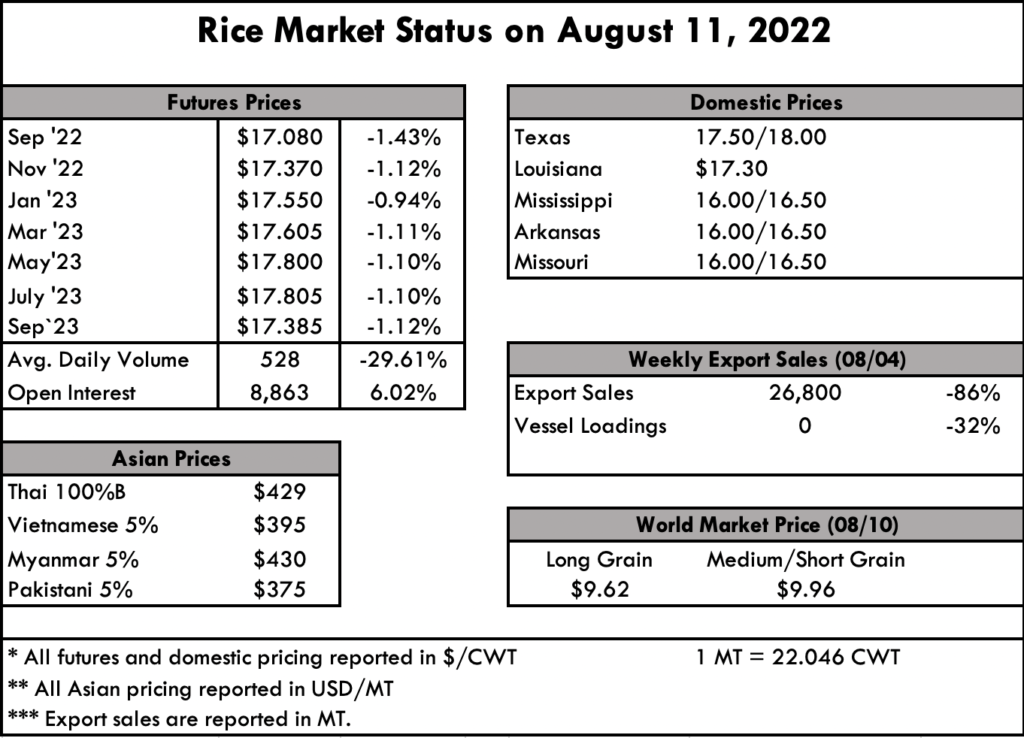

That being said, India remains the low-cost leader at $355 pmt, the same as last week and the same it’s been for months now, give or take 5%. Same goes for Thailand, where fluctuations have been minor compared to previous this year, this week with prices reported at $415 pmt. Vietnam prices did drop due to local factors, down to $400 pmt this week, where they were closer to $410 pmt last week.

The August FAO Rice Price Update shows the all rice price index averaged 108.4 points in July, down 2.1% from June, but up 7.2% compared to this time last year. Notably, the July decline is actually the first drop of the year. Rice is certainly the outlier when it comes to inflation compared against other commodities out there because of the tight band in which the price has remained, particularly when one considers the increased cost of inputs like fuel and fertilizer to bring the crop to fruition. We shall see next week what new information the USDA’s Rice Outlook Report might contain on August 16.

The weekly USDA Export Sales Report shows of 26,800 MT to kick off the marketing year. We did log in 18,000 MT for Haiti and 6,300 MT for Mexico. A total of 216,700 MT in sales were outstanding on July 31 and carried over to 2022/2023. Accumulated exports in 2022/2023 totaled 2,749,200 MT, which were down 14% from the prior year’s total of 3,195,900 MT. The destinations were primary to Panama. Exports for August 1 of 1,700 MT were primarily to Canada (1,000 MT), Japan (200 MT), Poland (100 MT), Jordan (100 MT), and Guam (100 MT).