In the latest crop progress report released by the USDA, Louisiana was pegged at 75% complete which lags the historical average by 5%. Mississippi and Texas are both on pace with their 5-year norms at 23% and 81%, respectively. Missouri and California are taking samples and preparing for harvest which should begin to pick up soon. Moisture levels in Arkansas are still a bit high at 23-25% and the recent dip in temperatures and lower humidity aren’t helping to bring the crop to final maturity. For the 11% of the crop that has been harvested, yield reports have been strong, but there is still a long way to go.

According to various market reports and brokers, cash markets were unchanged throughout the southern United States and even California. The easiest explanation for this is harvest. Currently, growers are fixated on bringing in their rice and determining yields and quality and are participating very little in cash trades. Since this is a seasonal norm, buyers are slow to fuel the market and are also waiting until more crop information comes to light before revising their cash bid.

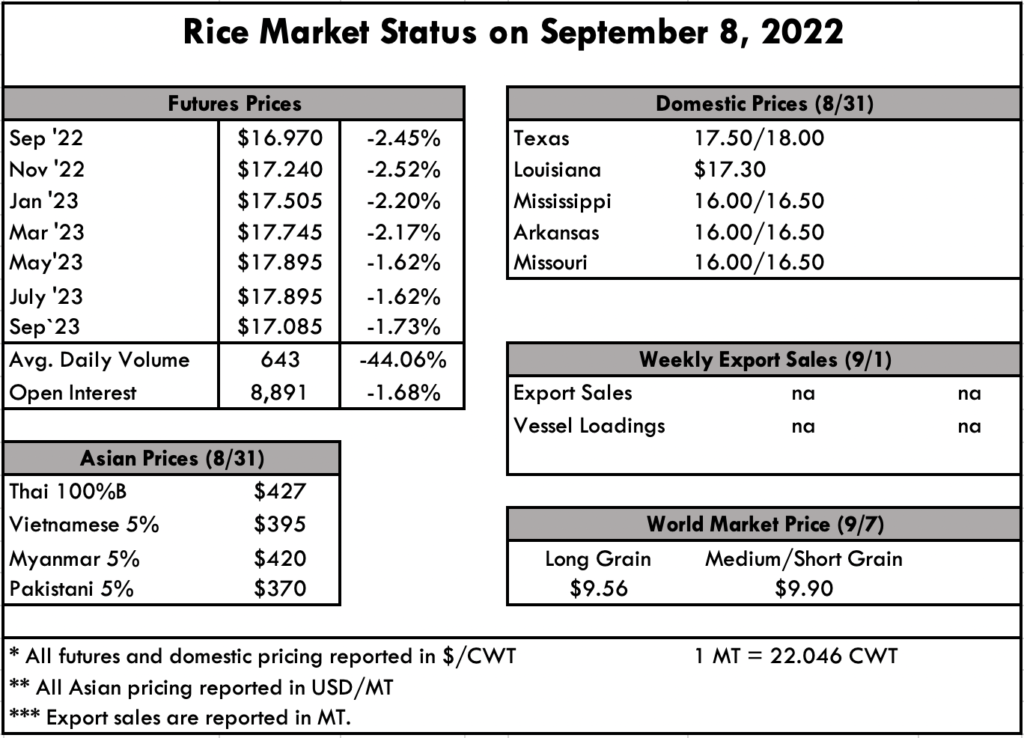

South American prices have reportedly slid over the past two weeks with Uruguayan rice now trading at $520 FOB or even lower, and Argentine rice trading as low as $480 FOB. Meanwhile, prices in the far east are relatively unchanged, despite India announcing a 20% duty on rice exports and a ban on brokens. This is an attempt to combat soaring food inflation and low rice prices domestically. Considering India accounts for more than 40% of global shipments, this protectionist policy can’t be overstated. World prices have yet to respond, but there is concern that this may be a catalyst for higher grain prices across the board, as China, the largest recipient of India brokens will be forced to import more corn for feed purposes. A duty of 20% would put Indian rice right on par with Thai prices, and above Viet prices by about $20 pmt if prices in both Vietnam and Thailand hold.

The futures market has continued to be a little volatile due to several factors in Asia, not to mention the lack of export data domestically. Reports of heat and flood damage in key rice growing regions in both China and Pakistan has spooked importers; however, some traders believe the loss will be offset by a large global carry over. Considering beginning stocks are up 61.5 million tons since 2013/14 and global consumption is only up 44.8 million tons, it stands to reason that the recent bumper crops and subsequent larger supplies may alleviate some supply concern moving through the new marketing year.