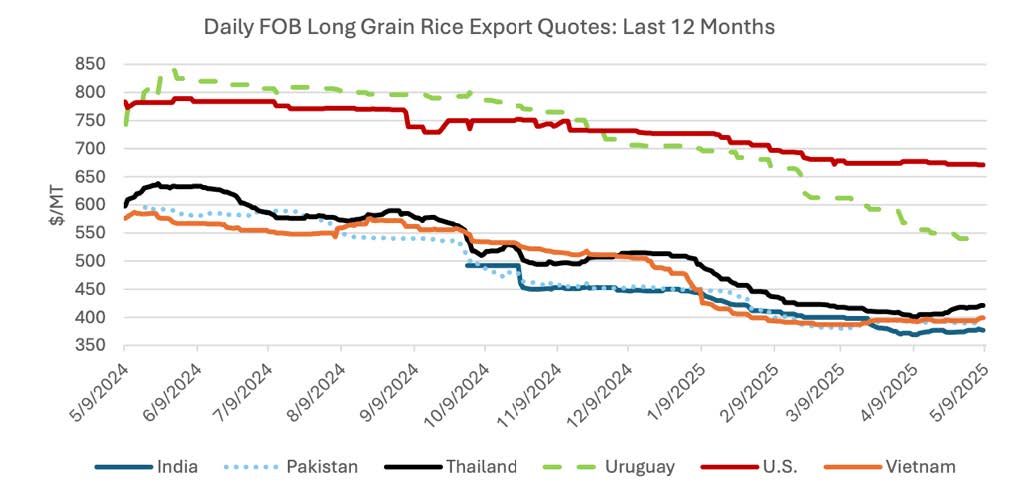

| Planting is wrapping up in some states, while it’s going full speed in California. Overall, we are still ahead of schedule, and the total acres lost is looking to be closer to 300,000 acres in total, the majority coming from Arkansas where the intense flooding took out a majority of these acres. More direct impact in the coming weeks on total acreage loss expectations. It remains difficult to find any cash prices, and futures have been on the doldrums too. Recent USDA reports indicate a lack of accurate and transparent stocks and made no adjustment for acreage in the Delta due to preventive planting and constant wet weather. It's raining now in northeast Arkansas and southeast Missouri, and severe storms are predicted for the days ahead. With a conservative acreage and production reduction, combined with a confirmed lower stock report reducing old crop carryover, ending stocks would be reduced significantly even with conservative numbers. We realize the USDA requires solid data, as they say. Lower supply certainly supports price and the USDA for now appears to be saying higher supplies are ahead of us. This market and especially rice farmers need this information in the marketplace. These current market conditions are the most difficult since the 1980s. The large crop in South America is putting a weight on new U.S. crop expectations. A number of recent sales out of Argentina, Paraguay, and particularly Uruguay have been confirmed to Mexico and Central America. Foreign exchange with Brazil is keeping those prices $10-$12 per ton FOB above its neighbors for now.The most recent Grain: World Markets and Trade report shows global rice production is projected to hit a record 538.7 million tons, up 1.0 million tons from last year. The increase is led by India, which maintains its position as the top producer for a second straight year, thanks to strong government support. China is also expected to slightly increase output. Together, these two countries contribute over 50% of the world’s rice production. Global consumption is also forecast to reach a record 538.8 million tons, up 6.1 million tons from the prior year. India’s consumption will hit a record 125.0 million tons, supported by government food programs and limited use in ethanol production. In China, consumption remains steady, with low feed use and cheaper coarse grains influencing demand. Growing populations are driving increased consumption in Sub-Saharan Africa, South Asia, and the Middle East. Global rice ending stocks are forecast nearly unchanged at 185.1 million tons, with China and India holding 80% of reserves due to public stockpiling. U.S. ending stocks are projected to rise 6% thanks to higher beginning stocks, while China and Thailand also expect stock gains. In the Western Hemisphere, imports are expected to increase modestly. The U.S. will likely import more due to demand for specific varieties, and Mexico’s imports are driven by population growth and reduced supply of alternative grains. Brazil, however, may reduce imports as domestic prices stay competitive. |

|

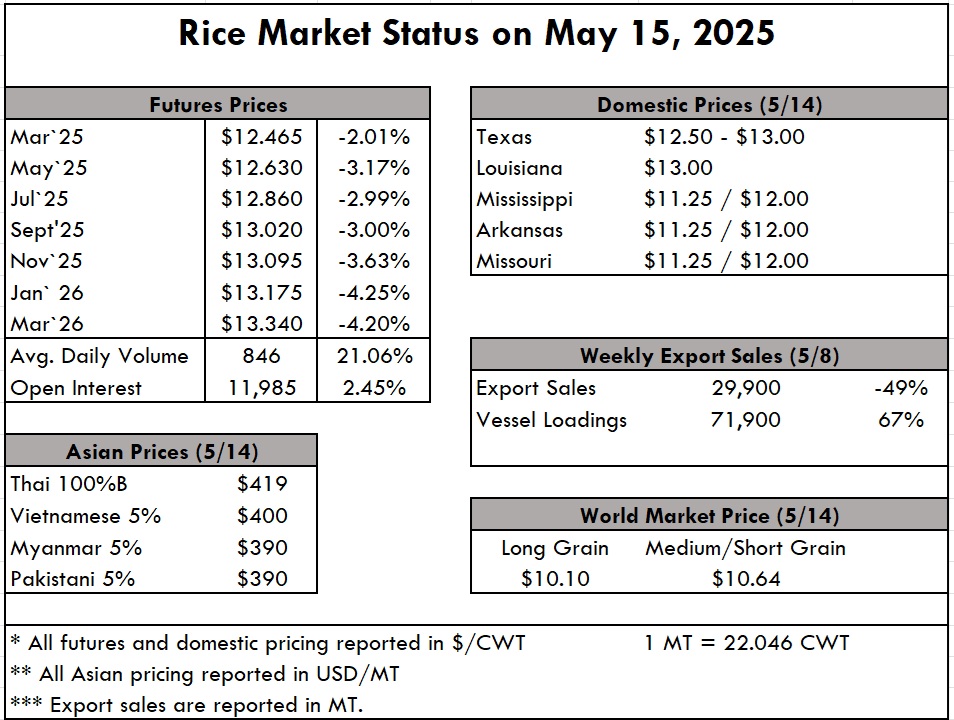

The weekly USDA Export Sales report shows net sales of 29,900 mt this week, down 49% from the previous week and 11% from the prior 4-week average. Exports of 71,900 MT were up 67% from the previous week and 28% from the prior 4-week average. |