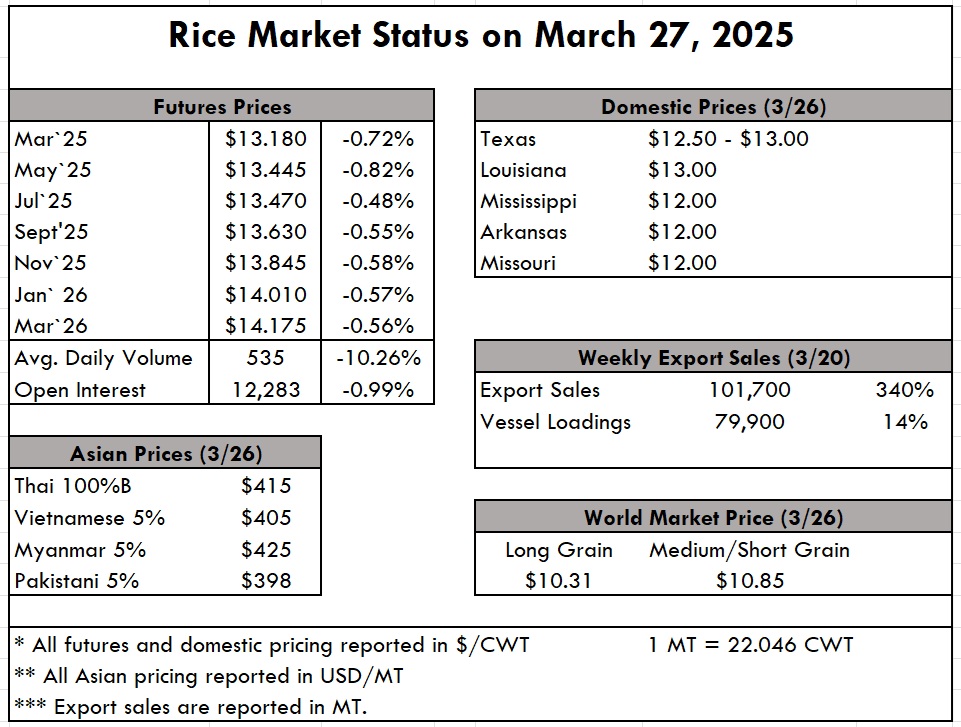

| Planting is underway in the U.S., where the expectation for planted acres is a contested issue on account of seed availability, financing, and the poor overall condition of the farm economy. While U.S. rice producers are sorting through these difficult issues, harvest is entirely underway in South America, where it is a few weeks behind schedule in Brazil and Uruguay and slightly ahead of schedule in Argentina and Paraguay. Prices in South America have been dropping like in North America, but not as severely as in Asia and India.Milled product from the U.S. is now quoted at $ 680 pmt, where Brazil is $ 630 pmt, Uruguay at $ 615 pmt, and Argentina at $ 580 pmt. Recall that the U.S. product was $800 pmt for much of last year, resulting in a 15% drop. Asian prices have seen much closer to a 30% drop over the past year on account of India’s stock release. Thailand, Vietnam, and India show prices of $405 pmt, $412 pmt, and $395 pmt, respectively, this week. Prices on the ground here in the U.S. have been flat from last week to this week. There has been so much focus on our internal politics as of late, it is refreshing to turn to Haiti to look at their next step in what we hope is the right direction. Haiti, the largest milled rice customer for the U.S., hasn’t held an election since July 2021, when President Jovenel Moise was assassinated. Earlier this month, Fritz Alphonse Jean was installed as the head of Haiti’s Transitional Presidential Council, with the express mission to ensure safe and fair elections by February 2026. This is all to say that restoring safety and stability to our largest market is key in the coming year, as Haiti imported 355,000 metric tons from the US in 2024. A recent GAIN report for Mexico, our largest paddy customer, expects rice production and consumption to increase in the coming year. Often, a government’s focus on increasing rice production can negatively impact our exports into that market, but the strong growth of the Mexican population and the acceptance of our rice into the market spells an expected increase of 2% for the coming year (assuming tariffs don’t get in the way). Over the last five years, paddy rice accounted for 85% of Mexico’s total rice imports, where the U.S. held 76% of the market share. Brazil followed with 21%, where Paraguay and Uruguay carried the balance. As for the 15% of milled rice imports, most came from Thai long grain, but that could change as there is now a 20% duty on Thai rice per the Mexican government’s anti-inflationary policy. The weekly USDA Export Sales report shows net sales of 101,700 MT this week, up noticeably from the previous week and up 39% from the prior 4-week average. Exports of 79,900 MT were up 14% from the previous week and 48% from the prior 4-week average. The destinations were primarily Nicaragua (18,000 MT), Haiti (15,300 MT), Mexico (12,900 MT), Guatemala (11,000 MT), and Honduras (10,300 MT). |

|