The USDA reported earlier this week that Texas was 68% headed, which is a little behind schedule. Still, some growers are already tuning up and even running their harvesters. Rice headed is on pace with historical averages for Louisiana, Missouri, and Mississippi, but it’s considerably off in Arkansas where only 19% of the crop has headed. Conversely, in California the early planted rice crop is already 40% headed compared to the norm of 24% for this point and time.

While it is too early into the harvest along the Gulf Coast, first reports are indicating good yields of 42 to 63 barrels per acre. Quality is unknown but what few samples have been graded have resulted in a 55% or better milling yield. No one in any area of the rice growing region has escaped weather and water problems. Bottom line is until this crop is cut, dried, and stored, the real impact on the market is unknown.

The Iraqi sale reported a couple of weeks ago continues to be a dominate factor in the long grain industry. At first, many thought it would be filled with old crop; however, that thought seems to have shifted as most claim it will be new crop now. This may not be fully ironed out for a couple more weeks. It is understood that half the 40,000 MT sale will be serviced by the larger Arkansas rice mills while the other half will be milled, bagged, and delivered to the shipyard via smaller mills.

While the U.S. milled rice business to Iraq reportedly out of Arkansas is certainly good news, the announcement of rough rice sales of new crop out of southwest Louisiana and east Texas totaling 50,000 tons by the South Louisiana Rail Facility is welcome news for the region’s farmers. Removing early harvest storage pressure supports local price.

Approximately 92% of the U.S. rice crop is within an area experiencing drought. This is less than ideal for an origin that is already battling high prices. Between inflated input costs, drought, and a strong U.S. Dollar, U.S. rice export prices have become dislocated from the rest of the world. In addition to higher production costs, the industry will also face higher trucking, drying, and storing costs. Natural gas prices ebbed lower last month only to rebound on pipeline maintenance and turmoil in Ukraine this month.

As a result of these hurdles, Uruguay’s market share in Mexico has risen from 5% in 2020 to 15% in 2022; in Costa Rica, Uruguay is on pace to capture 22% of the market in 2022. Brazil also remains a threat to traditional U.S. markets which is perhaps best seen in Mexico as well, where 54,000 MT of milled rice has already been sold during this calendar year. To the disappointment of Central American rice millers and U.S. paddy exporters, the amount of milled rice imports are surging in these markets. This is exactly what the USRPA was concerned of when CAFTA-DR approached its maturity in a market where the U.S. once had 99% marketshare. Unfortunately the entire U.S. rice industry did not agree. When Brazil’s milled rice prices are being quoted around $570 FOB versus U.S. long grain at $710, it’s not difficult to see why this pattern is forming.

Meanwhile, Asian rice may not be far off from moving west with India 5% brokens trading at $355 FOB. Thailand, currently the most expensive origin in the Far East, is only quoting Thai 5% at $400 FOB. The ongoing container and shipping debacle which was truly exacerbated by COVID-19 in early 2020 has yet to be fleshed out. While this has certainly impeded U.S. rice exports, it has also worked to prevent the infiltration of Asian rice into western markets.

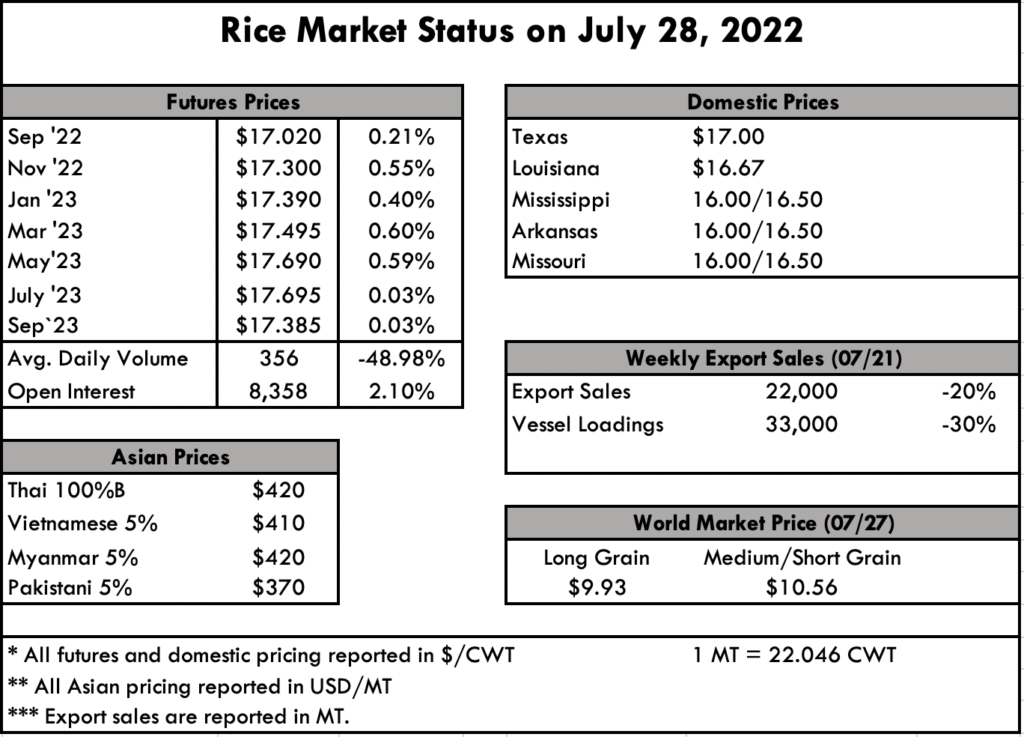

The futures market, as expected, edged higher again this week, touching a nearby high of $17.19 per cwt. Although the market gave back some of its gains, it still ended the week well.