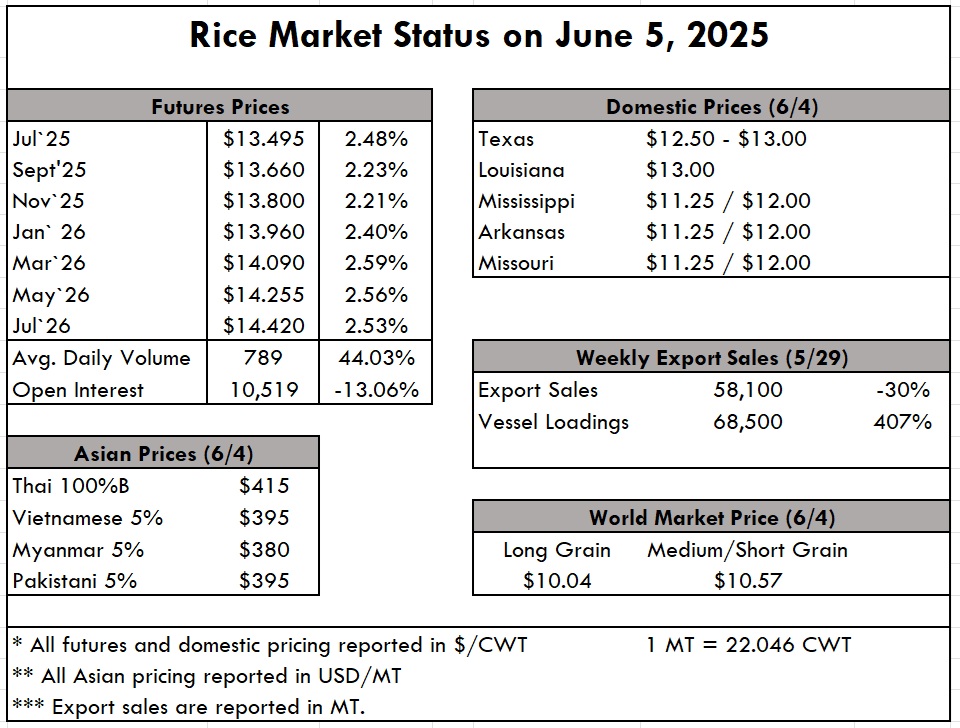

| This week’s rice market update comes with a side of drama — because what’s global trade without a little political spice? While tariffs tiptoe their way back into headlines, the real showstopper is the very public breakup between Donald Trump and Elon Musk. Once the poster boys of free-market bravado and social media swagger, their bromance has officially soured. What does this mean for rice? Maybe nothing... maybe everything. When the world’s loudest voices clash, markets twitch — especially when tech, trade, and policy start to tangle. Buckle up, because it’s going to be a weird growing season. So with planting and emergence largely behind us, we turn our sights more directly to crop condition across the rice-producing states. The good news is that we are 75% in the Good to Excellent condition this year, compared to 77% last year. It is still too early to make any prognostications, but not having any significant weather events early on is always a plus. That being said, weather has caused an obvious reduction in the concentrated area of long grain in northeast Arkansas, with an estimated 250,000 acres going to preventive planting. Keep your eye on the weather throughout the northern rice delta as the forecast calls for wet, stormy conditions. Prices on the ground here in the U.S. for any scant amounts of old crop are being reported with Texas at $12.50-$13. Louisiana is showing $13/cwt, while Mississippi, Arkansas, and Missouri are reporting in at $11.25-$12/cwt. Many of the mills are entering a summer slowdown, while others are busy milling the Iraq business so desperately needed to keep liquidity present. Check out June's FAO Rice Update here. In Asia, prices are still dismal, but at least steady. Thailand and Vietnam are both competing in the $400 pmt +/- $5, while India is sub-$400 at $390 pmt this week. Business is relatively steady in the Far East, with many destinations ordering at ease because of the low prices with no threat of an increase on the horizon. The weekly USDA Export Sales report shows net sales of 58,100 MT this week, down 31% from the previous week, but up 17% from the prior 4-week average. Increases primarily for South Korea (22,200 MT), unknown destinations (17,500 MT), Saudi Arabia (9,000 MT), Haiti (8,000 MT), and Japan (1,000 MT) were offset by reductions for Guatemala (1,200 MT). Exports of 68,500 MT were up a whopping 407% from the previous week and up 52% from the prior 4-week average. |

|