The rice complex is rounding the corner to finish planting the crop. The only state not 90% or more planted at this point is California, which is perfectly acceptable and normal. While California is a bit behind schedule at 40% planted, the next two weeks will be for the record books as round-the-clock effort and high horsepower will push to complete plantings by June 1. Emergence is solid as well, with all states besides California at 70% and higher. On the whole, we are 83% planted compared to 76% on the 5-year average, and 65% emerged compared to 54% for the 5-year average. Prices on the ground are relatively unchanged and light paddy supplies with all attention focused on planting. It will be interesting to see price discovery in action as we enter the summer months and get a handle on the true size and potential of the crop.

The long grain market continues to plug along with steady domestic business, and very sporadic export business that hasn’t amounted to much this year aside from Iraq and Haiti finally being a viable buyer once again. As we’ve mentioned, this has been the expected market response to consecutive years of short production, and with increased acreage coming down the pipe, we hope to see exports increase once again. Retaining and recapturing our historic core markets will prove to be an uphill battle, as trade agreements are expiring and rice from cheaper origins is flooding the market, namely Brazil. Today’s meeting in São Paulo of CONMASUR (Confederation of Rice Mills of Mercosur), which includes the major rice growers and milling companies of Argentina, Brazil, Chile, Paraguay, and Uruguay, will give insight into recent harvest numbers and the outlook for expected market competitiveness. The USRPA will publish these numbers in next week’s RA.

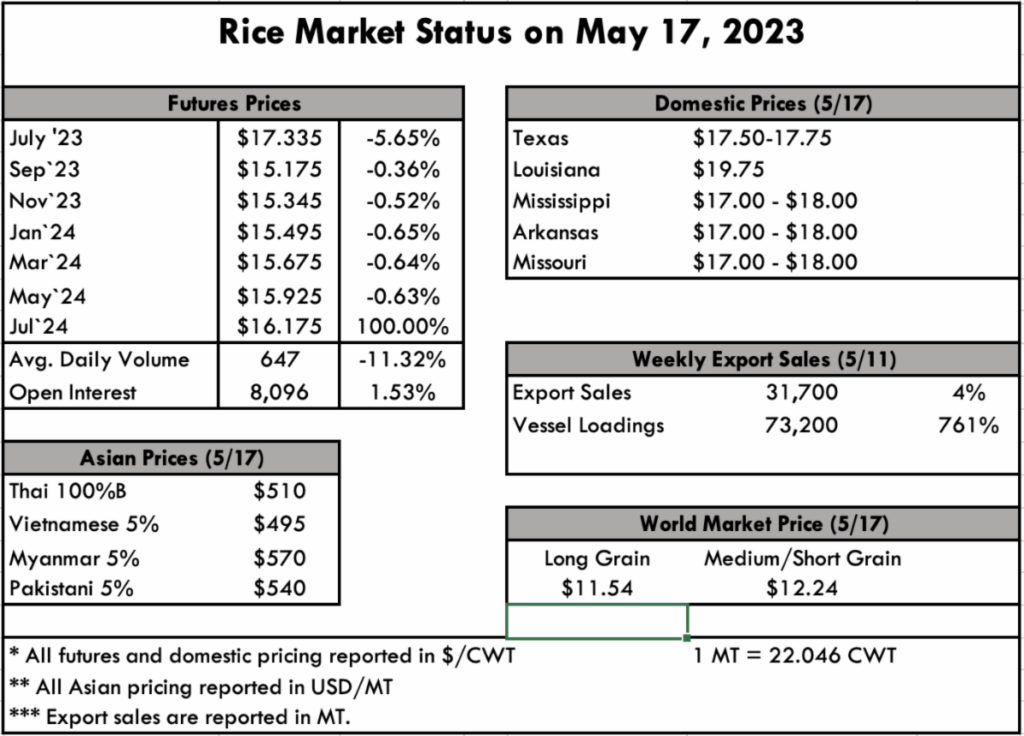

In Asia, price is still firm in Thailand, now flirting with the $500pmt price point. It has been approaching this number for the past several weeks, and continued strong demand could push it even higher. But with Vietnamese rice trailing by approximately $10 at $490pmt, it’s possible to see more demand flex that way. As discussed in last week’s report, rice from Thailand is on a vessel headed to Mexico; current pricing would disqualify this as a possibility in today’s market. However, Thai rice was significantly cheaper when the business was initially booked, putting further strain on competition for rice trade in the Western Hemisphere.

The USDA Grain Report most recently published calls for global rice production to be up 12 million tons from last year to a new record of 521 million tons. Pakistan had the largest bump in the numbers as it is recovering from a significant drought, and China is a close second where they expect to see an increase as well from a recovery of dry conditions. Global stocks are forecast down by 2.5 million tons to 167 million, where China and India hold a staggering 81% of all global stocks. Regarding the United States, it is expected that imports will remain flat at 1.25 MMT on a larger crop and sustained fragrant rice procurements. The report shows that exports from the U.S. are forecast to rise with a larger crop both for medium and short grain, thus creating lower prices. It is expected that exports will increase from 2.05 MMT to 2.35 MMT.

This week’s USDA Export Sales Report shows an export reduction to 31,700 MT this week — a marketing-year low — which is down noticeably from the previous week and from the prior 4-week average. Net sales of 73,200 MT for 2023/2024 were reported for Iraq (40,000 MT), Japan (27,200 MT), and Guatemala (6,000 MT).