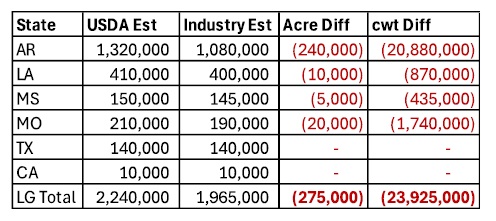

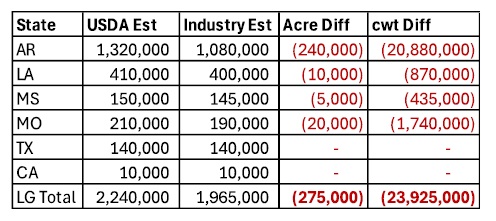

As the table illustrates, by not adjusting for lost acreage in this month’s WASDE, current production projections are overstated by at least 275,000 acres, or roughly 24 million cwt. This disconnect is materially affecting growers still trying to sell and mills attempting to manage inventory. While the true numbers will eventually surface, for many, it may be too late to influence favorable pricing. As the table illustrates, by not adjusting for lost acreage in this month’s WASDE, current production projections are overstated by at least 275,000 acres, or roughly 24 million cwt. This disconnect is materially affecting growers still trying to sell and mills attempting to manage inventory. While the true numbers will eventually surface, for many, it may be too late to influence favorable pricing.

With planting largely in the books and on par with the four-year average of 87%, we turn now to initial crop quality reports. As of the May 18 USDA report, 28% of the overall rice is rated Excellent, 51% rated Good, 18% Fair, 2% Poor, and 1% Very Poor. It’s still early to place too much stock in these numbers, but a positive sign that nearly 80% of the crop is rated Good or Excellent.

In Asia, market conditions remain soft. Demand out of Indonesia has cooled, pushing Indian prices as low as $385/MT, with Vietnam and Thailand holding around $400/MT but showing little upward momentum. Iraq continues to fulfill its MOU obligations with U.S. suppliers despite the pricing disadvantage, driven largely by geopolitical ties. Iraq is now the second-largest buyer of U.S. milled rice, trailing only Haiti. There are encouraging signals that Iraq may remain a consistent buyer in the coming years, though formal G2G agreements are still pending.

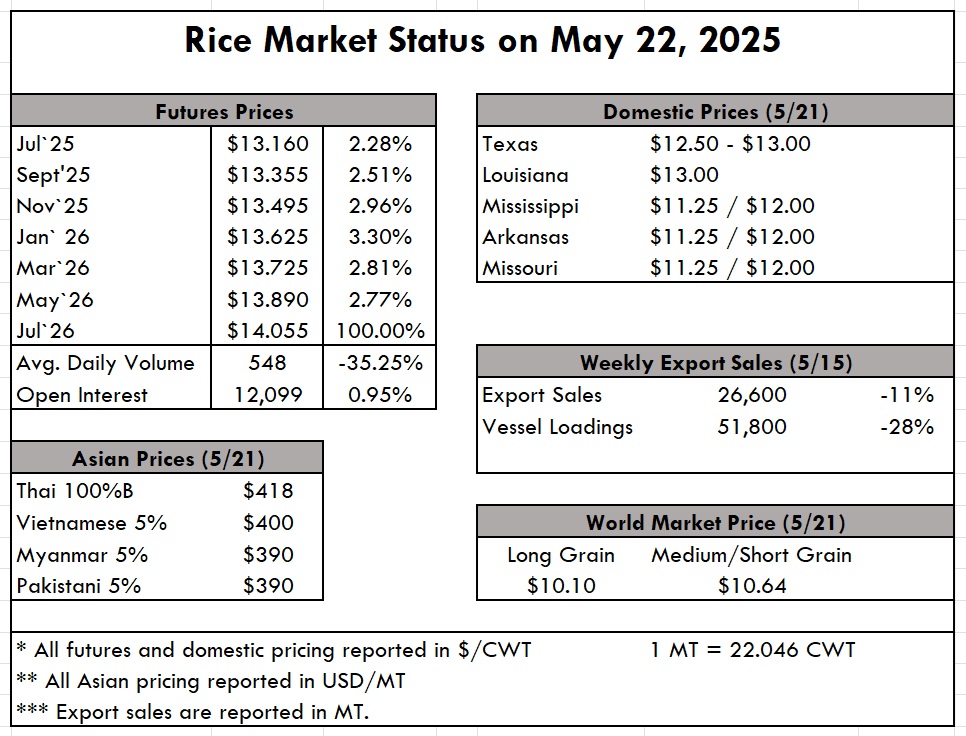

This week’s USDA Export Sales report shows net sales of 26,600 MT, down 11% from the previous week and 29% below the prior 4-week average. Exports totaled 51,800 MT, down 28% from the previous week and 4% from the 4-week average, reflecting the broader slowdown in market momentum. |

As the table illustrates, by not adjusting for lost acreage in this month’s WASDE, current production projections are overstated by at least 275,000 acres, or roughly 24 million cwt. This disconnect is materially affecting growers still trying to sell and mills attempting to manage inventory. While the true numbers will eventually surface, for many, it may be too late to influence favorable pricing.

As the table illustrates, by not adjusting for lost acreage in this month’s WASDE, current production projections are overstated by at least 275,000 acres, or roughly 24 million cwt. This disconnect is materially affecting growers still trying to sell and mills attempting to manage inventory. While the true numbers will eventually surface, for many, it may be too late to influence favorable pricing.