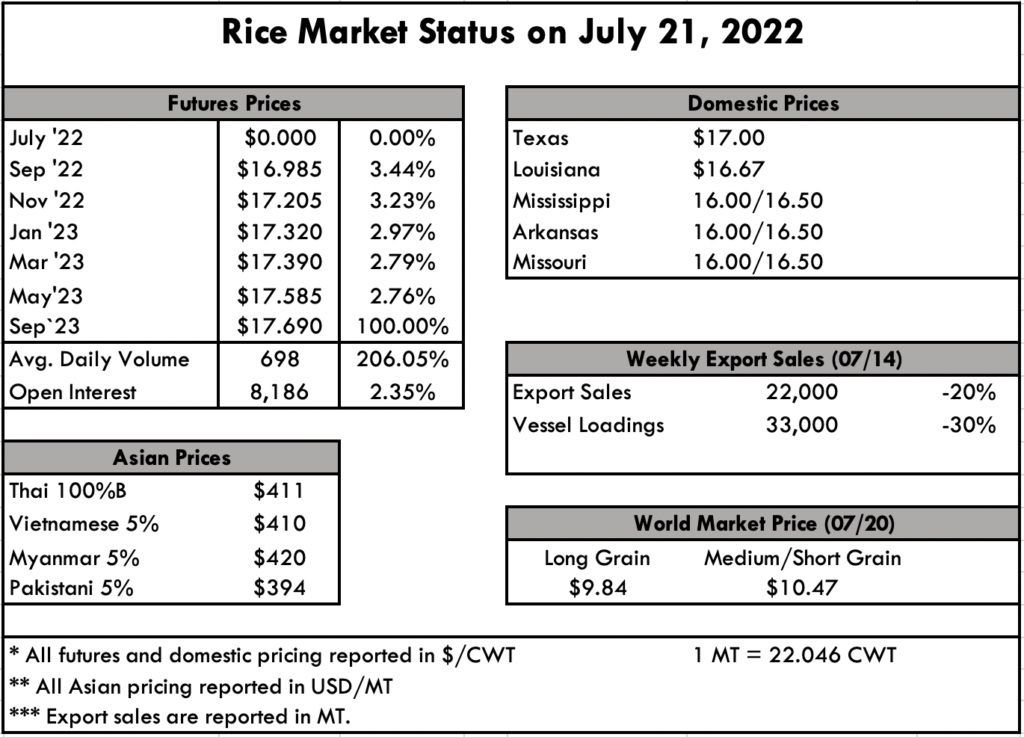

Although the cash market remains in the doldrums, that may soon change with the notable export activity that finally materialized. It was reported that Iraq recently purchased 40,000 MT of U.S. rice, or one vessel. Considering the shipping date is imminent, it will most likely aid old crop prices, and have little effect on new crop. For now, long grain paddy prices range from $16-17 per cwt depending on the location. Southern medium grain, when available, is trading between $19.50-20.50 per cwt.

The first fields of rice have been cut in Texas and south Louisiana as some farmers have struggled with water issues over the past two months due to the strong drought and intense heat. There are reports of some fields being abandoned in Texas as farmers have not been able to keep water on the crop in some areas due to the intense evaporation and individual well situations. Where water isn’t an issue, high field yields are expected.

There is plenty of border and internal Mercosur trade taking place, as per the usual. However, the powerful rice exporting region has also made strong headway in other markets as well. For example, roughly 135,000 MT (paddy equivalent) has traded to Mexico from Brazil. Other notable destinations for Brazil that overlap with US rice are Peru at 68,000 MT, Costa Rica at 40,800, and Venezuela at 130,000 (all paddy basis). Furthermore, these are just the sales reported since January. While some of this business was actually paddy exports other portions were milled rice sales; when U.S. 5% long grain is being quoted at $710 FOB compared to Brazil where quotes were recently $575, it’s not difficult to understand how the US rice market is being undermined by South America. Brazil’s prices are the highest export prices in Mercosur, but that’s also because of the logistics required to bring the rice to ocean ports.

Based on the most recent USDA export sales report, it appears that U.S. long grain rice is struggling to maintain its footing in the Mexico market. Export demand to this destination is down 22% YTD or 174,000 MT. Fortunately for the industry, some of this market loss has been offset by improved demand in Colombia and Guatemala. Overall, paddy export demand is sluggish against last year, but milled rice demand is up 25% YTD on increased shipments to Haiti and Colombia.

In Thailand, the ongoing harvest has alleviated some pressure in the market, allowing export prices to soften. In addition to fresh supplies, export demand has benefitted from a weakening Baht, down 11% since January. Iraq, the largest benefactor of these fundamentals has now purchased upwards of 600,000 MT since December from this origin. India remains the cheapest option for long grain rice in the world market, despite a lagging monsoon season. Some traders speculate that exports may see a slight downturn if the monsoon conditions don’t drastically improve in the last half of the rainy season.

The futures market was up against last week as every contract climbed at least $0.60 per cwt. Since Monday, the trading volumes have shot upward, and open interest is also climbing. This leads some to believe that the recent rally may find support and even continue.