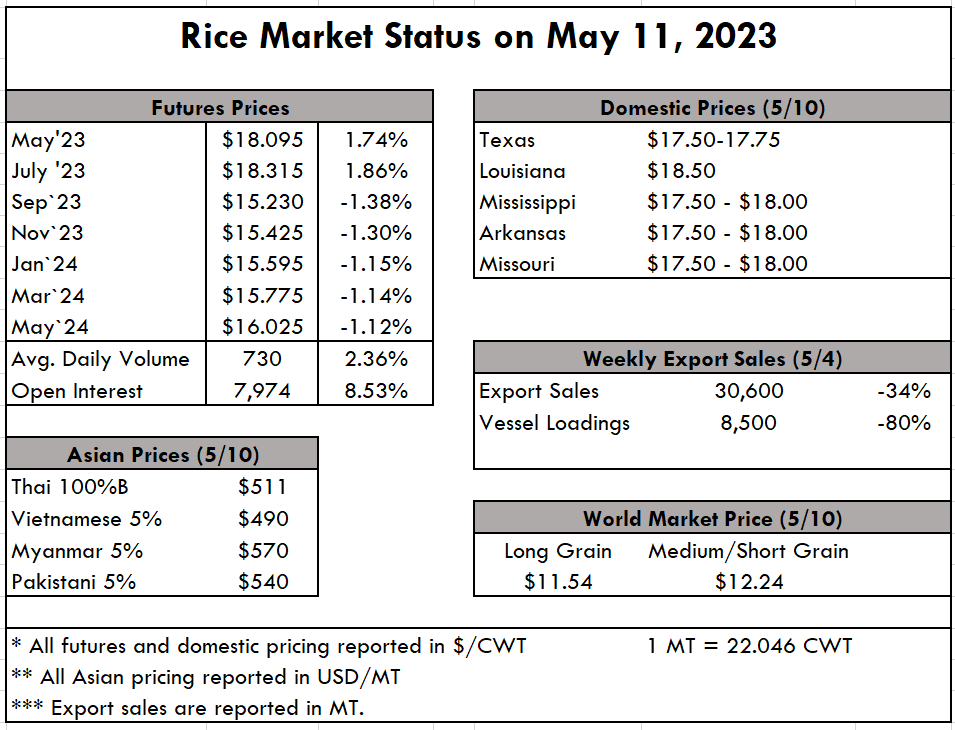

| Planting continues to race forward in most states, as the entire complex is nearly 10% ahead of normal pace, while rice emerged is almost 15% ahead of the 5-year average. Louisiana continues to lead the pack with 94% planted and 88% emerged. Texas is just behind with 89/79, then comes Missouri at 85/61, followed by Arkansas with 79/56, Mississippi with 66/45, and California with 15/1. Conditions on the west coast have finally improved with warm weather on the horizon, and nothing impeding planting progress in the 10-day forecast. Turning to the market, things are stable at the moment. With very little old crop to source, executing any sales at sizable volumes is difficult. This isn’t a problem because exports have been so low this year, and the fresh demand from Haiti isn’t in portions large enough for additional upward pressure. What could put a strain on domestic business, however, is the Bud Light debacle with the Dylan Mulvaney promotion. The market loss in excess of $5 billion has been widely publicized in the news, but it’s important to remember that Anheuser-Busch is the largest domestic buyer of U.S. rice. If people stop drinking Bud Light and other AB products, AB stops procuring rice. This is a moral dilemma for some that we’re not here to help you through, but the facts are the facts, and poor sales of Bud Light hurt the rice industry. Today’s USDA supply/demand report is considered bullish with lower carryover numbers. The summer months are typically quiet by way of new sales for the U.S., but it will be important to track the intrusion of rice from new markets. We know Brazil into Mexico is a problem that was highlighted by the anti-food inflation policies that Mexico enacted. But a potentially more significant problem could be Southeast Asian rice. Current Asian values have risen, making business in Mexico reportedly “unfeasible.” However, bulk-milled rice from Thailand to Veracruz, Mexico that was purchased prior to the price increase is apparently on the water. Cheap rice from Pakistan to Cuba is also moving east to west, and paddy rice from Uruguay has won a tender in Costa Rica that was exclusively for Mercosur origin. None of this is good news, and the hope is that a larger U.S. crop at harvest will help gain back these markets. And as we all know, until the U.S. crop is harvested, dried, and stored, we don’t know what we really have to market. In Asia, firm pricing on strong demand prevails. Thai 5% is holding steady at $495pmt, with Viet just behind at $490pmt. India remains at $440pmt, and Pakistan at $540pmt. Exports from Thailand and Vietnam are both ahead of last year on strong demand, as India is keeping pace, indicating that Thai and Viet rice aren’t increasing at India’s expense. The weekly USDA Export Sales report shows net sales of 30,600 MT this week, down 34% from the previous week and 15%from the prior 4-week average. Increases primarily for Honduras (20,000 MT), the Dominican Republic (6,000 MT), Jordan (1,700 MT), Mexico (1,700 MT), and Canada (700 MT), were offset by reductions for Venezuela (200 MT). Exports of 8,500 MT were down 80% from the previous week and from the prior 4-week average. The destinations were primarily to Canada (2,800 MT), Mexico (2,500 MT), Jordan (1,700 MT), Saudi Arabia (600 MT), and the United Kingdom (400 MT).  |