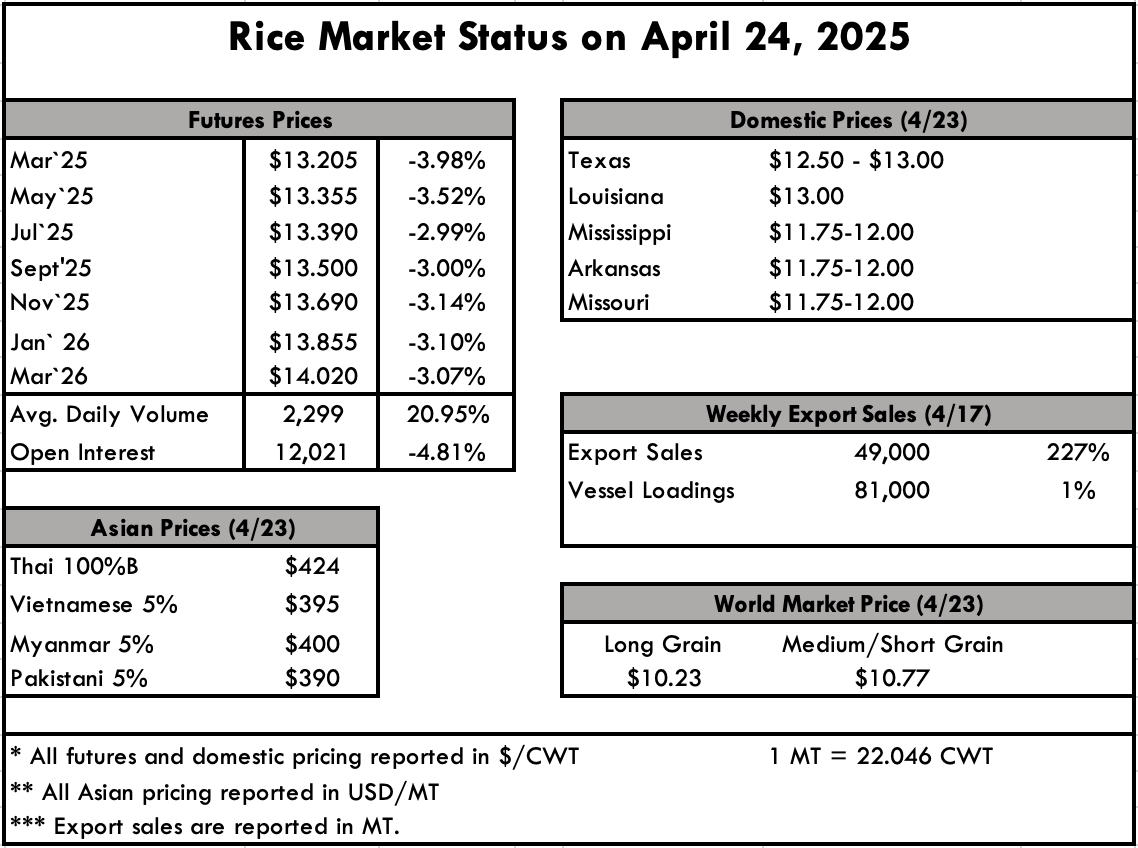

| When one considers the volatility we see in the news and global markets, there is something comforting about steadiness of planting a new crop for the coming year. While the coming campaign will present its own set of challenges, focusing on planting is a welcomed respite from the outside noise. Along that vein, planting is racing along in Louisiana and Texas, where they are 90% and 77% completed, and 80% and 68% emerged. Arkansas is 48% planted and 16% emerged, where Mississippi is 41% and 20%. Missouri is at 18% planted and 7% emerged, while California finally has some rice in the ground at 2%, but nothing emerged. That puts the average plantings at 48%, which is well above the 5-year average of only 9% for this time of year, but behind last year’s pace of 57%. The same trend follows for emergence. The market conditions are largely unchanged, with stable milling taking place on account of domestic business, Iraq fulfillments, and Haitian orders. The fact that we can report things as “stable” is truly a blessing, though it would be nice to see more buying activity. U.S. long grain prices are now quoted closer to $780 pmt (more than double current Indian prices), with Brazilian prices at $575 pmt, Uruguay at $545 pmt and Argentina down to $505 pmt. A recent GAIN report on Paraguay, a growing competitor in the export market, shows that production is forecast up for the 2025/26 marketing year, up to 1.42 MT on a rough basis, or 951,000 MT milled. This is the second highest production level, notching in at just over 538,000 acres. As of mid-April, the harvest was nearly complete with favorable yields and good quality overall. The bottleneck came in the form of infrastructure though, as max acreage is taxing the rice processing system in the form of trucks, intake, and export handling. Exports of 790,000 MT are the third highest, and will supply Brazil, Chile, Costa Rica and other Central American customers. Brazil imports nearly 600,000 MT of the 790,000 MT on a regular basis. Paraguay like its Mercosur neighbors is experiencing its largest harvest in recent years. Yields as high as 9,200 pounds per acre are being reported in numerous areas. The southern Brazilian State of Rio Grande do Sul alone is estimated to have a final paddy harvest of 8.8 million MT. While milling yields are somewhat inconsistent at this time, the overall large production in the four countries may very well total 17 million MT as the final phase of the harvest will soon be completed. As a result prices continue to soften with paddy at an even $300/ton FOB loading port if not lower. Prices in Asia are still bouncing a long the bottom, which after four weeks, is considered a good thing. It would indicate a bottom has been established and the market has adjusted by systematically removing the “unknowns” that accompany a drop. These low prices are a result oversupply, not of the tariffs. Thailand is now reported up from last week at $410 pmt, while Vietnam is steady at $400 pmt, and India is steady at $385 pmt. The weekly Export Sales report shows net sales of 49,000 MT this week, up noticeably from the previous week and up 6% from the prior 4-week average. Increases were primarily for Honduras (13,300 MT), Mexico (12,700 MT), Saudi Arabia (3,100 MT), and Jordan (1,400 MT). Exports of 81,000 MT were up 1% from the previous week and 20% from the prior 4-week average. The destinations were primarily to Mexico (34,100 MT), Honduras (18,000 MT), Haiti (15,200 MT), Japan (4,200 MT), and Saudi Arabia (2,800 MT). |

|