| USDA WASDE Report Lowers U.S. Rice Exports |

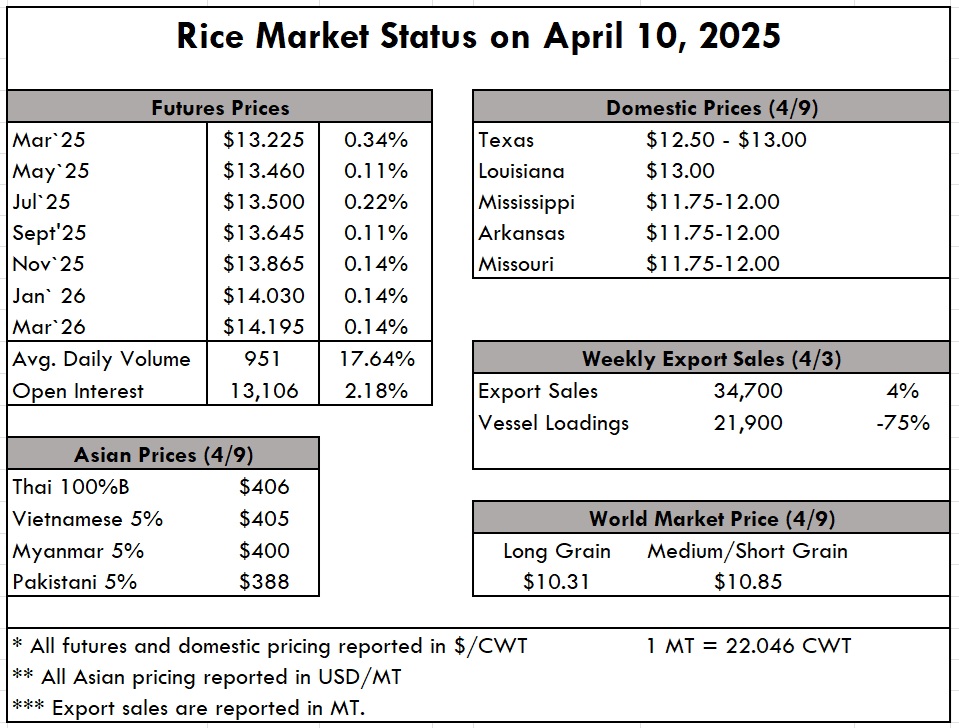

| While the activity in Washington is unprecedented and the pull to analyze the tariffs on a broad scale has a magnetic force to it, our focus here will be to remain steadily focused on the rice market. As each day passes, a “steady-as-she-goes” approach seems to be paying off because, as of this writing, President Trump has cancelled or relaxed tariffs on all countries except China for 90 days. April’s FAO Rice Price Update shows that the Rice Price Index declined by another 1.7% in March to an average of only 104.1 points. This is 24.6% lower than this time last year and hit another three-year low. As we’ve continued to report, price quotations have dropped from all major exporting regions; i.e., the low prices we are seeing in the United States are not an isolated incident — it’s worldwide. The WASDE report released yesterday has the futures market trading lower as the USDA cut exports 2 million cwt, but raised residual use by 3 million, while cutting carryover by 1 million cwt to 34.3 million cwt. World stocks (not including China) actually increased by 1.73 MMT up to 79.74 MMT. This is being blamed more on slow demand from the Philippines and Indonesia than any significant production increase. A recent GAIN report on the Philippines, often the world’s largest importer, is projecting that this year they import less than last year. While that could happen, it is a common refrain for the Philippines to boast about an increase in domestic production and not needing to rely so heavily on imports, only to come to market later in the year with a severe need for large quantities of rice. The expected production numbers this year are 11.6 million acres, right in line with 2023 and up less than 1% from last year. Imports this year are at 5,200 MMT, down from 5,300 MMT last year but up from 4,500 MMT from 2023. The overall consumption of rice is expected to increase by .6% this year, up to 17.30 MMT. Vietnam has been the largest supplier by far, accounting for 75% of the 4.5 MMT of imports last year. In the broader global market, Asia is hurting, while the Mercosur is steady in harvest. Prices continue to bring pain, where Thailand is quoted at $395 pmt, Vietnam at $400 pmt, and India at $380 pmt. Prices in the Western Hemisphere are certainly higher but still below break-even levels. Harvest in the Mercosur is continuing well, with strong numbers and what can currently be described as light demand. The result is a continued softening of prices, with paddy prices hovering around $310/ton FOB, if not lower. The hope is that demand picks up significantly. This year’s first Crop Progress Report shows Louisiana at 69% planted, Texas at 60%, Arkansas at 15%, Mississippi at 14%, Missouri at 2%, and California at 0%, where tractors are just beginning to turn over dirt for initial field work. Recent flooding in southeast Missouri and northeast Arkansas has had a limited impact while water levels continue to recede. Rice is 52% emerged in Louisiana and 35% in Texas. Prices on the ground haven’t moved much as everyone is waiting with bated breath to see what will come of the tariffs.  |