With harvesters in the field and Iraq in the market, it feels like progress. Of course, there is always hope that there will be more business from Iraq in the near future, but the mills in Arkansas are happy for the opportunity to connect on this 40,000 metric tons. By way of harvest, most reports are strong so far. There have been a few bouts of wet fields and lodging throughout the harvesting regions, but overall there is muted optimism on initial reports. In Texas, the market seems to be hovering in that $17.50/cwt range; however, since the drought has curtailed all second crop canal water, farmers not on wells are going to need a bit more than that to make ends meet this year. Some 15,000 acres of second crop estimated to be affected.

New reports are surfacing this week about a weak monsoon in India that is resulting in at least 13% decreased production. India has been the lowest cost supplier and largest exporter for a long time, and as a result of three record crops, has largely kept a lid on rice inflation relative to the other baskets of commodities. While that has been good for some poor and developing countries, it has hit other regions, like the U.S., hard and made it difficult to be competitive in a global market. There is now talk surfacing that an Indian drought and the resulting reduction of acreage could result in a significant shift in the price and exportable supply of Indian rice. While nothing is written in stone at this point, it will be important to watch in the coming weeks as price volatility is becoming a key factor in every decision.

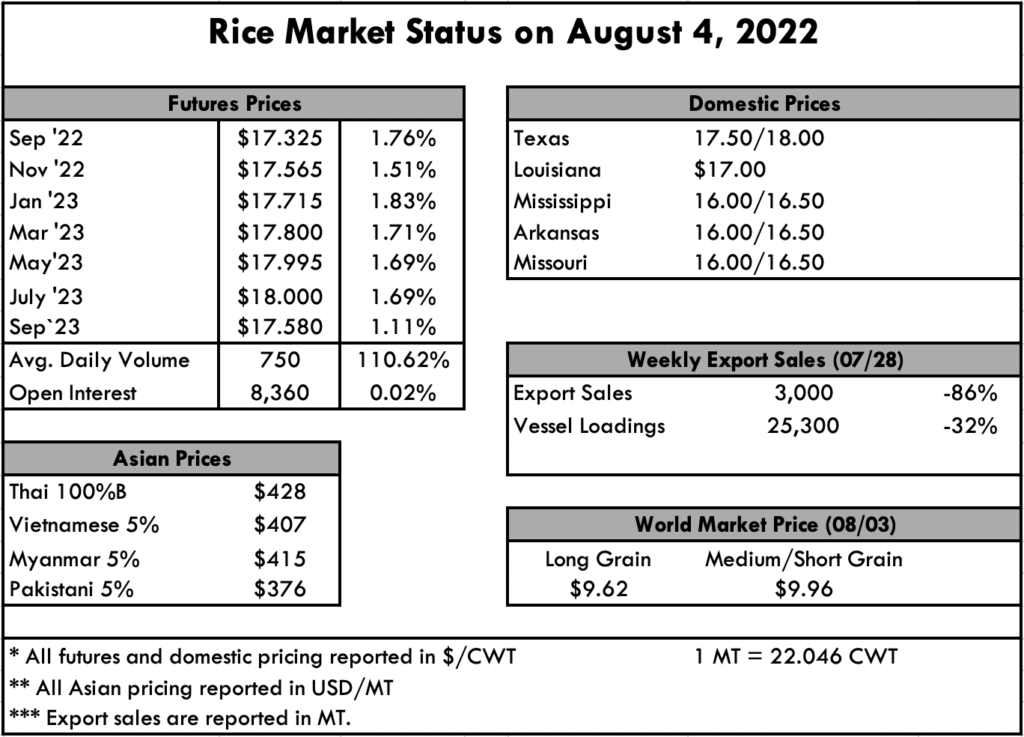

In Asia, Thailand had a small bounce in price, from $400 pmt last week to about $410 pmt this week. Prices in Vietnam have held steady at just over $410 pmt, as have those in India and Pakistan, at $355 pmt and $375 pmt, respectively. The market here is described as stable, but could be shaken if India’s monsoon continues to be light.

On the ground, paddy prices in Texas are at the $17.50/cwt number mentioned above. Louisiana would be quoted at $17/cwt, while Mississippi, Arkansas, and Missouri would be at $16/cwt and $16.50/cwt. This would be translated to indicative pricing of approximately $700 pmt for exportable milled 5% rice.

In the futures market, we saw an average daily volume of 750, up significantly from last week. We saw open interest of 8,360, which is right in line with last week.

The weekly USDA Export Sales report shows net sales of only 3,000 MT—a marketing-year low—which is down 87% from the previous week and 88% from the prior 4-week average. Exports of 25,300 MT were down 32% from the previous week and 33% from the prior 4-week average. The destinations were primarily to Japan (12,000 MT), Honduras (5,500 MT), South Korea (3,000 MT), Canada (2,700 MT), and Mexico (1,600 MT).