Rice planting in the U.S. is coming to an end as most states are now passing the finish line. In California, rice emerged is about 5% ahead of last year whereas the other states are slightly behind. Only about one-third of the crop is considered to be in poor condition, but with it being so early in the growing season, that statistic doesn’t yet hold much merit at this point in time.

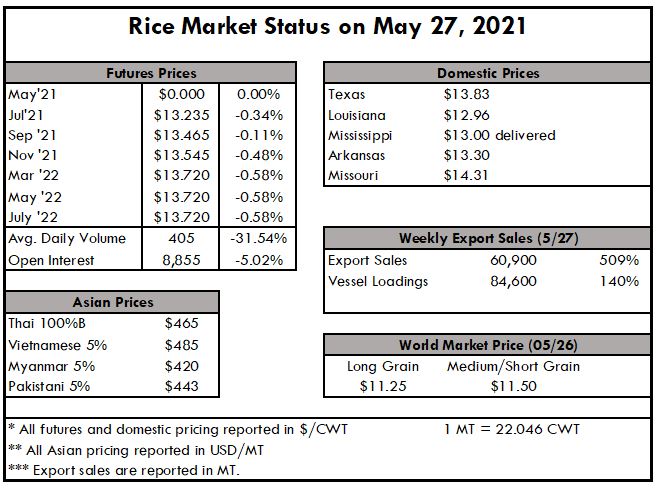

World market prices are showing small signs of softening, according to the USDA which recently reported world market prices (rough rice) to only be down 2% in the last 3 months. Last year at this time, world market prices were at a similar level, however, they had made a 15% run in the 3-months leading up to the middle of May.

We are on the bridge between old crop and new crop. The June 29th actual planting report is much anticipated as it will indicate how many acres shifted over into corn and soybeans. Then the next WASDE report is due out on July 12th and will set the tone and real indications for new crop pricing.

With prices dropping in Brazil those suppliers should become more competitive and closer to the U.S. if not lower. Much depends on the freight market and foreign exchange. Some analysts see 200,000 tons of paddy exports and much more milled rice as well. The government agency CONAB is saying yields in the largest state of Rio Grande do Sul reached 8,500 lbs per acre.

Brazil must export to avoid additional price reduction. Currently business is slow and vessel freights are very high including for containers. We understand the Brazilian grain quality is excellent.

After a several-month bull run in freight markets, which was extra aggressive in April and May, the Dry Bulk Index showed its first sign of letting up. The recent retreat in shipping prices is attributed to China’s claim to police the industry and reduce hoarding and market manipulation. Of course, most analysts expect this small slide in prices to be quickly reversed as the shortage of ships and containers is clearly an ongoing obstacle.

An inflating US Dollar coupled with excessive shipping and logistics costs continues to have a significant impact on grain trade worldwide. If those economic factors weren’t enough, the relentless COVID outbreaks which seem to pop right when another starts to get reeled-in is working only to muddy the “market water” even more. If these components can’t stabilize in the near future, the global commodity markets may be in for a relatively volatile year.

The Futures market is already supporting volatile expectations as rough rice prices eroded further. Declining prices, and rising volume, and open interest normally point to a weak market. In this sense, the futures market actually reflects what is being seen on the ground, where buy interest is weak at best which is only working to demotivate sellers from engaging the market. The reduced output in 2021 may work to reverse the current sentiment, but with the crop having just been planted, that may take a little while.