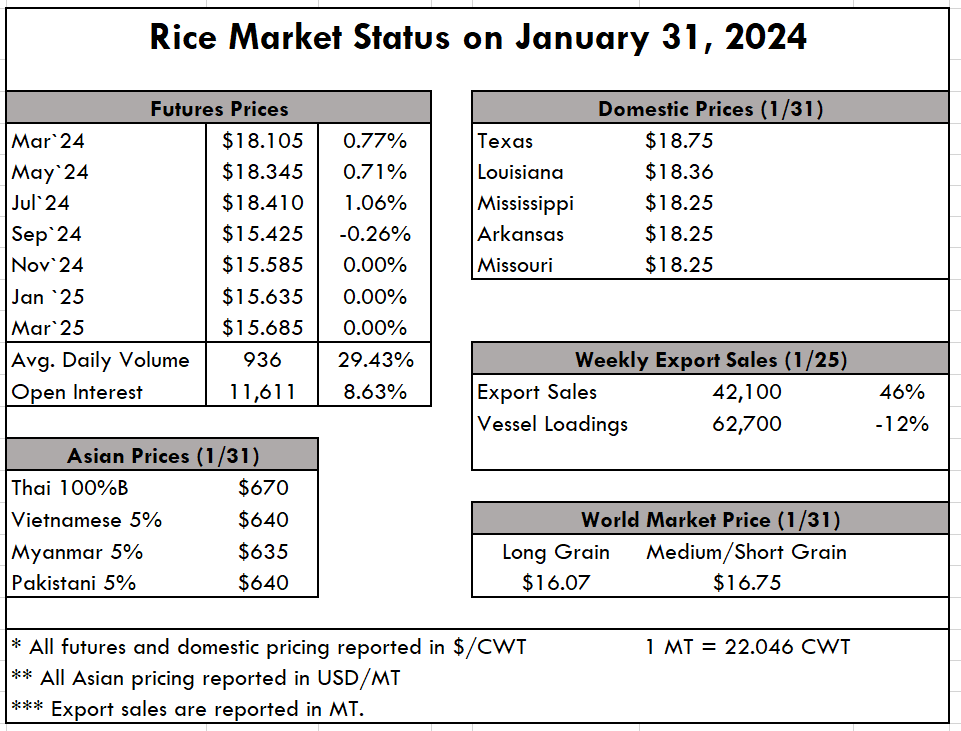

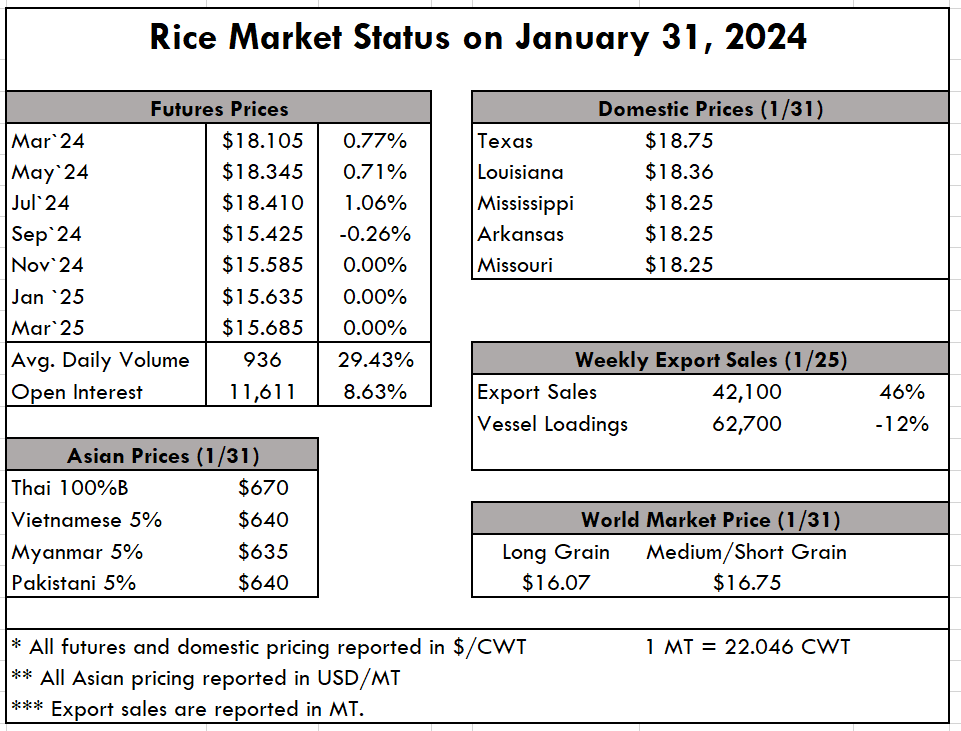

| Steady business is the name of the game, though it’s been slightly dampened by the freezing temps. Demand has remained strong throughout the marketing year thus far both domestically and internationally, helping to keep prices firm across the chain. Even though the rice complex in India and Asia doesn’t often have a direct impact on pricing in the Western hemisphere, the ban on Indian exports seems to be the tide that raises all ships. Just like Thailand and Vietnam are benefiting from India being out of the market, the U.S. is benefiting from Brazil, Paraguay, Uruguay, Argentina, and other S. American suppliers being short of rice for the past several months. India continues to be a wild card in the minds of U.S. rice farmers about the effect the lifting of the export ban would have on prices…..eventually. Harvest is underway in Paraguay and getting started in other origins, so the competition in the Western Hemisphere will be heating up in the near term. Easier said than done as early reports indicate inconsistent field yields and quality but it's early of course. Uruguay will not begin until the end of this month. The good news is that demand has remained strong both to Iraq and Haiti, while Mexico continues to procure rice at a faster pace than last year, where significant quantities of paddy rice are benefiting. Just as the rice from South America hits the market, the US will be determining its planting intentions, which we will cover more fully next week. Those intentions were a constant conversation at this week’s National Conservation Systems Cotton & Rice Conference held in Jonesboro, Arkansas. The US Rice Producers Association has been a sponsor of this popular farmer conference since 1999. A recent GAIN report on Mexico outlines what could be read as good news for the U.S. long-grain industry. Post forecasts that despite slight increases in rice plantings, imports are expected to increase even more based on rising consumption patterns. Plantings are expected to increase only 5% up to 150,000 metric tons, milled basis. The good news is that rice imports are expected to increase by 10% up to 830,000 metric tons. Right now, exports to Mexico are up over 10% from this time last year, so the increased crop size is paying off in the form of increased exports. When supply returns to Brazil and other South American origins, the competition will be fierce for this market; we will see the playing out of any anti-inflationary policies in this new cycle. In Asia, prices are staying high and not showing signs of stopping. This week Thai prices remained above $650 pmt, and Viet prices hovered just below $645 pmt. Even Pakistan has joined the party and is quoting rice as high as $640 pmt. Now when we compare these prices from the Far East with our Western rice, the spread seems to shrink every week! Right now, the average price of Asian rice is $645 pmt. US quotes are sitting right around $770 pmt…a mere $125 pmt difference. Spreads this small are uncommon, especially when prices are this high. The weekly USDA Export Sales report shows a nice rebound in net sales of 42,100 MT this week, up 46% from the previous week, but down 24% from the prior 4-week average. Increases were primarily for Mexico (15,700 MT), Japan (13,600 MT), Canada (5,000 MT), Honduras (4,400 MT), and Guatemala (1,200 MT). Exports of 62,700 MT were down 12% from the previous week and 4% from the prior 4-week average. The destinations were primarily to Mexico (33,000 MT), Guatemala (12,600 MT), El Salvador (11,800 MT), Canada (2,400 MT), and Jordan (1,500 MT). |

|

| Market Update: Farmers Pondering 2024 Planting Decisions |

| Steady business is the name of the game, though it’s been slightly dampened by the freezing temps. Demand has remained strong throughout the marketing year thus far both domestically and internationally, helping to keep prices firm across the chain. Even though the rice complex in India and Asia doesn’t often have a direct impact on pricing in the Western hemisphere, the ban on Indian exports seems to be the tide that raises all ships. Just like Thailand and Vietnam are benefiting from India being out of the market, the U.S. is benefiting from Brazil, Paraguay, Uruguay, Argentina, and other S. American suppliers being short of rice for the past several months. India continues to be a wild card in the minds of U.S. rice farmers about the effect the lifting of the export ban would have on prices…..eventually. Harvest is underway in Paraguay and getting started in other origins, so the competition in the Western Hemisphere will be heating up in the near term. Easier said than done as early reports indicate inconsistent field yields and quality but it's early of course. Uruguay will not begin until the end of this month. The good news is that demand has remained strong both to Iraq and Haiti, while Mexico continues to procure rice at a faster pace than last year, where significant quantities of paddy rice are benefiting. Just as the rice from South America hits the market, the US will be determining its planting intentions, which we will cover more fully next week. Those intentions were a constant conversation at this week’s National Conservation Systems Cotton & Rice Conference held in Jonesboro, Arkansas. The US Rice Producers Association has been a sponsor of this popular farmer conference since 1999. A recent GAIN report on Mexico outlines what could be read as good news for the U.S. long-grain industry. Post forecasts that despite slight increases in rice plantings, imports are expected to increase even more based on rising consumption patterns. Plantings are expected to increase only 5% up to 150,000 metric tons, milled basis. The good news is that rice imports are expected to increase by 10% up to 830,000 metric tons. Right now, exports to Mexico are up over 10% from this time last year, so the increased crop size is paying off in the form of increased exports. When supply returns to Brazil and other South American origins, the competition will be fierce for this market; we will see the playing out of any anti-inflationary policies in this new cycle. In Asia, prices are staying high and not showing signs of stopping. This week Thai prices remained above $650 pmt, and Viet prices hovered just below $645 pmt. Even Pakistan has joined the party and is quoting rice as high as $640 pmt. Now when we compare these prices from the Far East with our Western rice, the spread seems to shrink every week! Right now, the average price of Asian rice is $645 pmt. US quotes are sitting right around $770 pmt…a mere $125 pmt difference. Spreads this small are uncommon, especially when prices are this high. The weekly USDA Export Sales report shows a nice rebound in net sales of 42,100 MT this week, up 46% from the previous week, but down 24% from the prior 4-week average. Increases were primarily for Mexico (15,700 MT), Japan (13,600 MT), Canada (5,000 MT), Honduras (4,400 MT), and Guatemala (1,200 MT). Exports of 62,700 MT were down 12% from the previous week and 4% from the prior 4-week average. The destinations were primarily to Mexico (33,000 MT), Guatemala (12,600 MT), El Salvador (11,800 MT), Canada (2,400 MT), and Jordan (1,500 MT). |

|