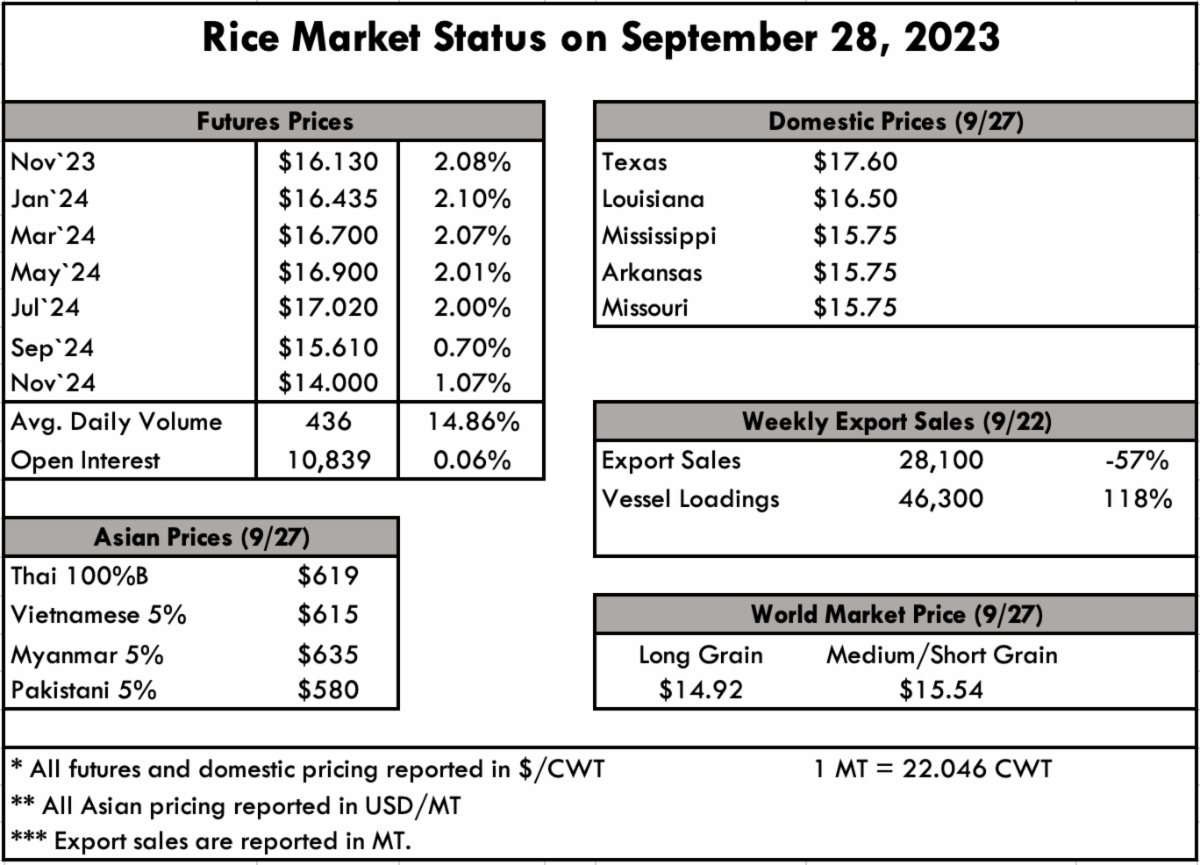

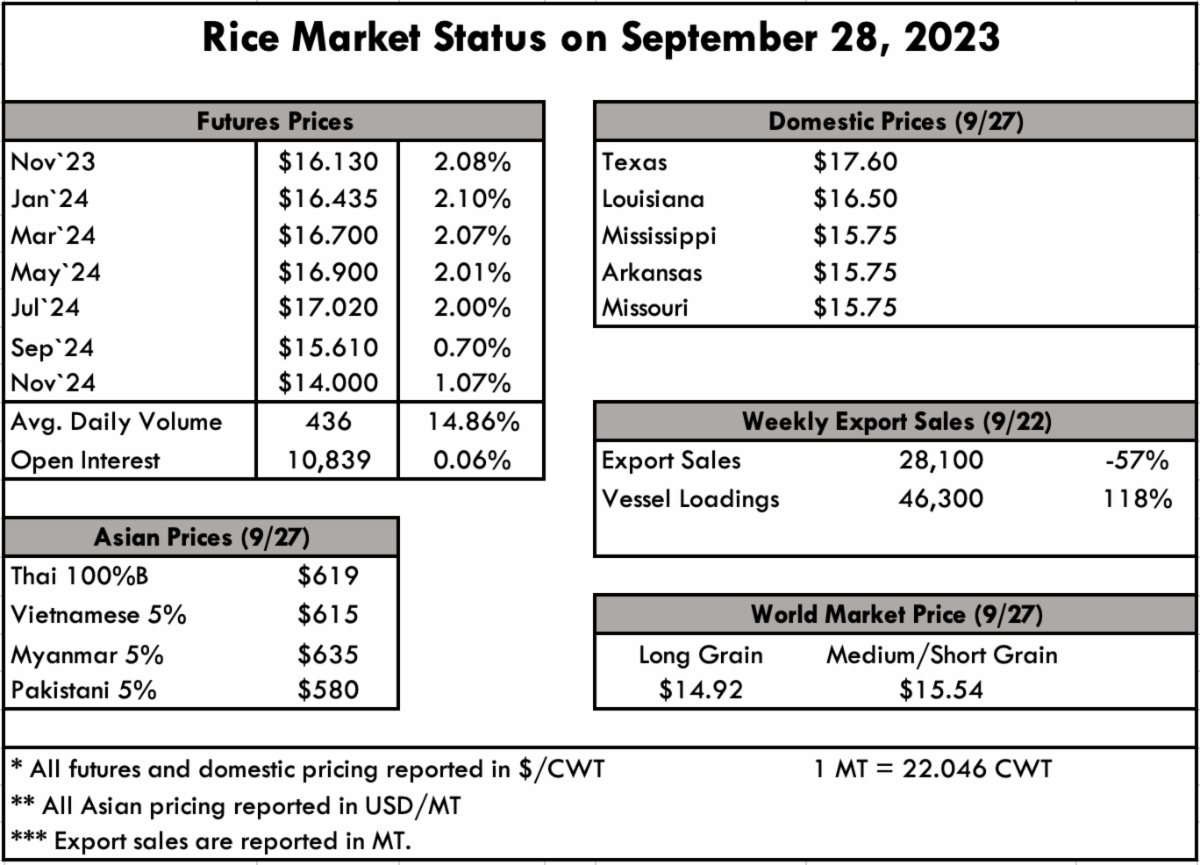

| Milling yields are the only thing that’s lacking this harvest. We are ahead of pace, up on acres, and up on yields almost across the board, but converting the ample paddy supply to an ample milled product is proving more difficult than anticipated. While this isn’t a huge surprise to anyone because of the excessive heat at key times throughout the growing season, it’s about the only negative we can cite at the moment — which is a net positive! Export prices are competitive with South American origins, and we are largely isolated from any negative impacts of the Indian export bans. In actuality, we are a beneficiary because Iraq took swift action to book milled rice from the U.S., and mills are busy through the end of the year filling that business. Last year all we could report was the doom and gloom of negative food policies foreign governments were taking to combat raging food inflation to the detriment of our U.S. long grain crop. This year represents a new opportunity, in which we will be a featured and stable supplier of long grain rice. Let’s just hope the milling yields improve, as this will be the year we can gain some of our market share back from our drought-stricken South American competitors, namely Brazil. On the ground, prices in Texas are holding at $17.60/cwt, while Louisiana is at $16.50/cwt. Mississippi, Arkansas, and Missouri are in the $15.75/cwt range. The futures market is also firming up a bit, 2%+ increases from Nov '23 thru Jul ’24, with Jul ’24 registering as high as $17.020. Average daily volume jumped 14.86% up to 436, while open interest held steady at 10,839 this week. The USDA crop progress report shows the entire complex at 66% complete, 7% above the 5-year average. Louisiana is leading the charge with 95% complete, followed by Texas at 92%, Mississippi at 90%, Arkansas at 70%, Missouri at 53%, and California at 10%. Arkansas is 1% ahead of last year, and California is 8% behind last year. In Asia, stability has returned with prices settling in Thailand and Vietnam between $600-$610 pmt. India is still the driver in the region, but with small announcements surfacing of approved G2G deals (Saudi Arabia) an adjusting market, a “business as usual” is returning. In the Western Hemisphere, all prices are now exceeding $700 pmt, with Brazil around $715 pmt, Argentina at $740 pmt, Uruguay at $745-750 pmt, and the U.S. at $755-$765 pmt. The difference here is that the U.S. is the only origin with legitimate supplies until March when the Southern Hemisphere harvest is underway. With prices this firm in the long grain market, it will be interesting to see the medium grain acres planted next year. It’s too early to tell now, but by February when seed is booked and planting decisions are made, we would forecast a drop in medium grain acres and a return to long grain by some degree. The weekly USDA Export Sales report shows net sales of 28,100 MT, 57% down from the previous week and 55% down from the prior 4-week average. Increases primarily for Haiti (15,100 MT, including decreases of 100 MT), Honduras (9,500 MT), Canada (2,000 MT), Belgium (500 MT), and Israel (400 MT), were offset by reductions for Guatemala (400 MT). Exports of 46,300 MT were up noticeably from the previous week, but down 13% from the prior 4-week average. The destinations were primarily to Japan (26,000 MT), Haiti (15,100 MT), Canada (2,100 MT), Mexico (1,900 MT), and Belgium (500 MT). |

|

| Market Update: Milling Yields Down, But Pace and Acres Up |

| Milling yields are the only thing that’s lacking this harvest. We are ahead of pace, up on acres, and up on yields almost across the board, but converting the ample paddy supply to an ample milled product is proving more difficult than anticipated. While this isn’t a huge surprise to anyone because of the excessive heat at key times throughout the growing season, it’s about the only negative we can cite at the moment — which is a net positive! Export prices are competitive with South American origins, and we are largely isolated from any negative impacts of the Indian export bans. In actuality, we are a beneficiary because Iraq took swift action to book milled rice from the U.S., and mills are busy through the end of the year filling that business. Last year all we could report was the doom and gloom of negative food policies foreign governments were taking to combat raging food inflation to the detriment of our U.S. long grain crop. This year represents a new opportunity, in which we will be a featured and stable supplier of long grain rice. Let’s just hope the milling yields improve, as this will be the year we can gain some of our market share back from our drought-stricken South American competitors, namely Brazil. On the ground, prices in Texas are holding at $17.60/cwt, while Louisiana is at $16.50/cwt. Mississippi, Arkansas, and Missouri are in the $15.75/cwt range. The futures market is also firming up a bit, 2%+ increases from Nov '23 thru Jul ’24, with Jul ’24 registering as high as $17.020. Average daily volume jumped 14.86% up to 436, while open interest held steady at 10,839 this week. The USDA crop progress report shows the entire complex at 66% complete, 7% above the 5-year average. Louisiana is leading the charge with 95% complete, followed by Texas at 92%, Mississippi at 90%, Arkansas at 70%, Missouri at 53%, and California at 10%. Arkansas is 1% ahead of last year, and California is 8% behind last year. In Asia, stability has returned with prices settling in Thailand and Vietnam between $600-$610 pmt. India is still the driver in the region, but with small announcements surfacing of approved G2G deals (Saudi Arabia) an adjusting market, a “business as usual” is returning. In the Western Hemisphere, all prices are now exceeding $700 pmt, with Brazil around $715 pmt, Argentina at $740 pmt, Uruguay at $745-750 pmt, and the U.S. at $755-$765 pmt. The difference here is that the U.S. is the only origin with legitimate supplies until March when the Southern Hemisphere harvest is underway. With prices this firm in the long grain market, it will be interesting to see the medium grain acres planted next year. It’s too early to tell now, but by February when seed is booked and planting decisions are made, we would forecast a drop in medium grain acres and a return to long grain by some degree. The weekly USDA Export Sales report shows net sales of 28,100 MT, 57% down from the previous week and 55% down from the prior 4-week average. Increases primarily for Haiti (15,100 MT, including decreases of 100 MT), Honduras (9,500 MT), Canada (2,000 MT), Belgium (500 MT), and Israel (400 MT), were offset by reductions for Guatemala (400 MT). Exports of 46,300 MT were up noticeably from the previous week, but down 13% from the prior 4-week average. The destinations were primarily to Japan (26,000 MT), Haiti (15,100 MT), Canada (2,100 MT), Mexico (1,900 MT), and Belgium (500 MT). |

|