The market is moving steadily along, which is a comfort to most involved. There was a nice bit of milled business to Haiti that was booked this week, as any business to this destination can no longer be taken for granted. What now seems to be the expectation is a strong domestic market that keeps the mills churning, and paddy prices firm for the time being. Recall that there have been two short crops, and this supply shock has resulted in high prices for farmers and exporters — but largely to the detriment of the ability to be price competitive.

Just this week, there is talk beginning to surface of a rebound in rice acres, albeit the discussion includes more medium grain acres as well. Farmers in the largest producing state of Arkansas are indicating a slight increase over last year. Remember last year U.S. production was the lowest in 30 years. New crop planting in Texas and south Louisiana will begin in late February, weather permitting. More acres would be welcome to the industry as a whole, and the hope would be to find pricing that would get some of our core markets back in Mexico and Central America. Easier said than done given domestic market conditions. However, with Brazil and other origins in the Mercosur region considerably below current U.S. long grain prices, there is a long way to go for price competitiveness to be a factor, not to mention quality issues. One thing to note is a prolonged drought that is plaguing rice production, particularly in Argentina, and to some degree in both Brazil and Uruguay. River levels have fallen significantly and reservoirs are almost exhausted. Several local analysts feel some rice will be lost while hoping that forecasted rains will be a reality. If not, the crop will be hurt. Only Paraguay, which has harvested close to 20%, is having a largely normal crop. Yields are reported at 8,000 lbs per acre. As most Mercosur relies on surface water, those areas that have close to normal water supplies will have high yields and may offset losses. The extent remains to be seen but could certainly have an impact on price perspectives in the coming marketing year and the firmness of the Mercosur market.

A GAIN report published in China this week forecasted lower rice imports with a smaller production of 2%, down to 146 MMT on account of drought in the mid and late-season crops. The lower rice imports can in part be credited to not bringing in as many brokens from India as a corn substitute for feed because of their export situation, resulting in a drop of 300,000 MT down to 5.2 MMT. 5.2 MMT is a staggering number for imports but pales in comparison to the 5.7 MMT of rice imported through November 2022.

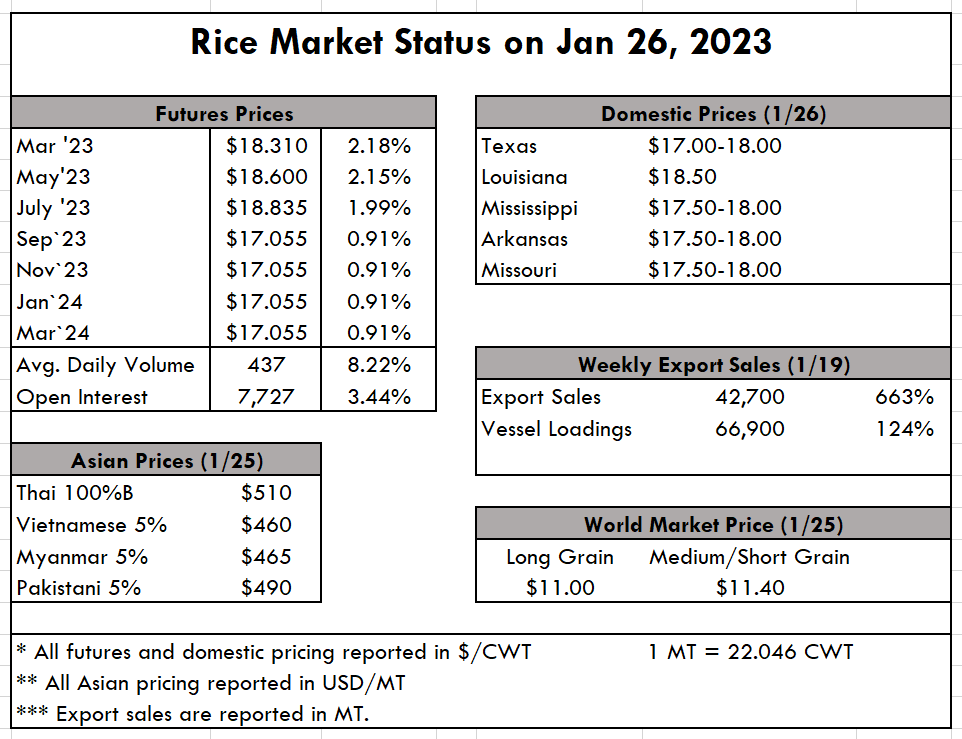

In the rest of Asia, we have seen a consistent week with prices holding firm; Thai prices are unchanged from last week at $495 pmt, and Viet prices are unchanged at $455 pmt. The lack of price movement can be attributed to the Chinese New Year, as most are focused on the celebration. This will be the case through the first week of February.

The weekly USDA export sales report shows net sales of 42,700 MT this week, primarily for Japan (13,000 MT), Haiti (12,000 MT), Mexico (6,500 MT), El Salvador (5,600 MT), and Saudi Arabia (2,500 MT). Exports of 66,900 MT -- a marketing-year high -- were up noticeably from the previous week and from the prior four-week average. The destinations were primarily to Panama (27,500 MT), Honduras (15,600 MT), the United Kingdom (10,600 MT), Mexico (5,600 MT), and Jordan (3,900 MT). Results of the recently conducted Colombia-U.S. auction under the Free Trade Agreement will be released on January 31 after successful bidders have paid in full for their awards. Both paddy and milled rice has been awarded totaling 89,000+ tons milled basis.