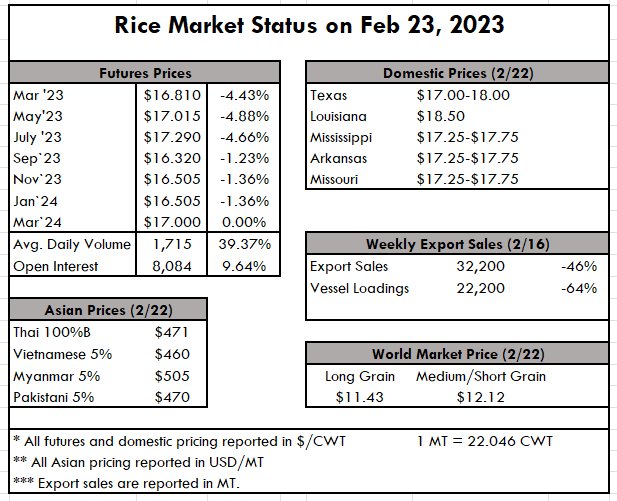

| The long-grain rice market remains on auto-pilot for a few more weeks as the industry awaits planting decisions. While it results in rather lackluster stories for reporting, the steady market is wonderful for producers and millers alike. The consecutive years of decreased supply have largely matched the reduced demand for milled rice out of Haiti and other key export markets, keeping prices stable for several months now. A recent USDA report revised U.S. exports sharply downward, now projected to be at the lowest level in 37 years. While this can be attributed in part to the acreage loss in California, the lion’s share of the decrease is the result of the loss of U.S. long-grain market share in Mexico and Central America. While the decrease in Calrose exports is entirely supply-driven (hence record high medium grain prices) the loss in the southern U.S. is more trade policy driven. A phasing out of longstanding trade agreements that increased market access in Central America, and with Mexico’s opening to alternative origins, is wreaking potentially longer-term havoc on the long-grain industry. Both rough and milled rice buyers in Mexico and Central America have the attention of Mercosur suppliers as the new harvest in that area is moving ahead. However, like elsewhere very unusual weather continues to affect and it gives the feeling that the crop is getting smaller by the day. “Until it’s cut, dried, and stored, we don’t know what we have”, said one Brazilian farmer. The changes in government policies for importing countries in an effort to maintain food prices are causing a change in buying habits. Costa Rica today must import 70% of long grain rice consumption needs. Brazilian rough rice currently hovers around $400/ton FOB. New crop sales for April deliveries are underway. You will notice in the January 2023 Brazilian Foreign Trade Report that the U.S. has become an important market for milled rice and we are told this is largely on the East Coast. In Asia, prices continued to soften slightly. Thailand dropped from $465 pmt last week down to $460 pmt this week, now directly in line with Vietnam which is also priced at $460 pmt. With these two origins now in concert, the market dynamics are very interesting and will largely boil down to currency valuations and logistical costs. The second crop harvest in Thailand is on the approach, which could source additional demand; in any case, having parity in these two regions, while not unheard of, is a rare occurrence. The volatility in the futures market this last week would indicate a divergence of thought in the carryover quantity for the current crop. It would seem that the ups and downs are largely on account of the current cash business at hand, attributed to the domestic milled business. That has to be the case, as the export sales numbers are so dismal it’s difficult to attribute much activity to that at all. The story of carryover will come to light soon, but it’s being worked out in the futures market now. One thing is certain, and that’s that if there is a carryover, it won’t be a large one. |

|